Central banks are adjusting their perspectives in response to ongoing fluctuations in the global economic activity stemming from the trade strategy of the White House. A prevailing sense of caution is thus anticipated to persist. As the European Central Bank and the Reserve Bank of India appear poised to reduce their benchmark rates, the Bank of Canada and the National Bank of Poland are expected to adopt a more cautious stance, remaining on the sidelines for the time being.

European Central Bank (ECB) – 2.25%

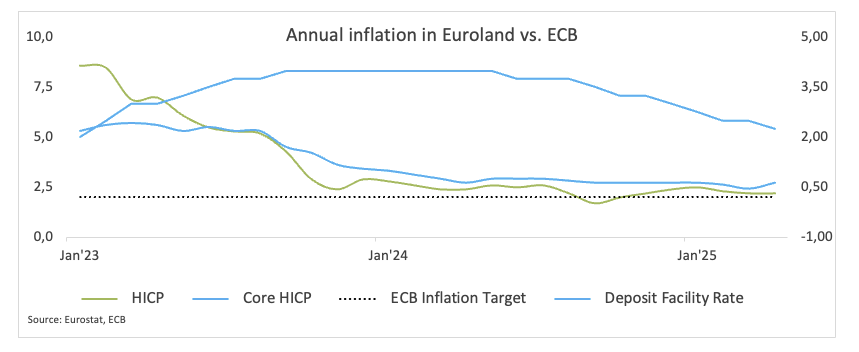

Based on the most recent meeting Accounts, the ECB is becoming more certain that inflation will return to its 2% objective in accordance with its March estimates.

Policymakers saw a more subdued near-term picture, citing ongoing uncertainties, a stronger Euro, declining oil and petrol prices as projected to lower inflation in the short run. Even while inflation is expected to remain close to the 2% goal until year-end, the medium-term outlook is still very unclear.

Indeed, the figures show that pay increases are slowing down more quickly than expected, which should somewhat assist to lessen price pressure. Loan growth much higher than predicted at the same time and market-based signs pointing to tighter financial conditions further complicate the ECB’s policy arithmetic.

About the June event, voices of ECB rate setters appear to not match. While some of them lean towards further easing, others believe maintaining rates steady is the best line of action. But all of them seem to highlight the growing uncertainty that President Trump’s “Liberation Day” tariffs and generalised, anarchic viewpoint of international trade create throughout the world markets.

Upcoming Decision: June 5

Consensus: 25 basis point rate cut

FX Outlook: EUR/USD seems to have embarked on a consolidative phase in the upper end of the range, although a convincing surpass of the key 1.1400 barrier still remains elusive. Price action around spot continues to hinge on Dollar dynamics as well as Trump’s erratic trade policies.

Bank of Canada (BoC) – 2.75%

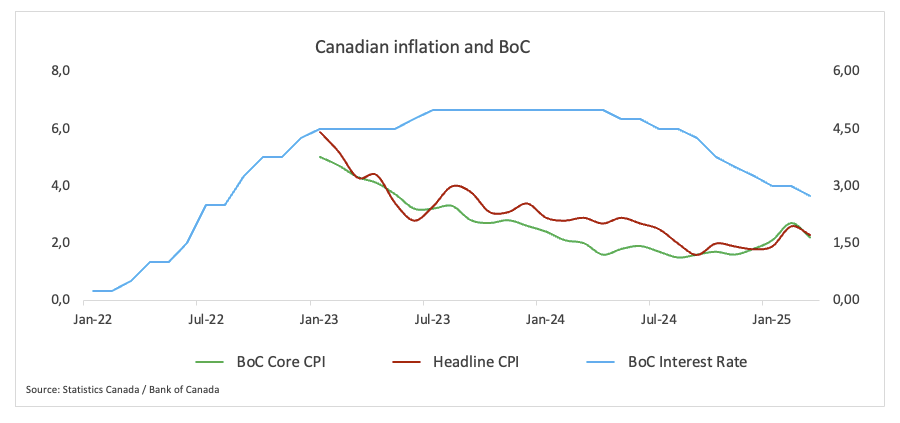

Consensus among market participants appears slightly tilted to the BoC’s leaving its policy rate unchanged in June, following its April decision to hold interest rates steady due to uncertainty around US trade strategy and potential spillover effects on Canada.

Economic signals have weakened in Canada, with GDP growth expected to slow in Q2, and consumer spending and business investment declining. Headline inflation is also softening, with CPI forecasted to dip to around 1.5% in April.

The labour market has shown strain, with manufacturing losing more jobs than expected in April, pushing the unemployment rate higher. The housing market has also cooled, easing concerns about monetary easing overheating real estate prices.

The BoC has made no commitment to cut, but the case for easing is growing stronger.

