Summary:

The EPA is poised to approve Texas’ bid for managing CO2 storage, potentially benefiting Occidental Petroleum. Analysts predict a moderate upside for Occidental Petroleum shares, with price targets suggesting potential growth. Occidental Petroleum holds a “Hold” status with a fair valuation estimate indicating significant upside potential.U.S. EPA’s Strategic Move on Carbon Storage

The U.S. Environmental Protection Agency (EPA) is nearing approval of Texas’ application to oversee its own permits for underground carbon dioxide storage. This strategic move is set to bolster projects from companies such as Occidental Petroleum (OXY, Financial). The approval is in sync with Texas’ ambition to forge ahead with carbon capture initiatives, notwithstanding ongoing environmental debates about groundwater safety and seismic hazards.

Wall Street Analysts Forecast

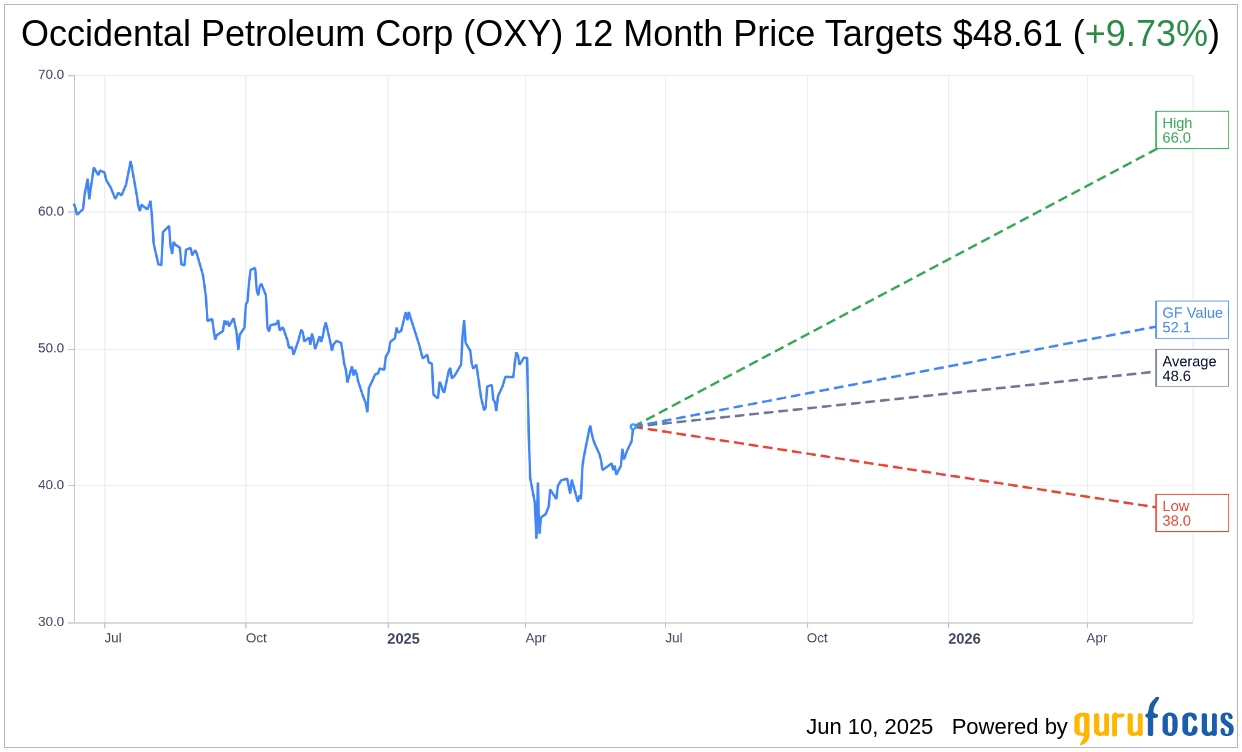

Recent analysis by 23 analysts presents an intriguing picture for Occidental Petroleum Corp (OXY, Financial). The average one-year target price is pegged at $48.61, with projections ranging from a high of $66.00 to a low of $38.00. This average suggests an upside potential of 9.73% from the current trading price of $44.30. For more comprehensive estimate data, visit the Occidental Petroleum Corp (OXY) Forecast page.

Brokerage Recommendations and GF Value Estimate

Occidental Petroleum Corp’s (OXY, Financial) brokerage recommendation signals a “Hold” status, based on the consensus from 26 firms. The rating scale, where 1 represents “Strong Buy” and 5 indicates “Sell,” places Occidental at a midpoint of 2.7.

According to GuruFocus, Occidental Petroleum Corp (OXY, Financial) has an estimated GF Value of $52.13 for the year ahead. This estimate projects an upside of 17.68% from the current price of $44.2986. The GF Value is calculated considering historical trading multiples and the past and future performance estimates of the business. Additional data can be explored on the Occidental Petroleum Corp (OXY) Summary page.