Dublin, June 20, 2025 (GLOBE NEWSWIRE) — The “South Korea Prepaid Card and Digital Wallet Market Intelligence and Future Growth Dynamics Databook – Q2 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

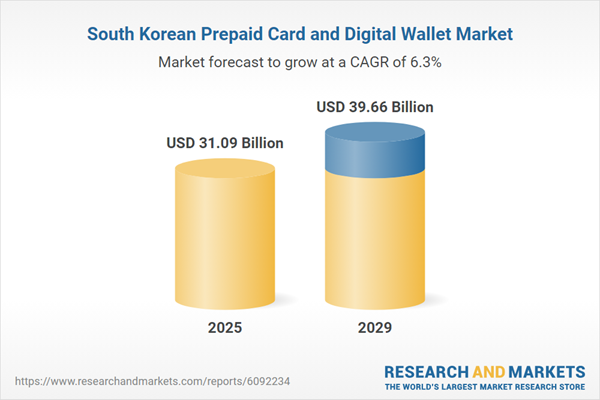

The prepaid card and digital wallet market in South Korea is poised for a significant upswing, with an anticipated annual growth rate of 7.5%, reaching USD 31.09 billion by 2025. From 2020 to 2024, this market has witnessed a robust expansion with a CAGR of 11.5%. Continuing on this trajectory, it is forecasted to grow at a CAGR of 6.3% from 2025 to 2029, potentially hitting USD 39.66 billion by the decade’s end.

Key Trends and Drivers in the South Korea Prepaid Cards Sector

South Korea’s prepaid card market is transforming significantly, fueled by digital payment growth, fintech innovation, and expanding corporate adoption. These trends will continue shaping the financial landscape over the next few years.

As traditional banks and fintech companies introduce enhanced prepaid solutions, competition will increase, leading to greater accessibility, improved functionality, and broader adoption across consumer and business segments.

Continued Expansion in the Prepaid Card Market

The South Korean government has actively promoted cashless transactions, implementing policies to reduce cash dependency and increase electronic payments. Additionally, the expansion of e-commerce platforms has driven demand for secure and efficient payment methods, with prepaid cards emerging as a convenient solution for online purchases. These trends continue to reinforce the growth of the prepaid card sector.Over the next 2-4 years, the prepaid card market is expected to sustain its upward trajectory, supported by advancements in payment infrastructure and increased financial innovation. As consumer trust in electronic transactions strengthens, wider adoption is anticipated across different demographics, ranging from unbanked populations to corporate users seeking financial flexibility.

Increasing Integration of Prepaid Cards with Digital Wallets

Prepaid card integration with digital wallets is becoming increasingly common in South Korea, offering consumers a seamless way to manage their funds. This development enhances accessibility by allowing users to conduct transactions, monitor spending, and transfer funds through mobile applications without needing physical cards. As digital payments become more ingrained in everyday financial activities, the adoption of prepaid cards within mobile wallet ecosystems continues to grow.Key factors driving this trend include technological advancements in mobile banking and digital payments, which have streamlined linking prepaid cards to digital wallets. Consumer demand for convenience has also pushed financial institutions and fintech companies to develop integrated financial solutions. Users increasingly prefer platforms that consolidate multiple payment options, simplifying financial management and reducing reliance on traditional banking services.Over the next 2-4 years, the integration of prepaid cards with digital wallets is expected to gain further momentum, with financial service providers introducing more advanced and user-friendly solutions. As adoption rates increase, digital wallets will play a more central role in South Korea’s payment landscape, gradually diminishing the need for physical payment cards and reinforcing the country’s transition to a cashless economy.

Expanding Corporate Use of Prepaid Cards for Expense Management

South Korean businesses increasingly incorporate prepaid cards into their financial management strategies, particularly for employee benefits, travel expenses, and corporate expenditures. This shift primarily aims to enhance operational efficiency while ensuring better financial oversight. As companies seek streamlined solutions for expense management, prepaid cards are emerging as a preferred tool for simplifying disbursements and reducing reliance on cash transactions.The adoption of prepaid cards in corporate finance is driven by operational efficiency and improved expense tracking. Businesses benefit from automated financial processes, eliminating the need for manual cash handling and reimbursement procedures. Additionally, real-time expense monitoring and spending limits allow organizations to enforce better financial discipline, reducing fraud risks and ensuring compliance with internal policies.Over the next 2-4 years, demand for corporate prepaid cards will rise, fueled by the increasing need for secure and automated financial solutions. Companies will likely adopt industry-specific prepaid card offerings tailored to sector-specific requirements, further expanding usage across different business verticals. As corporate financial management becomes more digitized, prepaid cards will be critical in streamlining company expenses and enhancing overall financial transparency.

Competitive Landscape of the South Korea Prepaid Card Market

South Korea’s prepaid card market is evolving rapidly, with growing competition among financial institutions and fintech firms. Regulatory shifts, strategic partnerships, and advancements in digital payment infrastructure are driving the sector’s expansion.

Over the next few years, innovation in mobile payments and corporate prepaid solutions will shape the competitive landscape, providing consumers and businesses with more flexible and efficient payment options. As companies leverage emerging financial technologies, South Korea’s prepaid card ecosystem is set to become more dynamic and integrated within the country’s broader digital economy.

