Summary:

Ocugen secures exclusive rights for OCU400 in South Korea through a lucrative agreement. Analysts project a substantial increase in Ocugen’s stock price, with a potential upside of 606.52%. Current analyst consensus rates Ocugen stock as “Outperform.”Ocugen’s Strategic Move in South Korea

Ocugen (OCGN, Financial) has taken a significant step forward by entering into a preliminary agreement with a prominent South Korean pharmaceutical company. This strategic partnership grants Ocugen exclusive rights to market OCU400, a groundbreaking gene therapy designed to treat retinitis pigmentosa. The agreement promises substantial financial benefits, including upfront fees and development milestones that could reach up to $11 million, complemented by ongoing royalties from sales within the Korean market.

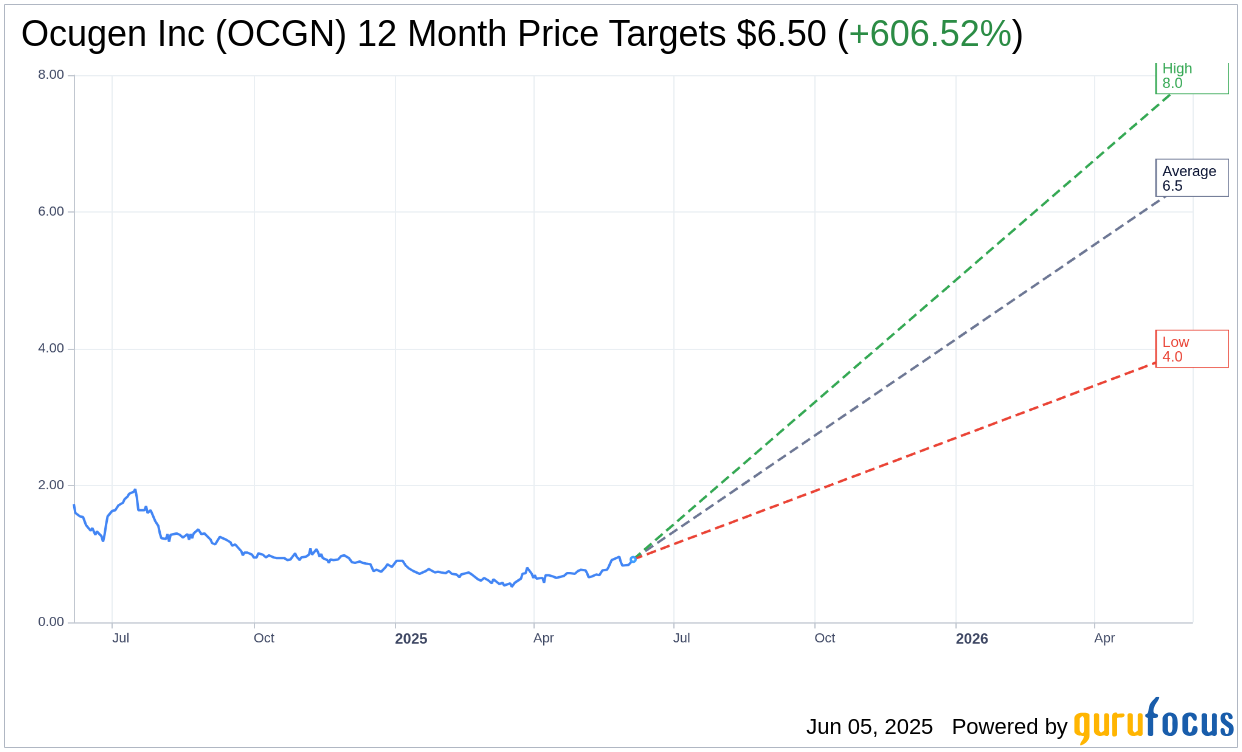

Wall Street Analysts Forecast

According to projections by four analysts, Ocugen Inc (OCGN, Financial) has an average target price of $6.50. The forecast includes a high estimate reaching $8.00 and a low estimate of $4.00. This average target signals a remarkable potential upside of 606.52% from the current market price of $0.92. For more in-depth information on these projections, please visit the Ocugen Inc (OCGN) Forecast page.

The consensus recommendation from brokerage firms underscores a positive outlook for Ocugen Inc (OCGN, Financial), with an average brokerage recommendation standing at 2.0. This “Outperform” status is derived from a rating scale where 1 represents a Strong Buy, and 5 indicates a Sell. Such a rating suggests confidence in Ocugen’s market performance and potential growth.