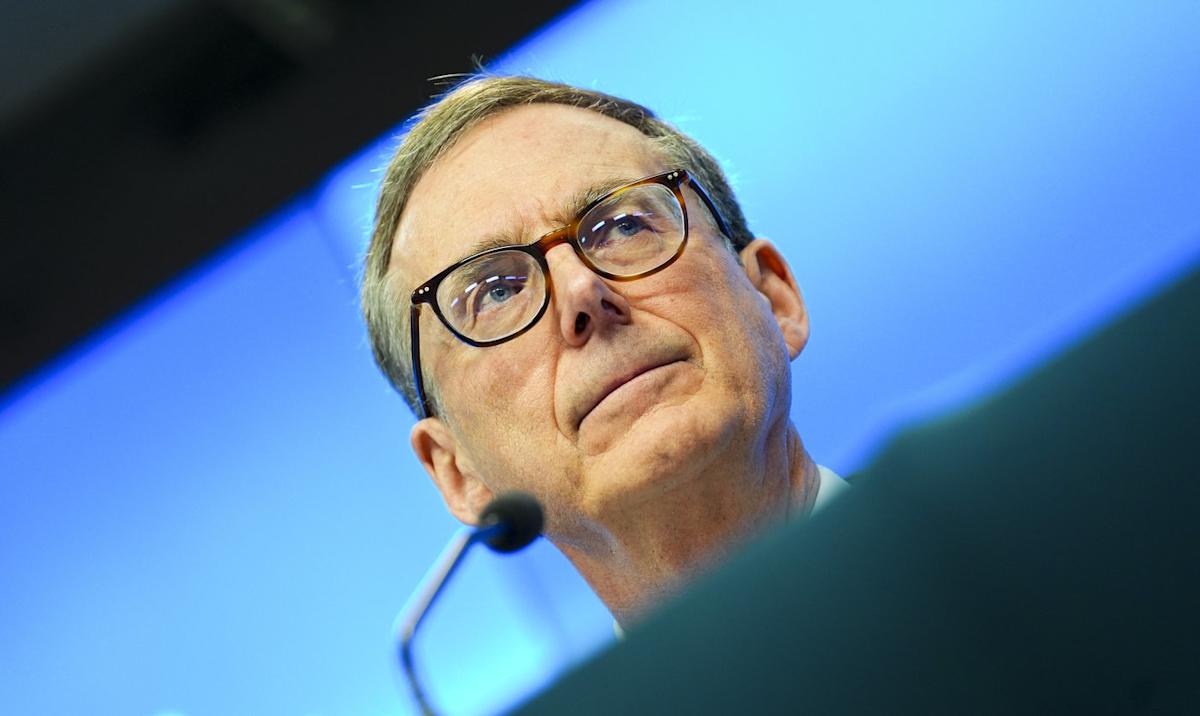

OTTAWA — Few would confuse Hollywood action star Tom Cruise with Bank of Canada governor Tiff Macklem.

But while Cruise rides a plane in tailspin to his latest box office smash, some economists say Macklem finds himself in his own high-stakes circumstances with the central bank’s interest rate decision on Wednesday.

Macklem’s mission is to chart a path for interest rates that keeps Canada’s economy afloat at a precarious moment without straying from its inflation-taming mandate.

“It really is mission impossible,” said Andrew DiCapua, principal economist at the Canadian Chamber of Commerce.

The latest data show price pressures could be building up again in Canada at the same time some economists warn of a tariff-induced slowdown on the horizon, pulling monetary policy in opposite directions.

“The bank really is in a difficult position here, but they really should be resuming rate cuts to get their interest rates lower to somewhere around two per cent, again, to cushion the Canadian economy for what’s to come,” DiCapua argued.

The Bank of Canada’s policy rate stands at 2.75 per cent following a pause at the central bank’s last decision in April, snapping a streak of seven consecutive cuts. Most economists expect the central bank will hold rates again on Wednesday.

In April, Macklem said the Bank of Canada would pause issuing any formal forecasts and be less forward-looking than usual until it gained more certainty on how the economy would react to ever-shifting tariff threats.

President Donald Trump threw a new wrench into the gears of global trade late Friday when he announced plans to double existing tariffs on steel and aluminum entering the United States to 50 per cent starting Wednesday.

After Statistics Canada reported a surprisingly strong 2.2 per cent annualized rise in real gross domestic product for the first quarter on Friday, money markets were betting overwhelmingly in favour of another rate hold this week.

BMO last week firmed up its call for another hold in response to the latest economic data, now projecting a cut to instead come in July.

“The key point here is that the GDP figures are sending no obvious distress signals so far in 2025,” BMO chief economist Doug Porter said in a note to clients.

But the question for some economists isn’t what the economy has done — it’s what comes next.

The Bank of Canada’s own surveys of businesses published in early April showed sentiment was “sharply” lower amid the tariff uncertainty, with many firms putting investment and hiring plans on hold.

Story Continues