Current Market Dynamics

This growth is fueled by digital payment adoption, increased corporate use of prepaid cards, and integration with mobile wallets. The South Korean government’s commitment to a cashless economy has encouraged prepaid card usage, particularly in e-commerce, transport, and corporate expense management.

Key Players and Market Share

The prepaid card market in South Korea is dominated by major financial institutions and fintech firms offering physical and virtual prepaid card solutions. Leading players include the Shinhan Card, KB Kookmin Card, Woori Card, and BC Card, which cater to a broad consumer base.Fintech startups have also entered the market, introducing mobile-first prepaid card solutions. For example, Toss Bank, a South Korean digital bank, has expanded its prepaid card offerings to attract younger users and digital-native consumers. The entry of international payment providers is also intensifying competition, with foreign companies seeking to leverage South Korea’s advanced digital payment infrastructure.

Recent Launches and Partnerships

Additionally, KB Kookmin Card acquired a minority stake in a local fintech startup specializing in prepaid card solutions, signaling a trend toward increased investment in digital finance services. The merger of payment service providers and traditional banks continues to reshape the competitive landscape as financial institutions seek to strengthen their digital capabilities.

Anticipated Market Evolution (Next 2-4 Years)

Competition in the South Korean prepaid card market is expected to intensify, driven by fintech innovation, increased consumer adoption, and regulatory developments. Traditional banks and new fintech players will continue to launch customized prepaid solutions, targeting specific market segments, including travel, corporate expense management, and youth financial services.Prepaid card integration with super apps and digital wallets will become a key differentiator, with companies leveraging AI-driven financial services to enhance user experience. Additionally, cross-border payment partnerships may emerge as South Korean companies explore international prepaid card markets.

Regulatory Changes

The Financial Services Commission (FSC) of South Korea has introduced new regulations to enhance consumer protection and financial security in prepaid card transactions. In March 2024, revised guidelines on prepaid electronic payment services were implemented, requiring stronger anti-money laundering (AML) and fraud detection measures.Furthermore, the Korea Fair Trade Commission (KFTC) has increased scrutiny of digital financial services, ensuring that fintech firms and traditional financial institutions operate within a fair and competitive market environment. These regulatory updates will shape how prepaid card providers innovate and expand their services.

Key Attributes:

Report AttributeDetailsNo. of Pages159Forecast Period2025 – 2029Estimated Market Value (USD) in 2025$31.09 BillionForecasted Market Value (USD) by 2029$39.66 BillionCompound Annual Growth Rate6.3%Regions CoveredSouth Korea

Report Scope

This report offers an in-depth, data-driven examination of prepaid payment instruments, focusing on expenditures via prepaid cards and digital wallets within both retail and corporate consumer sectors. It also presents an overview of consumer behavior and retail spending patterns in South Korea.

The report includes a detailed breakdown of key market segments for each country. It delivers a comprehensive analysis of the prepaid card and digital wallet markets. With over 80+ country-level key performance indicators (KPIs), the report provides a thorough understanding of market dynamics in the prepaid card and digital wallet sectors.

Market Insights:

South Korea Prepaid Payment Instrument Market Size and ForecastSouth Korea Digital Wallet Market Size and ForecastSouth Korea Digital Wallet Retail Spend DynamicsSouth Korea Prepaid Card Industry Market AttractivenessSouth Korea Open Loop Prepaid Card Future Growth DynamicsSouth Korea Closed Loop Prepaid Card Future Growth DynamicsSouth Korea Prepaid Card Consumer Usage TrendsSouth Korea Prepaid Card Retail Spend DynamicsSouth Korea General Purpose Prepaid Card Market Size and ForecastSouth Korea Gift Card Market Size and ForecastGift Card Market Size and Forecast by Functional AttributeGift Card Market Size and Forecast by Consumer SegmentsGift Card Market Share Analysis by Retail CategoriesSouth Korea Entertainment and Gaming Prepaid Card Market Size and ForecastSouth Korea Teen and Campus Prepaid Card Market Size and ForecastTeen and Campus Prepaid Card Market Size and Forecast by Functional AttributeSouth Korea Business and Administrative Expense Prepaid Card Market Size and ForecastSouth Korea Payroll Prepaid Card Market Size and ForecastPayroll Prepaid Card Market Size and Forecast by Consumer SegmentsSouth Korea Meal Prepaid Card Market Size and ForecastMeal Prepaid Card Market Size and Forecast by Consumer SegmentsSouth Korea Travel Forex Prepaid Card Market Size and ForecastTravel Forex Prepaid Card Market Size and Forecast by Consumer SegmentsSouth Korea Transit and Tolls Prepaid Card Market Size and ForecastSouth Korea Social Security and Other Government Benefit Programs Prepaid Card Market Size and ForecastSouth Korea Fuel Prepaid Cards Market Size and ForecastSouth Korea Utilities, and Other Prepaid Cards Market Size and ForecastSouth Korea Virtual Prepaid Card Industry Market AttractivenessSouth Korea Virtual Prepaid Card Market Size by Key Categories

For more information about this report visit https://www.researchandmarkets.com/r/p8r2f

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

South Korean Prepaid Card and Digital Wallet Market