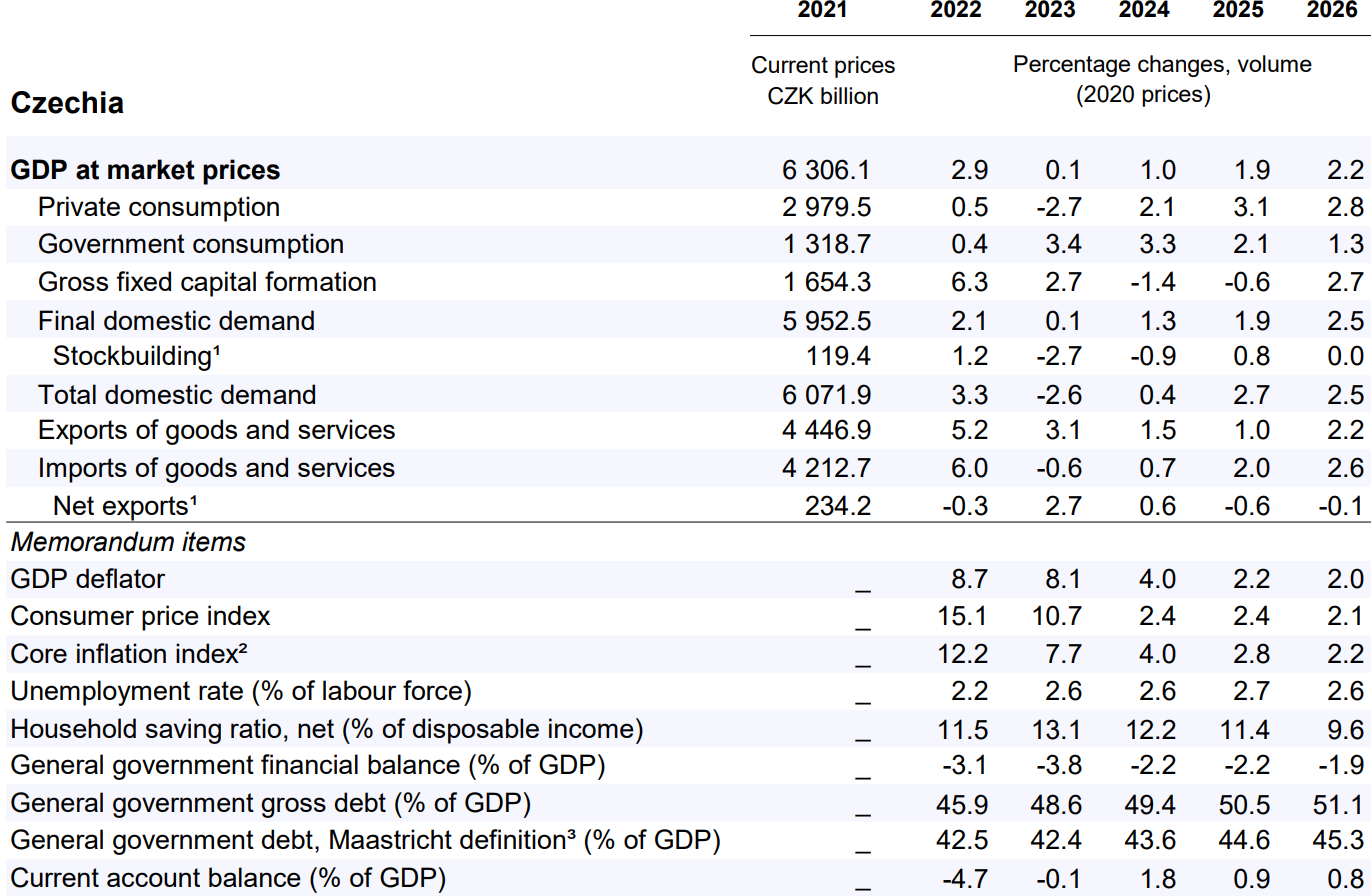

GDP growth is set to pick up from 1% in 2024 to 1.9% in 2025 and 2.2% in 2026. The ongoing recovery in households’ real disposable income will support robust consumer demand. High trade policy uncertainty and trade restrictions, especially in the automotive sector, are weighing on investment and exports. The fiscal expansion in Germany and stronger use of EU funds will support faster growth in 2026. Headline inflation is projected to fall back gradually to the 2% target. Risks are tilted to the downside, related to a further escalation of trade tensions that could lead to lower growth.

