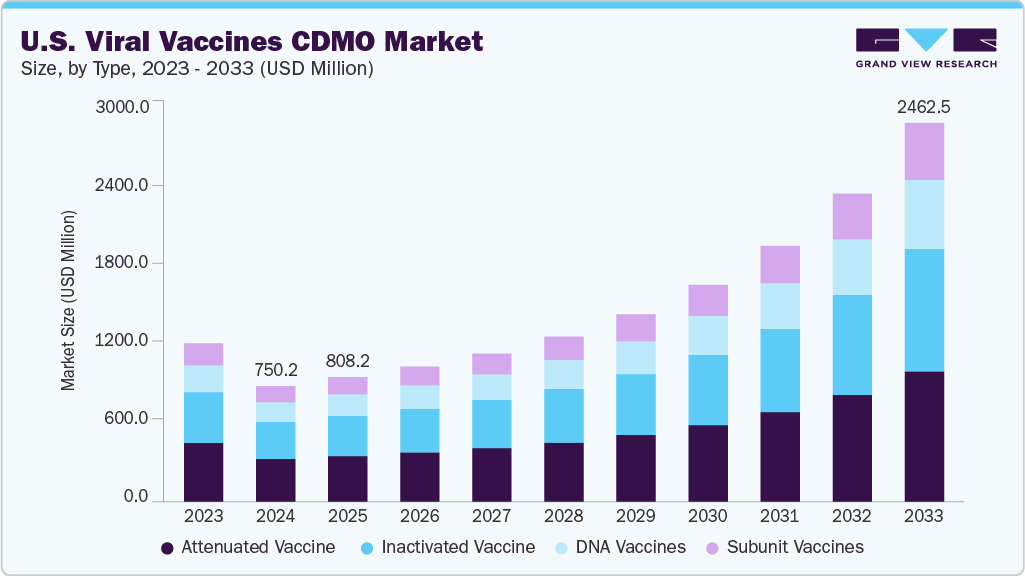

The U.S. viral vaccines CDMO market size was estimated at USD 750.2 million in 2024 and is projected to grow at a CAGR of 14.94% from 2025 to 2033. The growth is primarily attributed to strong government funding, advancements in vaccine technologies, and increasing demand for rapid, scalable production. Additionally, CDMOs with advanced capabilities such as single-use systems, lipid nanoparticle formulation, and fill-finish services are in high demand as pharmaceutical companies increasingly outsource to reduce costs and speed up timelines. Strategic partnerships, pandemic preparedness goals, and support from organizations like CEPI further the market growth.

The rising prevalence of viral diseases such as Respiratory Syncytial Virus (RSV), influenza, and monkeypox is accelerating demand for the U.S. viral vaccines CDMO market. Following pandemic-related trends, RSV surged significantly in 2022, resulting in hospitalizations among infants under six months, which increased sevenfold compared to pre-pandemic levels. Meanwhile, influenza test positivity in early 2025 rose to 18.7% across 44 states, along with rising hospitalizations and pediatric fatalities. At the same time, the monkeypox outbreak during 2022-2023 accounted for over 34,700 U.S. cases, prompting the administration of more than 1 million JYNNEOS vaccines. These surges have compelled public health agencies and vaccine developers to enhance manufacturing capacity, leading to contracts, process development, and infrastructure upgrades through CDMOs. This, in turn, supports market growth in the U.S.

The growth of the U.S. viral vaccines CDMO industry is significantly driven by public health emergencies and increasing demand for scalable, rapid vaccine production. Programs like Operation Warp Speed have catalyzed partnerships between the government and CDMOs, with over USD 10 billion in funding allocated to expand domestic manufacturing for COVID-19 and future outbreaks. This focus on pandemic readiness has led to long-term contracts through entities like BARDA, fostering consistent CDMO project pipelines. At the same time, pharmaceutical and biotech firms are increasingly outsourcing vaccine development and manufacturing to CDMOs to reduce upfront capital investments, accelerate time to market, and manage risks across complex viral platforms. Outsourcing also allows companies to concentrate on core R&D activities while leveraging CDMOs’ regulatory expertise and GMP infrastructure. This strategic shift, particularly evident in viral-vectored and multivalent vaccine development, positions U.S.-based CDMOs as key enablers of national biosecurity and public-private preparedness, enhancing long-term market growth opportunities.

