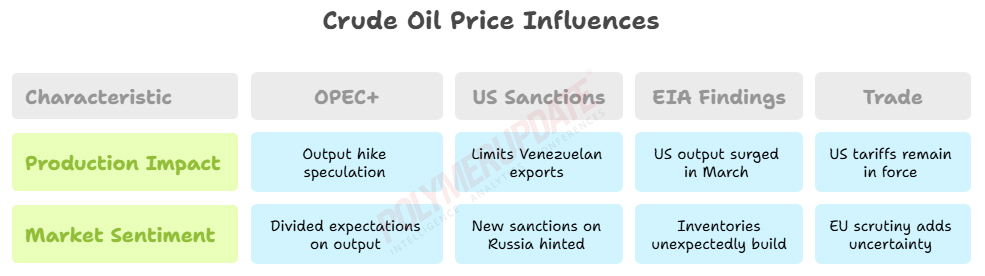

Crude oil prices declined for the second consecutive day on Friday due to optimism that the Organization of the Petroleum Exporting Countries and allies (OPEC+) would continue raising output for July—a decision slated for the group’s meeting on Saturday. During the 39th Ministerial Meeting held on May 28, OPEC+ members reaffirmed the mandate of the Joint Ministerial Monitoring Committee (JMMC) to closely review global oil market conditions, production levels, and conformity with the Declaration of Cooperation (DoC).

According to Polymerupdate Research, benchmark Brent crude futures for near-month delivery on the InterContinental Exchange (ICE) fell by 0.39 percent, or US$ 0.25 a barrel, to settle at US$ 63.90 a barrel on Friday, down from US$ 64.15 a barrel the previous day. The decline is steeper at 1.5 percent when compared to the one-week high of US$ 64.85 a barrel recorded on Wednesday.

Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (NYMEX) dropped by 0.25 percent, or US$ 0.15 a barrel, to close at US$ 60.79 a barrel on Friday, compared to US$ 60.94 a barrel the previous day. WTI Cushing also posted a 1.7 percent decline from its recent high of US$ 61.84 a barrel seen two days earlier.

An analyst from Kedia Stocks and Commodities Research remarked, “Crude oil prices fell on Friday amid investor caution ahead of the upcoming OPEC+ meeting on May 31, where a potential output hike of more than 411,000 barrels per day (bpd) for July is anticipated. While Kazakhstan’s deputy energy minister hinted at a production increase, no formal discussion has occurred, as noted by Russian officials. Market expectations remain divided, with Goldman Sachs analysts suggesting OPEC+ might choose to hold output steady after the July adjustment due to new supply projects, weakening global demand, and growing oil inventories.”

Geopolitical tensions also influenced market sentiment. U.S. President Trump hinted at new sanctions on Russia amid stalled Ukraine negotiations, while the U.S. tightened restrictions on Venezuelan oil exports by limiting Chevron’s operations. Additionally, increased EU scrutiny of U.S. investments added to global trade uncertainty.

From a supply-demand perspective, recent data from the U.S. Energy Information Administration (EIA) revealed an unexpected build in crude oil inventories, contrary to expectations of a draw. Gasoline and distillate stockpiles also increased, adding further bearish pressure to the market.

OPEC+ meeting outcome

Oil market participants adopted a ‘wait-and-watch’ approach toward liquid fuel holdings as concerns about an oversupplied market persisted. Any further additions from the OPEC+ coalition could exacerbate the glut amid weak demand forecasts. Additional supply is also anticipated from Iran, contingent on the potential lifting of sanctions if Tehran’s ongoing nuclear talks with Washington prove successful. Initially, the market had anticipated a potential production hike from OPEC+, but the alliance instead chose to outline a framework for 2027 production baselines without implementing immediate changes.

At the OPEC+ meeting scheduled for Saturday, analysts predict coalition members may continue unwinding the temporary output cuts implemented after Russia’s invasion of Ukraine in February 2022. While some forecasters expect the OPEC+ group to maintain the cuts due to unfavorable market conditions, others believe the Middle East-centric oil producers’ coalition might opt for larger reductions in cuts to penalize member nations that have exceeded their allocated quotas.

Previously, OPEC+ announced plans to accelerate output increases for the second consecutive month, raising production by 411,000 bpd in June as part of their strategy to restore 2.2 million bpd of voluntary cuts. Saudi Arabia warned that supply increases might continue if member nations persist in exceeding their output quotas. The OPEC+ coalition collectively accounts for approximately one-third of global crude oil production.

US tightening sanctions

The United States has threatened to impose additional sanctions on Russia, a leading crude oil producer and exporter, citing the Kremlin’s failure to pursue peace with Ukraine. U.S. President Donald Trump, who has been advocating for peace between Russia and Ukraine since his election campaign, urged both sides to exercise caution. Additionally, the terrorist organization Hamas is reportedly reviewing a Trump-mediated 60-day ceasefire proposal.

Meanwhile, the United States has declined to renew Chevron’s operational license in Venezuela, effectively barring the company from exporting Venezuelan crude oil. On Wednesday, Chevron terminated its oil production, service, and procurement contracts in Venezuela but announced plans to retain its direct staff in the country. The company delegated governance of its joint ventures to its partner, the state-owned oil company PDVSA, following the revocation of its key operating license by the Trump administration in March. The administration had granted Chevron a two-month period to wind down its transactions, which expired this week, thereby ending the license.

EIA’s findings

U.S. crude oil output surged to a monthly record high in March, while demand declined to its lowest level in a year, the U.S. Energy Information Administration (EIA) reported in its Petroleum Supply Monthly published on Friday. According to the report, U.S. crude oil production rose to 13.49 million bpd in March, up from 13.16 million bpd in February and surpassing the previous all-time high of 13.45 million bpd recorded in October 2024. Crude oil output in Texas, the country’s leading oil-producing state, increased by 50,000 bpd from February to 5.71 million bpd in March, the highest level since November 2024.

The EIA also projected global oil inventories to grow by an average of 720,000 bpd this year, rising to 930,000 bpd by 2025. The report highlighted that global onshore crude oil inventories increased by over 100 million barrels to 3.127 billion barrels between mid-April and mid-May. This marks the highest level of onshore inventories since the COVID-19 pandemic, excluding the seasonal peak recorded in July 2023.

Trade uncertainties

With the U.S. Appellate Court admitting the Trump administration’s petition challenging the Manhattan Federal Court ruling, the tariffs previously announced will remain in force. This development has added to global market uncertainties, renewing tensions between the United States and its trade partners.

On Wednesday, the Manhattan Federal Court blocked the implementation of President Donald Trump’s unilateral and retaliatory tariffs, which were intended to reshape U.S. trade dynamics by penalizing import-heavy countries. A three-judge panel ruled that President Trump exceeded his authority by imposing tariffs under the International Emergency Economic Powers Act (IEEPA).

“The IEEPA does not grant the president the power to unilaterally impose broad import duties, particularly when the declared national emergencies—such as drug trafficking, immigration, and trade imbalances—are not directly addressed by the tariffs. An unlimited delegation of tariff authority would constitute an improper abdication of legislative power to another branch of government,” the court order stated.

Outlook

The European Union’s scrutiny of U.S. investments has added to global trade uncertainty. From a supply-demand perspective, recent data from the U.S. Energy Information Administration (EIA) revealed a surprising build in crude oil inventories, which increased by 1.3 million barrels, contrary to expectations of a draw. Considering these developments, the crude oil market may remain under pressure in the medium term; however, much will depend on the OPEC+ output decision expected today.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com