Given high uncertainty, monetary policy needs to remain vigilant. If inflationary pressures subside durably, the central bank should further ease policy interest rates. A broadly neutral fiscal stance is appropriate in the short-term, while spending efficiency needs to be improved in the medium-term to accommodate higher spending for defence, an ageing population and the green transition. Further developing the capital market and streamlining regulations to facilitate the entry and scaling up of firms can boost investment and business dynamism.

Household consumption is driving growth

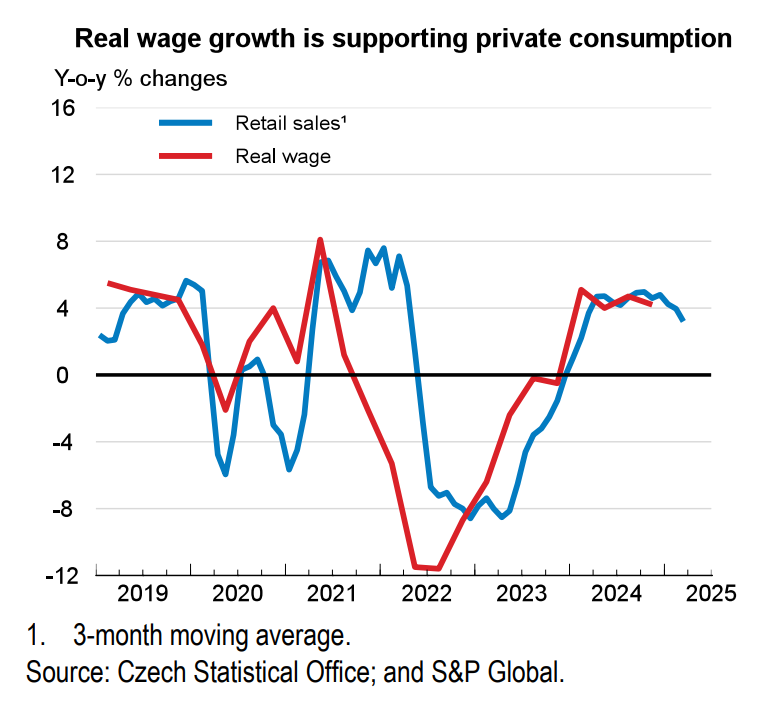

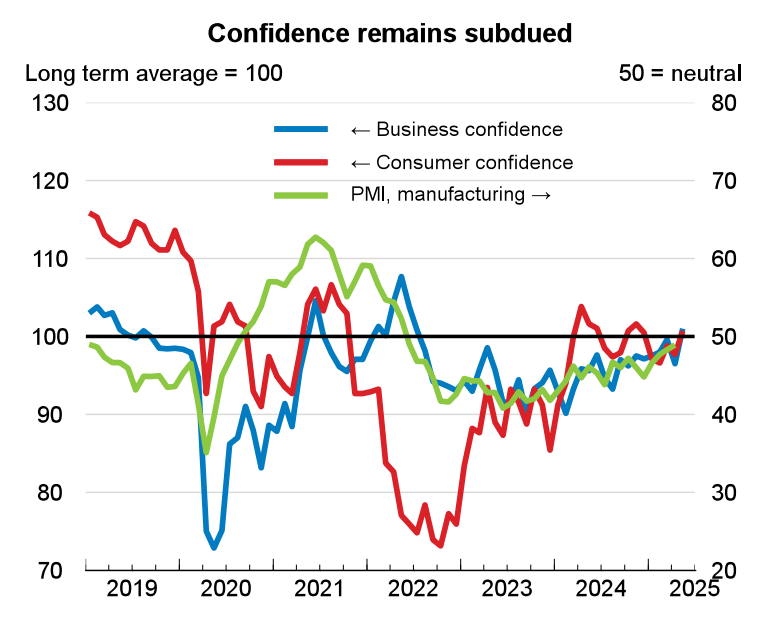

GDP growth continued to expand robustly in the first quarter of 2025, by 0.5% compared to the previous quarter, helped by a strong recovery in household consumption. High frequency indicators point to some moderation of growth in the near term. Retail sales growth remained solid in March but economic sentiment declined markedly in April. The manufacturing purchasing managers index continued to recover from a subdued level in April but export orders declined. Falling interest rates supported a pick-up in loan growth to the private sector in the first quarter of 2025. Consumer price inflation eased to 1.8% in April 2025 as food price inflation abated, but service price inflation remained elevated at close to 5%. The labour market remains tight, with employment growth concentrated in the services sector. Labour shortages are contributing to continued strong wage growth.

Czechia: Demand, output and prices

1. Contributions to changes in real GDP, actual amount in the first column.

1. Contributions to changes in real GDP, actual amount in the first column.

2. Consumer price index excluding food and energy.

3. The Maastricht definition of general government debt includes only loans, debt securities, and currency and deposits, with debt at

face value rather than market value

Source: OECD Economic Outlook 117 database.

The slow recovery in foreign demand, especially from Germany, has weighed on export growth. While direct trade exposure to the United States is limited, with goods exports to the United States accounting for around 3% of total exports in 2024, the recent increase in US tariffs will affect the economy via European manufacturing supply chains, especially for automotive parts. The koruna exchange rate has been relatively stable vis-a-vis the euro since the beginning of 2025.