Opportunity Analysis

The U.S. viral vaccines CDMO market presents substantial growth opportunities propelled by evolving government policy, diagnostic trends, platform innovation, and pandemic-readiness mandates.

A key opportunity exists in the demand for scalable, rapid-response manufacturing platforms to address emerging and re-emerging viral threats such as COVID-19 variants, RSV, mpox, and influenza. Government-backed initiatives, including BARDA contracts and the Strategic National Stockpile, continue to support large-scale CDMO partnerships to improve national preparedness. Additionally, the shift toward advanced vaccine modalities like mRNA, self-amplifying RNA, and viral vectors necessitates specialized capabilities such as lipid nanoparticle formulation, high-containment GMP suites, and single-use bioreactor systems. CDMOs that invest in these technologies can secure a larger share of complex vaccine projects.

Additionally, the rising prevalence of viral infections among pediatric and geriatric populations increases the demand for tailored vaccine formulations, dosing, and delivery technologies, creating new business opportunities for CDMOs with expertise in formulation and fill-finish. Strategic partnerships between CDMOs, biotech startups, and academic vaccine developers also pave the way for early-stage process development, tech transfer, and scale-up services. Furthermore, the trend toward modular and continuous manufacturing systems fosters operational efficiencies and regulatory advantages, allowing CDMOs to reduce time-to-market and serve a wider client base.

With North America holding a dominant share of global GMP vaccine manufacturing capacity, U.S.-based CDMOs are well-positioned to serve both domestic and international clients, particularly as nearshoring trends continue. The focus on pandemic resilience, the emergence of personalized and multivalent vaccines, and the expanding vaccine pipelines for oncology and rare viral diseases further increase market potential. As global health threats evolve and manufacturing complexity grows, the U.S. viral vaccines CDMO sector is set for strong, innovation-driven growth throughout the forecast period.

Technological Advancements

The integration of advanced technologies is driving the growth of the U.S. viral vaccine CDMO sector, with multiple innovations enhancing manufacturing speed, flexibility, and quality. A notable shift in single-use bioreactor systems eliminates cleaning downtime and reduces contamination risk while enabling rapid scale-up, which is crucial for pandemic responsiveness. Simultaneously, lipid nanoparticle (LNP) delivery systems, refined during the COVID-19 mRNA vaccine revolution, are now central to mRNA production workflows. They improve payload protection, delivery efficiency, and stability, factors that have driven demand for CDMOs skilled in LNP formulation. Innovations in viral-vector processing, including streamlined workflows for adenovirus and AAV platforms, have accelerated translational timelines from concept to clinic by integrating upstream cell culture and downstream purification into modular suites.

Moreover, automation and continuous manufacturing capabilities distinctly set apart top-tier CDMOs; by utilizing real-time monitoring, AI, and closed-loop controls, these processes provide enhanced batch consistency, shortened cycle times, and smaller facility footprints. Furthermore, fixed-bed bioreactor platforms are on the rise, allowing for more efficient production of complex viral vaccines at compact scales, as illustrated by solutions like Batavia Biosciences. At the analytical forefront, the integration of high-resolution mass spectrometry, AI-driven process analytics, and digital quality systems enables precise characterization and regulatory compliance, accelerating development and supporting scalable GMP operations.

Pricing Model Analysis

In the U.S., the viral vaccine CDMO industry shapes its pricing models through a blend of service complexity, platform technology, project scale, and regulatory requirements. Typically, CDMOs utilize three primary pricing structures: fee-for-service (FFS), full-time equivalent (FTE)-based, and milestone-based contracts. Early-stage development services, such as process development or analytical method validation, often employ FTE or hourly billing models for greater flexibility. In contrast, manufacturing projects, especially those involving viral vectors or live-attenuated viruses, typically adopt fixed-fee or milestone-based pricing linked to GMP batch production, lot release, or tech transfer success.

