What’s going on here?

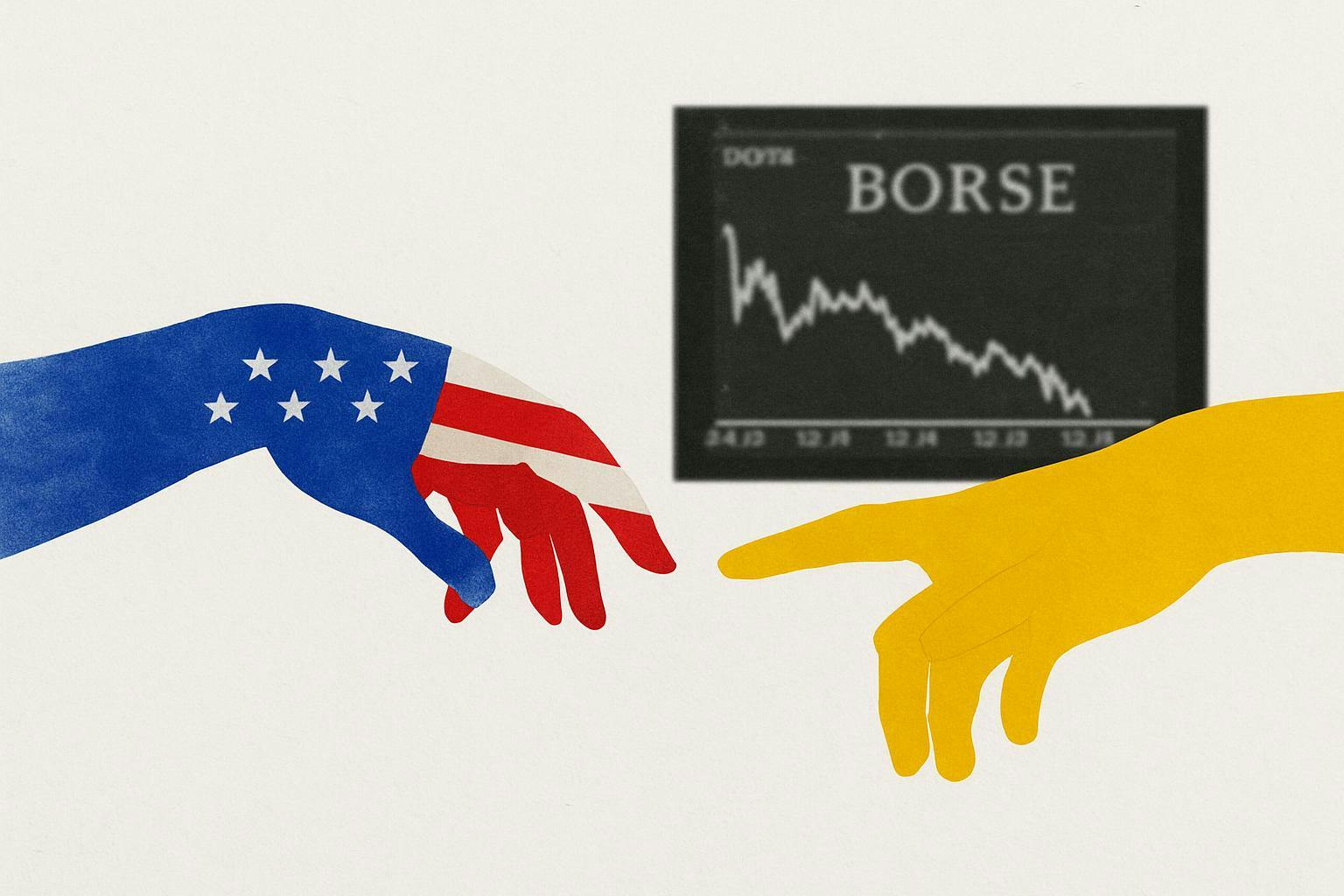

European markets dipped slightly as investors watched the evolving trade talks between the US and China.

What does this mean?

As the world waits for a breakthrough in US-China trade talks, European markets are in a holding pattern. The new framework on the table needs approval from Presidents Donald Trump and Xi Jinping. This uncertainty nudged the Stoxx Europe 600 Index down by 0.2%, with bank stocks bucking the trend, gaining 0.4%. Retail struggled, dropping 1.6%. Meanwhile, Wall Street futures remained steady with a hint of optimism, inspired by Asia’s positive market close. With the ECB implementing measures to curb inflation, mixed signals leave investors eagerly awaiting more clarity.

Why should I care?

For markets: Playing the waiting game.

Investors are in a holding pattern as they wait for definitive trade news, causing mixed reactions across European trading floors. The Stoxx Europe 600 Index sees variability, with sectors like retail and technology under scrutiny, while banking shows strength. Traders are on edge, waiting for the next big move.

The bigger picture: Global trade balancing act.

The ongoing trade talks impact market dynamics and have broader economic implications. With the ECB focusing on inflation and major economies watching geopolitical moves, the effects of these negotiations are significant. A stable trade resolution could lead to economic adjustment and potential growth.

SPONSORED BY CONSUMERDIRECT

This is a paid advertisement for ConsumerDirect’s CF offering. Please read the offering circular athttps://invest.consumerdirect.com/. Reserving the ticker symbol is not a guarantee that the company will go public. Listing on a national securities exchange is subject to approvals. Important details available in disclosures *#1, **#6, #24 and ***#25 of the attached link: https://bit.ly/3YApFU6