Monetary policy is slightly restrictive and fiscal policy is neutral in 2025

The central bank lowered its policy rate from 7% to 3.5% between December 2023 and May 2025. Monetary policy is projected to remain slightly restrictive in 2025 and broadly neutral in 2026, with the policy rate declining to 3%. The fiscal position has improved significantly, with the budget deficit falling from 3.8% of GDP in 2023 to 2.2% of GDP in 2024, helped by the phasing out of energy support measures and the implementation of a consolidation package. In line with the fiscal-structural plan the projections assume a neutral fiscal stance in 2025 and a moderately restrictive stance in 2026.

Growth is set to pick up but uncertainty is high

Robust private consumption growth supported by gains in real disposable income will be the main driver of growth in 2025. High trade policy uncertainty will weigh on investment growth this year but a stronger drawing of EU funds will support a pick-up in 2026. Export growth will be subdued due to the increase in trade restrictions, particularly in the automotive sector, which are offset only partly by the fiscal expansion in Germany in 2026. Stronger productivity growth will mitigate labour cost growth and help ease inflation, which should fall back to target in 2026. Risks are tilted to the downside. A further escalation of trade and geopolitical tensions could depress confidence and foreign demand and lead to a resurgence of supply chain disruptions.

Managing uncertainty through prudent macroeconomic policy

Monetary policy needs to remain vigilant given the high uncertainty about future trade policy and the effects on prices, exchange rates and demand. If inflationary pressures durably subside, the central bank should further ease monetary restrictiveness. In this environment, the neutral fiscal stance in 2025 is broadly appropriate and automatic stabilisers should be allowed to work freely if downside risks materialise. In the medium-term, spending efficiency needs to improve to accommodate spending pressures related to military spending, population ageing and the green transition. For example, building capacity to regularly conduct spending reviews can help identify saving potential without harming outcomes but requires better access to data. Recent reforms to improve the overall sustainability of the pension system should be fully implemented. Further developing the capital market and streamlining regulations to facilitate the entry and scaling up of firms can boost investment and business dynamism.