High containment requirements, specialized infrastructure such as BSL-2/BSL-3 suites, and single-use systems significantly affect pricing. For instance, viral vaccine production involving adenovirus or influenza typically incurs higher costs due to biosafety, aseptic fill-finish, and the complexity of downstream purification. Additionally, surge capacity or accelerated timelines, as witnessed during COVID-19 and RSV outbreaks, command premium pricing due to resource prioritization and workforce scaling. CDMOs also add premiums for regulatory compliance support, particularly in pre-IND, IND, and BLA filing stages.

Bundled services, where CDMOs provide end-to-end capabilities, can lead to discounted pricing compared to standalone services. However, many clients are willing to pay a premium for single-vendor integration, reduced risk, and faster timelines. Long-term contracts with public-sector agencies often include volume-based pricing models and flexible payment schedules.

Type Insights

The attenuated vaccine segment held the largest market share of over 36.89% in 2024 due to their effectiveness in generating strong and lasting immune responses. These vaccines utilized weakened versions of viruses, such as those for measles, mumps, rubella, and influenza, which replicate without causing illness. Their production is relatively efficient, as they can be cultivated using cost-effective and scalable methods like bioreactor-based systems and cell cultures. U.S.-based CDMOs are actively expanding their capabilities to support this demand, focusing on comprehensive services including viral strain optimization, bulk drug substance manufacturing, and aseptic fill-finish. Their ability to meet quality and scale requirements makes them valuable partners for both pharmaceutical companies and public health programs, strengthening the prominence of attenuated vaccines in the overall market.

On the other hand, the subunit vaccines segment is anticipated to witness the fastest growth during the forecast period due to advancements in vaccine technology, a rising demand for safer immunization options, and strategic government initiatives. Unlike live attenuated or inactivated vaccines, subunit vaccines use purified protein antigens to stimulate immune responses, providing enhanced safety profiles that are especially important for immunocompromised populations. This safety advantage has led to an increase in their development, particularly for diseases like COVID-19, RSV, and mpox. For instance, the U.S. government has made significant investments in subunit vaccine production facilities, such as the $1 billion Merck manufacturing site in North Carolina, to strengthen domestic vaccine manufacturing capabilities. These investments are part of a broader trend in which public-private partnerships and increased outsourcing are driving the production of subunit vaccines. Consequently, CDMOs specializing in subunit vaccine manufacturing are experiencing rapid growth, positioning themselves as key players in the changing vaccine landscape.

Service Insights

The fill-finish services segment held the largest share of the U.S. viral vaccines CDMO market in 2024. This growth is driven by its critical role in the final stages of vaccine production. As vaccines move from bulk drug substance to finished product, precise aseptic filling, labeling, and packaging are essential to ensure safety, efficacy, and regulatory compliance. The increasing demand for viral vaccines, including mRNA and viral vector platforms, has intensified the need for scalable and flexible fill-finish capacities. The COVID-19 pandemic revealed global bottlenecks in fill-finish operations, prompting significant investments by CDMOs to expand and modernize sterile manufacturing facilities. Moreover, regulatory agencies require stringent quality control, compelling vaccine developers to rely on experienced CDMOs to efficiently meet compliance standards. The rising number of clinical and commercial viral vaccine candidates further fuels this demand.

On the other hand, the analytical testing segment is expected to witness the fastest growth over the forecast period, as rigorous analytical testing enhances vaccine safety, potency, and regulatory compliance throughout development and manufacturing. The increasing complexity of viral vaccines, such as mRNA and viral vectors, demands advanced characterization and quality control techniques. Regulatory agencies like the U.S. FDA require extensive analytical validation, which drives demand for specialized CDMOs with strong testing capabilities. Furthermore, faster development timelines and multi-dose vaccine formulations intensify the need for comprehensive stability, impurity, and potency testing. The growth of this segment reflects the industry’s focus on quality assurance and risk mitigation in viral vaccine production.