Upcoming Decision: June 4

Consensus: Unchanged

FX Outlook: The intense strength of the Canadian Dollar (CAD) motivated USD/CAD to retreat for the fourth consecutive month in May, approaching the key 1.3700 support, always following USD dynamics and the erratic trade policy from the White House. While below its 200-day SMA above 1.4000, further weakness in the pair should not be ruled out

Reserve Bank of India (RBI) – 6.00%

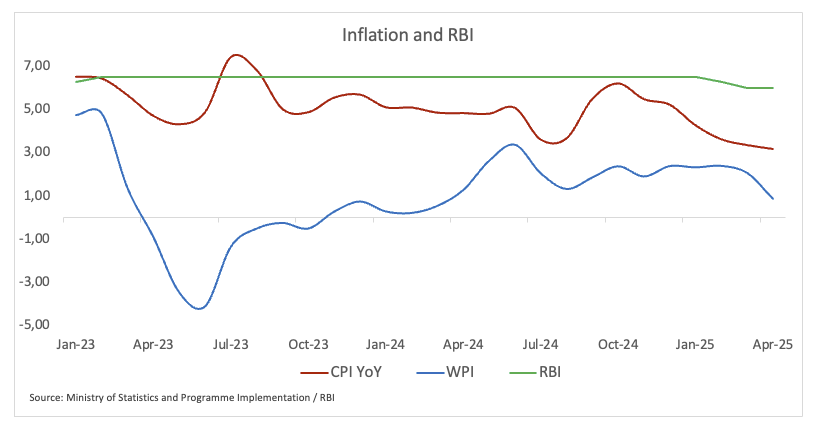

The RBI is expected to deliver a third consecutive 25-basis-point rate cut at its June Monetary Policy Committee meeting, according to projections that see a total of 100 basis points of easing in the current cycle.

This would bring the terminal policy rate to 5.50%—a level broadly aligned with the RBI’s estimate of the real neutral rate, which it placed between 1.4% and 1.9%.

With economic growth slowing to 6.3% in the last fiscal year—down from more than 9% previously—and inflation remaining below the 4% target, the central bank has significant scope to ease policy.

Furthermore, escalating global trade tensions pose a downside risk to both global and domestic growth. In such a context, and with inflation under control, the RBI is under increasing pressure to deliver a more forceful counter-cyclical response.

Upcoming Decision: June 6

Consensus: 25 basis point rate cut

FX Outlook: The Indian Rupee (INR) is trading at levels seen at the very beginning of the year vs. the US Dollar (USD), prompting USD/INR to gyrate around the 85.50 region amid the consolidative range in place since early May.

National Bank of Poland (NBP) – 5.25%

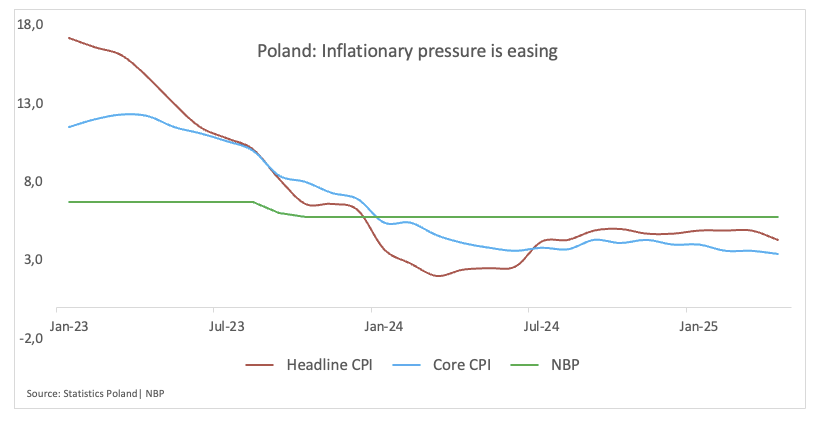

The NBP lowered its interest rate by 50 basis points in May, marking its first action since October 2023. The choice clearly shows a slowing down in inflation, a cooling of wage growth, and a less-than-projected economic performance in Q1 2025.

According to Governor Adam Glapiński, the CPI will drop to 3.5%, and inflation will peak in Q3. He underlined the continuous struggle against inflation and admitted more subdued economic times. If energy rates stay the same, Q4 inflation will only modestly increase. Furthermore, he foresaw higher GDP growth in 2025 than in 2024.

Glapiński suggested that while he expects economic trends to keep going, it’s unlikely there will be a rate change at the next meeting because of high risks. However, loose fiscal policy could lead to inflation, and future decisions will rely on data and forecasts.

In addition, the swaps market is pencilling in a total of 125 basis points of rate cuts over the next 12 months, with a further 50 basis points expected in the following year, bringing the policy rate down to around 3.5%.

Upcoming Decision: June 4

Consensus: Unchanged

FX Outlook: Following recent yearly lows vs. the Euro near 4.3100, the Polish Zloty (PLN) now seems to have embarked on a range-bound theme, with EUR/PLN hovering around its key 200-day SMA near 4.2600.