Dublin, June 17, 2025 (GLOBE NEWSWIRE) — The “Engineering Services Market Opportunities and Strategies to 2034” report has been added to ResearchAndMarkets.com’s offering.

This report describes and explains the engineering services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

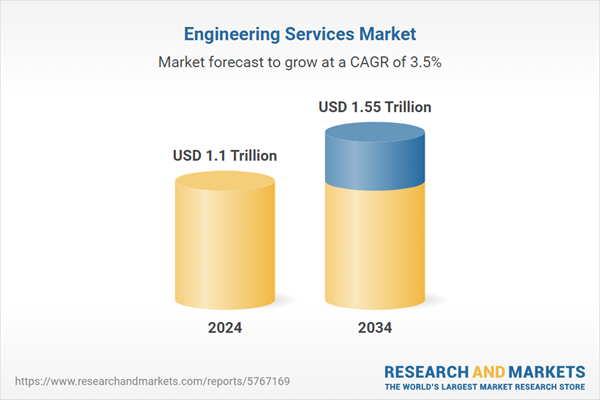

The global engineering services market reached a value of nearly $1.1 trillion in 2024, having grown at a compound annual growth rate (CAGR) of 3.48% since 2019. The market is expected to grow from $1.1 trillion in 2024 to $1.31 trillion in 2029 at a rate of 3.53%. The market is then expected to grow at a CAGR of 3.41% from 2029 and reach $1.55 trillion in 2034.

Growth in the historic period resulted from the rising infrastructure development projects, growing adoption of artificial intelligence, increased demand for industrial robots, increasing adoption of the industry 4.0 and rapid industrialization. Factors that negatively affected growth in the historic period was lack of quality control and safety concerns of engineering firms.

Going forward, the expansion of the renewable energy sector, increasing investments in smart cities, rising demand for IOT solutions for smart manufacturing and growing demand for sustainable and green engineering solutions will drive the growth. Factor that could hinder the growth of the engineering services market in the future include high liability risks and infrastructure funding gaps.

North America was the largest region in the engineering services market, accounting for 33.23% or $366.89 billion of the total in 2024. It was followed by Western Europe, Asia-Pacific and then the other regions. Going forward, the fastest-growing regions in the engineering services market will be Middle East and Africa where growth will be at CAGRs of 9.63% and 6.50% respectively. These will be followed by South America and Asia-Pacific where the markets are expected to grow at CAGRs of 6.26% and 4.35% respectively.

The global engineering services market is highly fragmented, with large number of small players operating in the market. The top 10 competitors in the market made up to 3.56% of the total market in 2023. AECOM was the largest competitor with a 0.67% share of the market, followed by McDermott International, Inc with 0.54%, WSP Global Inc with 0.51%, Jones Lang LaSalle Incorporated with 0.40%, Balfour Beatty Plc. with 0.31%, WorleyParsons Limited with 0.27%, Kiewit Corporation with 0.24%, AtkinsRealis Group Inc., (SNC-Lavalin) with 0.22%, Jacobs Solutions Inc. with 0.20% and Larsen & Toubro Limited with 0.19%.

The engineering services market is segmented type into civil engineering services, electrical engineering services, mechanical engineering services and other engineering services. The civil engineering services market was the largest segment of the engineering services market segmented by type, accounting for 50.69% or $559.61 billion of the total in 2024. Going forward, the other engineering services segment is expected to be the fastest growing segment in the engineering services market segmented by type, at a CAGR of 4.88% during 2024-2029.

The engineering services market is segmented by deployment mode into offshore and onshore. The offshore market was the largest segment of the engineering services market segmented by deployment mode, accounting for 57.99% or $640.17 billion of the total in 2024. Going forward, the offshore segment is expected to be the fastest growing segment in the engineering services market segmented by deployment mode, at a CAGR of 3.74% during 2024-2029.

The engineering services market is segmented by end-user into transportation infrastructure, other infrastructure, automotive, industrial manufacturing, healthcare sector, aerospace, telecommunications, information technology, oil and gas, utilities and other end-users. The transportation infrastructure market was the largest segment of the engineering services market segmented by end-user, accounting for 19.02% or $210.03 billion of the total in 2024. Going forward, the telecommunications segment is expected to be the fastest growing segment in the engineering services market segmented by end-user, at a CAGR of 4.65% during 2024-2029.

The top opportunities in the engineering services market segmented by type will arise in the civil engineering services segment, which will gain $81.48 billion of global annual sales by 2029. The top opportunities in the engineering services market segmented by deployment mode will arise in the offshore segment, which will gain $129.08 billion of global annual sales by 2029. The top opportunities in the engineering services market segmented by end user will arise in the transportation infrastructure segment, which will gain $44.75 billion of global annual sales by 2029. The engineering services market size will gain the most in the USA at $26.64 billion.