Workflow Insights

The commercial segment accounted for the largest share in 2024 due to increasing demand for large-scale vaccine production. As vaccine manufacturers transition from clinical trials to full commercialization, they rely heavily on CDMOs for scalable manufacturing, quality control, and regulatory compliance. Growing immunization programs for influenza, RSV, and emerging viral threats require robust commercial supply chains, inducing CDMOs to expand their fill-finish, packaging, and cold-chain logistics capabilities. This segment benefits from long-term contracts and steady revenue streams, making it a critical growth pillar within the U.S. viral vaccine manufacturing ecosystem.

On the other hand, the clinical segment is expected to witness the fastest growth over the forecast period, driven by the increasing number of novel vaccine candidates entering clinical trials. Growing investments in early-phase development for viral vectors, mRNA, and other innovative platforms necessitate specialized CDMO services such as process optimization, GMP-grade material manufacturing, and small-scale fill-finish. Regulatory pressures for rapid yet compliant supply of trial materials, combined with priorities for pandemic preparedness, further enhance segmental demand. Furthermore, biopharma companies are increasingly outsourcing clinical-stage manufacturing to CDMOs to expedite timelines, lower capital costs, and leverage technical expertise, establishing the clinical workflow segment as a significant growth driver in the U.S. market.

End Use Insights

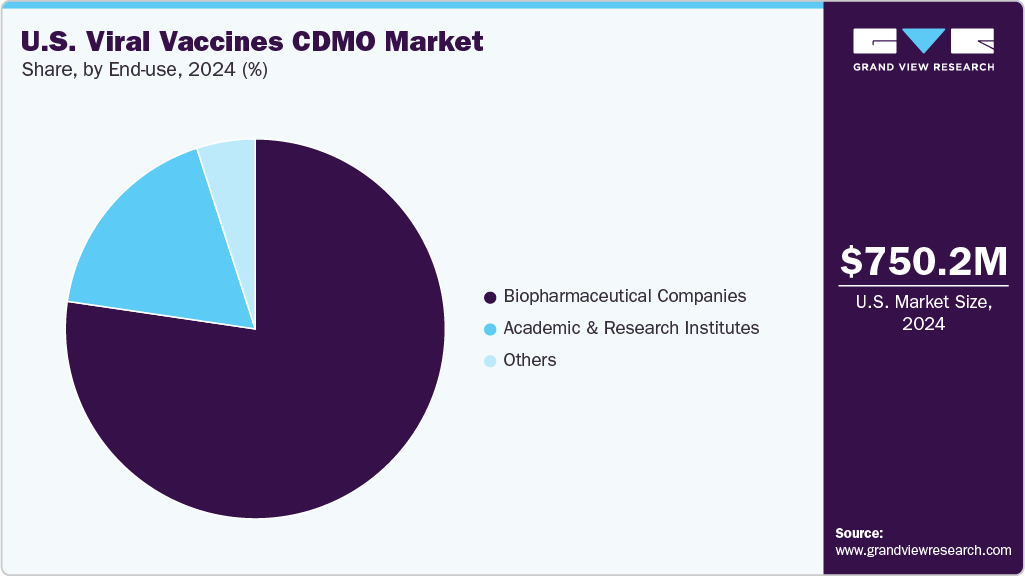

The biopharmaceutical companies segment held the largest market share in 2024 due to their increasing reliance on external partners for scalable, cost-effective manufacturing. These companies are increasingly outsourcing to CDMOs to accelerate development timelines, reduce capital investment in infrastructure, and access specialized capabilities such as viral vector production and aseptic fill-finish. The complexity of viral vaccine platforms, such as mRNA and adenoviral vectors, requires advanced bioprocessing expertise, which CDMOs are well-equipped to provide. Additionally, as biopharma firms expand their pipelines for infectious diseases, strategic collaborations with CDMOs enable faster clinical and commercial supply, making outsourcing a crucial growth strategy.

