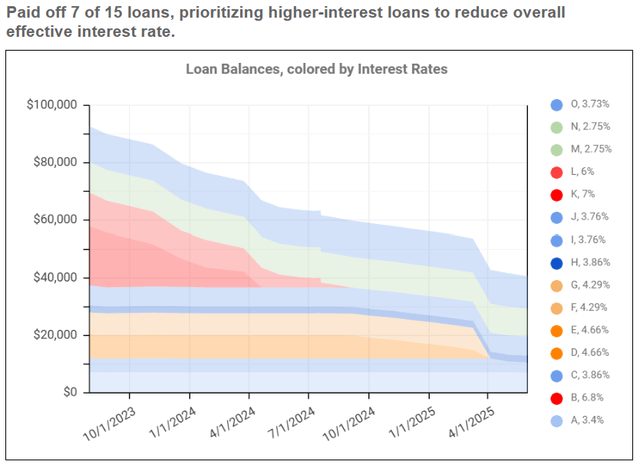

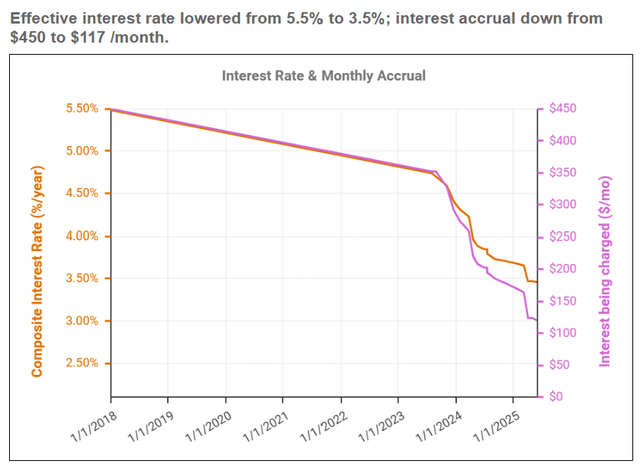

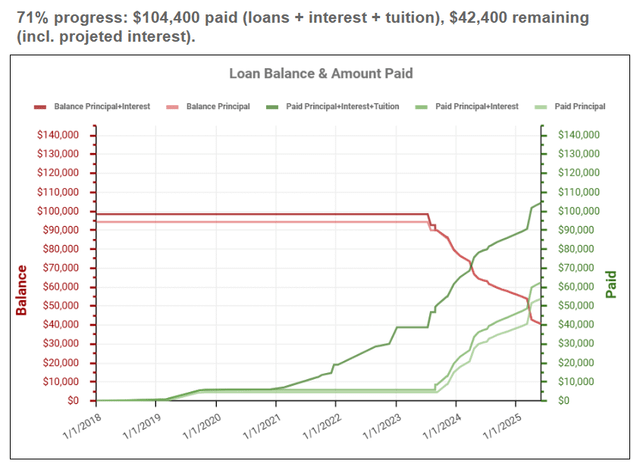

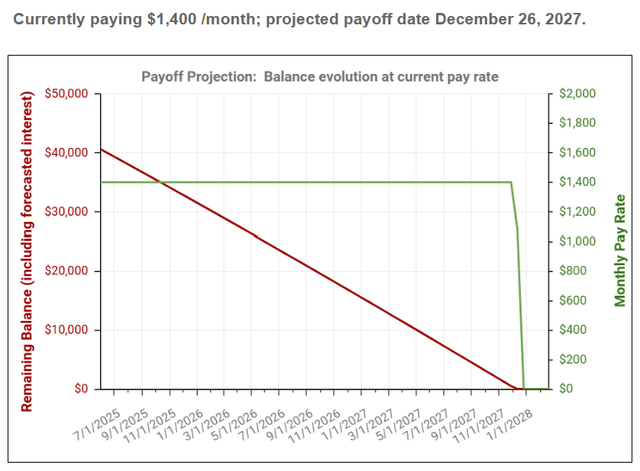

Playing around with the use of dynamic figure captions to summarize plots, interested to hear thoughts. Made with Google Sheets. Loans due to a few semesters of community college (2010-2012), two bachelor's degrees at separate universities (2012-2016 and 2021-2024) and a semester of pharmacy school (2017), resulting in 15 loan groups. Did not start tracking, or paying any meaningful amounts until the start of 2021. Today I am 71.1% of the way to checking off my #1 bucket list item.

Posted by Particle-in-a-Box

18 comments

Wow this is impressive! Great job!

It would be neat to see the counterexample of following the “snowball” method (lowest balance first), which is (wrongly, imo) touted by some “financial gurus”.

I like the first two a lot, though I think you should change the color coding so green is higher than blue because it would be a more intuitive warm-to-cool color scheme. Congratulations on paying off so much of your debt!

That’s a lot of school! Congrats on paying this down, the progress is impressive.

Great avalanche approach. Just a couple more years and your future will feel so much lighter. Keep up 💪

I take it the tons of student loans at least resulted in a useful degree allowing you to pay them off?

I was naive and consolidated after I graduated college, too me over 20 years 😟 to pay off.

The colors don’t match the key.

Snowball rolling, baby, let’s fuckin go

How did the balance not go down from 21-23 even though 40k was contributed?

First of all: Congratulations!!

Second: I just saw the average return of the inflation adjusted S&P500 is at around 7.5% and without inflation adjustment it´s at around 10.8%.

Doesn´t that mean, you´re (long term) better off allocating some of the repayment-money into an ETF, since the average return is almost double the interest?

If i am missing something feel free to educate me lol

Make a few more of them red. This comes way to close to being readable.

I would group together interest rates ranges for ease of readability.

Lovely to see someone going for the rational approach of highest interest rate first instead of waterfall.

You’re right where my wife was about a month ago. Same starting balance and remaining balance. Our goal is to wipe everything out by Jan 1. I’ll race you!

We did something similar after college. We called it snowballing, starting with highest interest loans. Paid off over $80k in CC debt in 6 years and got down to just paying extra on our mortgage last year and are on track to pay off that at the end of this year, if all goes well. Being out of debt is going to be amazing. In total we will have paid off over $315k in debts in 15 years, with dual salaries to support the budget and no kids (DINKs).

First, great job putting this together and getting those high interest ones down first ❤️

Second, what program did you use for tracking this?

I would stack the interest rate chart from low to high and color code appropriately based on that. The A–>O ordering or naming of it is not particularly meaningful to anyone and is random, and an interest rate sorting would clearly show how you’ve attacked the highest interest rate ones first.

Comments are closed.