Refresh

Would an interest rate “hold” be good news for savers?

(Image credit: Getty Images)

What does it all mean for Rachel Reeves?

(Image credit: Photo by Carl Court/Getty Images)

“A smorgasbord of mixed messages”

The economy slumped by 0.3% in April, as business tax changes and Donald Trump’s tariffs took their toll.

(Image credit: Christine Phillips via Getty Images)

How many further rate cuts this year?

Research provider Pantheon Macroeconomics expects just one more cut this year, potentially coming in August. It previously thought November, but has brought this date forward after the labour market showed signs of weakening in the latest ONS report. This would bring the base rate to 4%.Financial institution ING is expecting quarterly cuts, which would mean two more cuts this year. Its economists think they will come in August and November. This would bring the base rate to 3.75%.Deutsche Bank thinks we will see three more cuts, coming in August, November and December. Its economists think weaker pay data could allow the MPC to speed up the pace of rate cuts in the final quarter of the year. This would bring the base rate to 3.5%.

Pace of rate cuts “now shrouded in a lot more uncertainty”

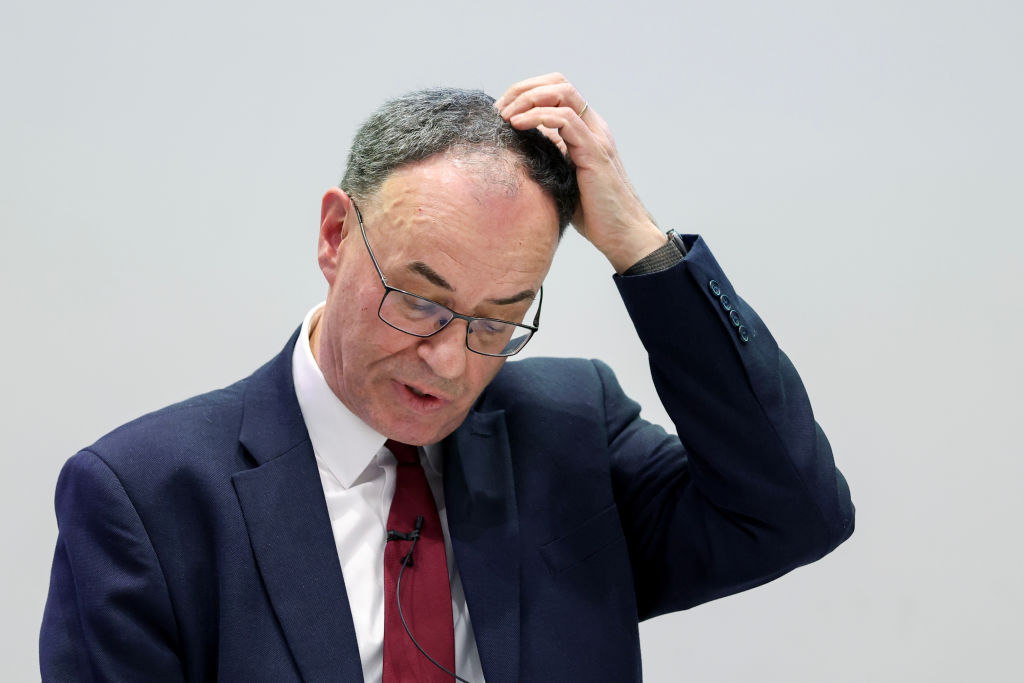

Governor of the Bank of England, Andrew Bailey

(Image credit: Photographer: Darren Staples/Bloomberg via Getty Images)

“Gradual and careful” approach to interest rate cuts

August 2024: The first cut this cycle brought rates from 5.25% to 5%.November 2024: Rates reduced from 5% to 4.75%.February 2025: Rates cut to 4.5%May 2025: Rates cut to 4.25%.

Inflation still coming in hot

(Image credit: AquaArts Studio via Getty Images)

Good afternoon and welcome to our live report. The Bank of England will announce its next interest rate decision at midday tomorrow.

(Image credit: Mike Kemp / In Pictures via Getty Images)