What’s going on here?

European stock markets posted modest gains as the eurozone’s economic performance beat predictions, with Germany’s DAX being the only major index that missed out on the upward trend.

What does this mean?

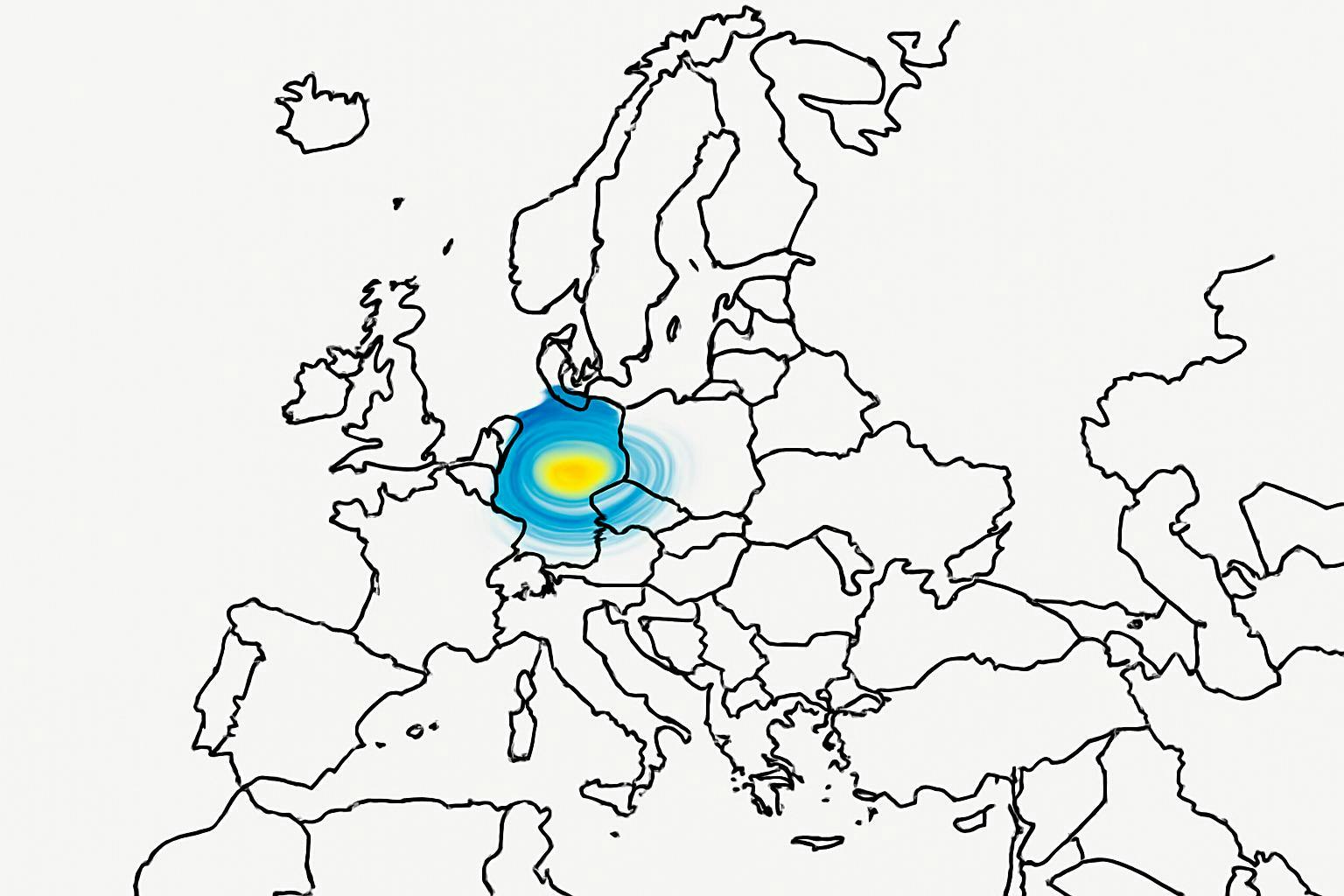

The eurozone’s GDP surprised with a 0.6% growth in the first quarter, setting an optimistic tone for European stocks like the FTSE 100, CAC 40, Stoxx Europe 600, and Swiss Market Index, all of which saw increases. Germany’s DAX, however, bucked the trend with a slight dip. While eurozone employment grew at a mere 0.2%, falling short of expectations and raising concerns about the labor market’s recovery, corporate developments added intrigue. Swiss banking giant UBS may face significant capital requirements due to proposed reforms, and HSBC is reportedly seeking new leadership. In addition, Amazon is tackling fake reviews, and TotalEnergies is steadfast on natural gas as a bridge to a greener future.

Why should I care?

The bigger picture: Economic performance defies expectations.

Stronger-than-anticipated GDP figures from the eurozone hint at a more robust recovery, potentially influencing future policy choices by the European Central Bank. This growth indicates resilience amid global economic uncertainties and could bolster investor confidence in European markets.

For markets: Navigating shifting dynamics.

With European stocks reacting positively to the upbeat GDP data, investors might find opportunities in sectors enhanced by economic expansion. Nevertheless, challenges like slower employment growth and potential hurdles for financial giants like UBS underscore the complexity of the current market landscape.