Market-trend-based strategies for the engineering services market include focus on adopting strategic partnerships approach to develop advanced engineering solutions, focus on adopting strategic partnerships approach to develop advanced engineering solutions, focus on prioritize developing interoperable portfolios to improve flexibility, efficiency and seamless integration across industries and focus on strategic investments to enhance innovation, optimize processes and technological capabilities. Player-adopted strategies in the engineering services market include focus on expanding business capabilities through partnership to expand its operational capabilities.

To take advantage of the opportunities, the analyst recommends the engineering services companies to focus on adopting generative AI to accelerate engineering efficiency, focus on building interoperable portfolios to enhance integration and flexibility, focus on strategic investments to strengthen technological capabilities and market reach, focus on high-growth opportunities in other engineering services, focus on expanding offshore engineering services capabilities, expand in emerging markets, continue to focus on developed markets, focus on strategic partnerships to drive innovation and market expansion, focus on pricing strategies to enhance competitive position, prioritize industry-specific digital channels for maximum reach, align promotional messaging with procurement priorities and focus on high-growth opportunities in the construction segment.

Major Market Trends

Strategic Partnerships Driving Innovation in Engineering ServicesGenerative AI Revolutionizing Engineering ServicesThe Impact of Flexible Engineering Portfolios on Industry GrowthStrategic Investments Transforming the Engineering and Construction Sector

Markets Covered:

Type: Civil Engineering Services; Electrical Engineering; Mechanical Engineering Services; Other Engineering ServicesDeployment Mode: Offshore; OnshoreEnd-User: Transport Infrastructure; Other Infrastructure; Automotive; Industrial Manufacturing; Healthcare Sector; Aerospace; Telecommunications; Information Technology; Oil and Gas; Energy and Utilities; Construction; Other End-Users

Key Companies Profiled:

AECOMMcDermott International, IncWSP Global IncJones Lang LaSalle IncorporatedBalfour Beatty Plc

Key Attributes:

Report AttributeDetailsNo. of Pages385Forecast Period2024 – 2034Estimated Market Value (USD) in 2024$1.1 TrillionForecasted Market Value (USD) by 2034$1.55 TrillionCompound Annual Growth Rate3.5%Regions CoveredGlobal

Companies Featured

AECOMMcDermott International, IncWSP Global IncJones Lang LaSalle IncorporatedBalfour Beatty Plc.WorleyParsons LimitedKiewit CorporationAtkinsRealis Group Inc., (SNC-Lavalin)Jacobs Solutions Inc.Larsen & Toubro LimitedICS Engineering ServicesEngineers India LimitedLaserBondCyientWiproSamsung EngineeringPorsche Engineering (Shanghai) Co. Ltd.Hyundai Engineering (HEC)UGLCybage Software Pvt. Ltd.China Overseas Engineering GroupChina Engineering Consultants, Inc. (CECI)Xodus GroupTech MahindraAssystem S.AColliers International Group Inc.Peakurban Pty LimitedBabcock International Group plciGreenDataTranstech Engineers, Inc.Porsche Engineering Group GmbHSunland.Al (International) Co. LimitedJacobs Solutions, Inc.Ramboll Group A/SJLL Engineering ServicesDyson UKStorkSNC-Lavalin Group IncJ. Murphy & Sons LimitedArcadisBabcock International GroupAlstomALTENArevaArteliaL&T Technology Services (LTTS)Axiscades Technologies LimitedMobica LimitedAmey plcBEP Engineering ServicesAutomotive Systems and ProjectsTecosim GroupIn-tech electronics GmbHIQT GroupTechno Engineering & AssociatesGT Ground Engineering & Construction ServicesPorsche Engineering Services, Ltd.International Business Machines Corporation (IBM)CapgeminiAKTIAS techOracleMMTR TechnologyGlobalLogicBoeing Airplane and Transport CorporationAyesaSoftelligence SRLColliersEnglobe CorporationNorda Stelo IncCWA Engineers IncUESRiner EngineeringKFW Engineers & SurveyingDeloitte Touche Tohmatsu LimitedDextra TechnologiesFluor CorporationBechtel CorporationABL Group ASAProper Marine10PearlsWhizSchlumberger Argentina S.A.Pecom Servicios Energia S.A.AnasacSilicon Engineering ConsultantsTechint Engineering and ConstructionEgis GroupOmraniaEmirates International Gas (EIG)Saudi Engineering Group International (SEGI)Aroma International Building Contracting LLCSmart Cities Building Contracting LLCBlack & White EngineeringISG ConstructionSaudi K-KEM Engineering Service CompanyRheinmetallResonant HoldingsThelo DBDorman Long Engineering LimitedCDR Engineering Consultancy Nigeria LimitedILF Engineers Nigeria LimitedGIBBEpsilon Engineering Services (Pty) LtdEHL Engineering GroupSouth Zambezi Engineering Services (Pty) Ltd

For more information about this report visit https://www.researchandmarkets.com/r/28fcej

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.