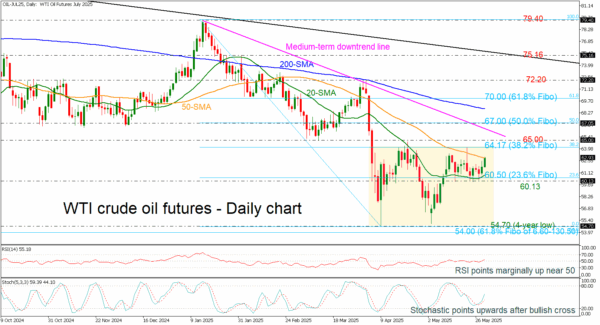

WTI crude oil futures repeatedly bounce off 60.13.

Momentum oscillators suggest bullish move.

WTI crude oil futures are rebounding off the 60.13-60.50 support region, which encapsulates the 23.6% Fibonacci retracement level of the downward wave from 79.40 to 54.70 and the 20-day simple moving average (SMA). In the short-term view, the commodity has still been developing within a consolidation area of 54.70-64.17 since the beginning of April.

The price is currently fighting with the 50-day SMA around 63.00, with the potential to reach the upper boundary of the range and even higher near the critical 65.00 resistance. More upside pressures could lead investors to the 50.0% Fibonacci at 67.00, which holds near the medium-term falling trend line. Above these restrictions, the 200-day SMA at 68.70 and the 61.8% Fibonacci at 70.00 may prove to be tough obstacles for oil.

On the other hand, a downside move below the 60.13-60.50 area would take the price toward the four-year low of 54.70, ahead of the 61.8% Fibonacci retracement level of the down leg from 6.60 to 130.50 at 54.00. Below that, the next support would come far lower at 43.80.

The technical oscillators confirm the recent upswing in the market with the RSI pointing upwards, crossing above the 50 level, while the stochastic is heading north.

To sum up, WTI crude oil futures are making another bullish attempt to reclaim and break out of the trading range to the upside, but they need additional momentum.