Jefferies analyst Lloyd Byrne maintains a Buy rating on Expand Energy (EXE, Financial), setting a price target of $135 following discussions with the company’s management. During these discussions, the firm emphasized a positive outlook for the natural gas market, driven by anticipated expansions in liquified natural gas and power demand. With a well-aligned transportation portfolio, Expand Energy is described as being in a prime position to leverage these growth opportunities. This strategic positioning is expected to enhance shareholder returns as the company capitalizes on its strengths in LNG and power demand sectors.

Wall Street Analysts Forecast

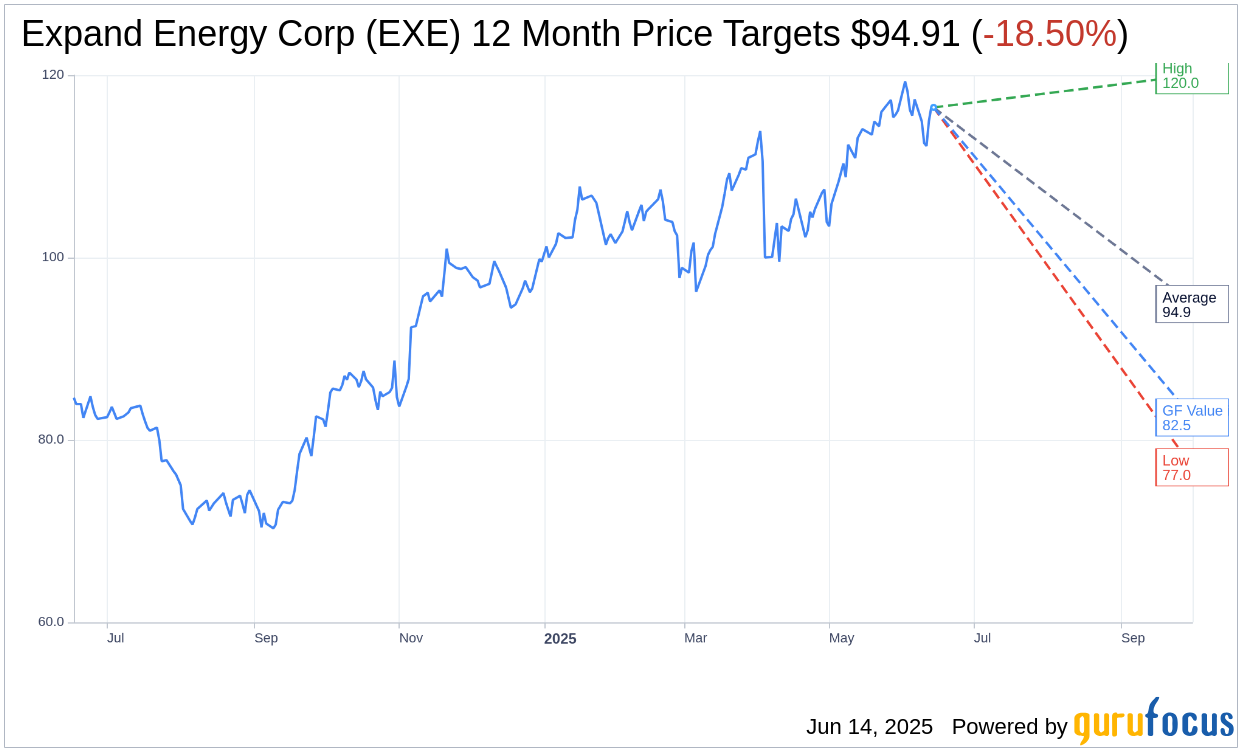

Based on the one-year price targets offered by 18 analysts, the average target price for Expand Energy Corp (EXE, Financial) is $94.91 with a high estimate of $120.00 and a low estimate of $77.00. The average target implies an

downside of 18.50%

from the current price of $116.46. More detailed estimate data can be found on the Expand Energy Corp (EXE) Forecast page.

Based on the consensus recommendation from 20 brokerage firms, Expand Energy Corp’s (EXE, Financial) average brokerage recommendation is currently 2.3, indicating “Outperform” status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Expand Energy Corp (EXE, Financial) in one year is $82.47, suggesting a

downside

of 29.19% from the current price of $116.46. GF Value is GuruFocus’ estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business’ performance. More detailed data can be found on the Expand Energy Corp (EXE) Summary page.