The academic and research institutes segment is expected to witness the second fastest growth during the forecast period. The high segmental growth is attributed to increased funding for public health research and early-stage vaccine development initiatives. These institutions are actively involved in translational research and depend on CDMOs for scalable GMP manufacturing, process optimization, and preclinical material production. Government and philanthropic grants, including those from NIH and CEPI, bolster academic-industry partnerships to accelerate responses to emerging viral threats. As vaccine platforms grow more complex, academic centers are increasingly partnering with specialized CDMOs to bridge the gap between discovery and clinical development, fostering sustained market demand.

Key U.S. Viral Vaccines CDMO Company Insights

The U.S. viral vaccines CDMO industry is dominated by a few key players with strong capabilities in viral vector manufacturing, fill-finish services, and end-to-end vaccine production. Leading firms include Catalent, Thermo Fisher Scientific, Fujifilm Diosynth Biotechnologies, Emergent BioSolutions, and Lonza. These companies benefit from extensive GMP infrastructure, advanced platform technologies like single-use bioreactors and LNP systems, as well as long-term contracts with government and biopharma clients.

For instance, Emergent BioSolutions and Fujifilm have played key roles in pandemic response efforts, securing federal funding to expand viral vaccine manufacturing. Thermo Fisher continues to grow its CDMO footprint through acquisitions and integrated service offerings. While the market remains moderately consolidated, mid-sized players and newer entrants are also capturing significant market share by specializing in specific viral platforms or providing flexible, modular production capabilities. The competitive landscape is influenced by technological readiness, regulatory history, and responsiveness to public health priorities, establishing U.S.-based CDMOs as global leaders in viral vaccine production.

Lonza

Catalent Inc.

Thermo Fisher Scientific, Inc.

Fujifilm Diosynth Biotechnologies

Emergent BioSolutions

Boehringer Ingelheim BioXcellence

Alcami Corporation

Samsung Biologics

Recipharm AB

Vetter Pharma

Recent Developments

In April 2025, FUJIFILM Diosynth Biotechnologies signed a 10-year manufacturing and supply agreement with Regeneron Pharmaceuticals, Inc. Through this partnership, FUJIFILM Diosynth Biotechnologies will provide U.S.-based manufacturing for Regeneron during the 10 years, leveraging current and planned expansions at its new large-scale biopharmaceutical manufacturing facility in Holly Springs, North Carolina. This partnership will strengthen the company’s large-scale biologic production and enhance critical capabilities for pandemic-response viral platforms.

In April 2025, AGC Biologics established a Cell and Gene Technologies Division by centralizing viral-vector platforms, such as ProntoLVV and BravoAAV, while scaling U.S. operations at its Longmont, CO facility. This division meets the growing demand for complex viral vaccine and gene therapy manufacturing support.

In April 2024, FUJIFILM Diosynth Biotechnologies announced the additional investment of USD 1.2 billion to expand its biomanufacturing facility in Holly Springs, North Carolina. This expansion aims to add eight 20,000-liter mammalian cell culture bioreactors by 2028, enhancing large-scale production capacity for biologics and vaccines.

U.S. Viral Vaccines CDMO Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 808.2 million

Revenue forecast in 2033

USD 2,462.5 million

Growth rate

CAGR of 14.94% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, workflow, service, end use

Country scope

U.S.

Key companies profiled

Lonza; Catalent Inc.; Thermo Fisher Scientific, Inc.; Fujifilm Diosynth Biotechnologies; Emergent BioSolutions; Boehringer Ingelheim BioXcellence; Alcami Corporation; Samsung Biologics; Recipharm AB; Vetter Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Viral Vaccines CDMO Market Report Segmentation

This report forecasts revenue growth country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. viral vaccines CDMO market report based on type, workflow, service, and end use:

Type Outlook (Revenue, USD Million, 2021 – 2033)

Attenuated Vaccine

Inactivated Vaccine

DNA Vaccines

Subunit Vaccines

Workflow Outlook (Revenue, USD Million, 2021 – 2033)

Service Outlook (Revenue, USD Million, 2021 – 2033)

End Use Outlook (Revenue, USD Million, 2021 – 2033)