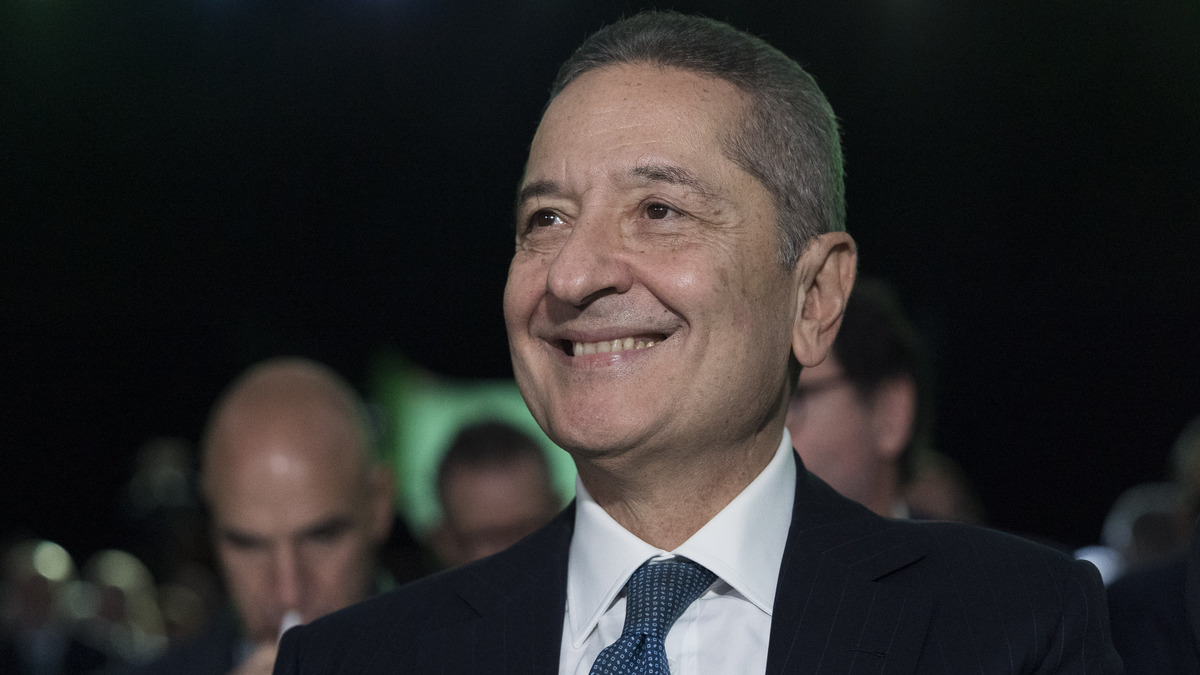

A clear condemnation of Trump’s tariff policy and its effects on the economy and world peace: this is the strongest message in the Final Considerations of the Governor of the Bank of Italy, Fabio Panetta, who urges Europe to advance on the integration level and Italy not to lower its guard on productivity and growth. And on the banking risk it is up to the market to decide “only”.

The annual report of the Governor of the Bank of Italy, Fabio Panetta, illustrates in a precise – one might say diligent – way the global economic and political situation, what theEurope and the problems of theItaly. The flights of fancy are missing Guido Carli, there are no accusations against the “archconfraternities of power”, there is a lack of severe criticism of the unions and business associations. The only exception concerns the economic policy of the president Trump, particularly on duties, but also on the effects that the extreme volatility of his announcements is causing on the dollar and on American government bonds. The economic effects of the duties could be disastrous for all countries and for the United States itself, which could lose 2 points of GDP in two years, but above all – and here lies the Governor’s only major foray into the political world – they could degenerate into obstacles to the movement of people, capital and knowledge. Finally, there is the risk of transforming a dispute over goods into a general conflict, to the point of putting peace at risk.

Trump’s policy is throwing the world into turmoil without having any concrete results in terms of the declared objective of reducing the American trade deficit. An imbalance that mainly derives from the strong American domestic demand for both consumption and investment, which must be treated with policies that are the opposite of those announced, further tax cuts and new increases in the federal deficit. Not only that, but President Trump is undermining confidence in the dollar as a reserve currency and as the main currency of trade.

Of course, the Governor emphasizes that Trump’s policies have roots that go back further in time and in the widespread and growing distrust of public opinion regarding globalization, whose many positive effects are overlooked in order to highlight only the negative ones that exist, but they are magnified by a nationalist political narrative that has an interest in exploiting people’s fears to promote its own political proposals based above all on ancient identity values.

Panetta: Europe must rethink its development model

In this storm, Europe must defend itself not only militarily but by reaffirming its values of solidarity-based democracy, open markets, freedom of movement of people and things, in a system well regulated by rules that must not be lightened so thoughtlessly, but rather improved. And yet the general changes require a real rethinking of the development model followed in recent decades.

The economic situation of the EU is uncertain, but not more critical than usual. Inflation is under control, ECB rates have fallen, financial markets are calm. But there is no shortage of problems that have been known for a long time but never addressed: labor productivity is growing less than that of the US, we have difficulty innovating, above all we are behind in research both public and, in particular, private. First of all we have a problem of energy costs that is double that of the United States and China. Not only that, but to remedy these shortcomings we know what needs to be done, even in the defense sector but we are proceeding too slowly. What is missing is the need to have common financing at a European level. Community public bonds that are also essential to finally create an integrated financial market for both banks and capital.

In short, we need more common European policies and less selfishness of individual states in all fields, from research to defense, to financial integration including banking rules to be unified to prevent the major banks, present in various countries, from being forced to act with different rules. Even if Panetta was careful to state that common debt can be issued even without creating a European Treasury, so as not to annoy the sovereignists who would like less Europe and do not want to cede national powers to Brussels, in fact we need to take new steps towards federal integration and abandon the “confederal” ideologies of a Europe of sovereign states.

Panetta: it is “solely” up to the market and shareholders to decide on the banking risk

Finally the theme of the bank risk. Here Panetta avoided taking direct positions against the interventionism of the Italian government, but also of other European governments, on the structures of the banks and on the operations in progress. Interventions justified by the claim of safeguarding national savings by directing them (forcibly as was done a few decades ago?) to finance the public debt or to save positions of power of political friends. However, after having clarified what the direct responsibilities of the ECB and Bank of Italy He clearly stated that the judgment on the merger between banks is up to the market and the shareholders and that these operations must be aimed “solely” at creating value.

Overall, the Bank of Italy sent a clear message to the political forces that are increasingly trying to exploit reality, distorting it for partisan purposes. We hope that ministers and parliamentarians can find the time to meditate on these pages and then develop political initiatives consistent with the technical indications provided by the Governor. And we hope that the President will also melon, who does not seem to have very clear ideas in economics, can find inspiration on what to do for the next two and a half years until the end of the legislature.