The UK Government announced its latest spending review on June 11 which, as the name suggests, sets out Labour’s key spending plans for the next three financial years.

This statement was greeted with a lot less criticism than the economically damaging tax rises announced in the Autumn Budget back in October.

Hardly surprising that spending money is more popular than raising taxes, but the scale of spending plans has raised concerns that taxes will need to rise again in the next budget.

Nevertheless, this announcement has given the Executive a tool it has lacked for over a decade, namely a multi-year budget.

In addition, a further £600 million is available for public services through to 2029 which brings the total additional funding secured since the Executive’s restoration to £1.3 billion.

Chancellor of the Exchequer Rachel Reeves delivering her Government’s spending review to MPs in the Commons earlier this month (House of Commons/UK Parliament/PA)

Chancellor of the Exchequer Rachel Reeves delivering her Government’s spending review to MPs in the Commons earlier this month (House of Commons/UK Parliament/PA)

This uplift is based on an updated “needs-based adjustment factor” of 124% which will apply to Barnett consequentials arising from the spending review, a significant uplift from the transitional 5% rate that would have otherwise applied.

Important to achieving this uplift was the exclusion of £329 million of agricultural funding from the relative funding calculation. Without this, the headline £600 million boost would not have been secured.

This outcome is broadly consistent with the recommendation of the independent Holtham Review, which estimated Northern Ireland’s relative need to be between 123% and 128%.

So far so good. But this does not remove the need to take difficult decisions nor will the money taps suddenly be turned on.

The Audit Office has previously criticised the short-term approach for stifling effective planning and Ministers will likely be under greater scrutiny when prioritising their spending, investment and reform agendas.

The challenges are significant. We have an aging population putting increasing pressure on the health budget.

In my almost 30 years of working in public policy, the NHS has never had enough money, even in the go-go Blair years, which begs the question if the current model for delivering health is sustainable.

Unfortunately, even raising that question would spell the end of a political career, both locally and nationally, so we plough on.

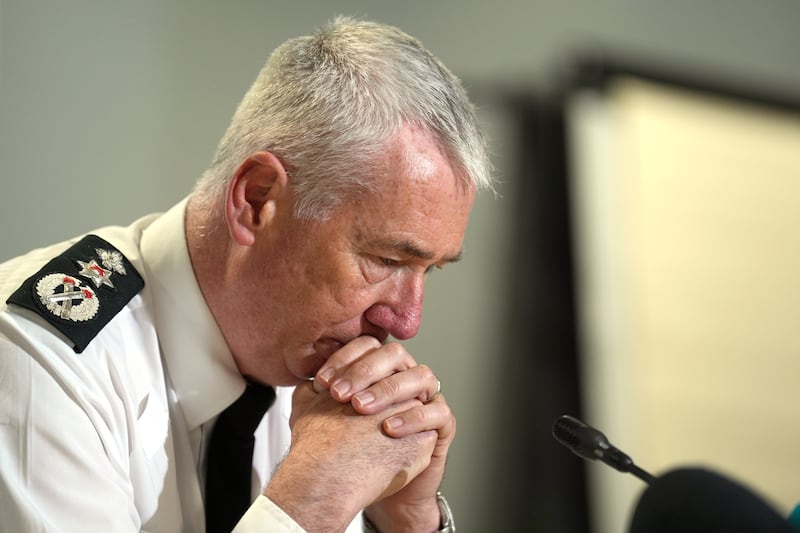

Just last week the Chief Constable indicated that the PSNI was critically underfunded as it required outside assistance to manage street disorder.

Similarly, the independent NI Fiscal Council has repeatedly warned of chronic underfunding in critical infrastructure, most notably wastewater infrastructure, which is hampering both economic and housing development.

Beyond the headline figures, other specific announcements also captured public attention. A £50 million commitment has been made towards the redevelopment of Casement Park, an important component in the overall sporting infrastructure for the north and a potential economic driver for West Belfast.

However, there is a question over the nature of this funding, which has been designated as Financial Transactions Capital (FTC). This is typically a loan rather than a grant and the finance minister confirmed that the precise terms of the funding were still to be finalised, but the funding looks secure.

Attention now turns to two critical next steps. First, the Executive must work to agree its own multi-year Budget, a process which will prove a true test of its priorities, forcing difficult choices about where to allocate limited resources.

Second, discussions will begin immediately with the Treasury on a full Fiscal Framework. This long-term arrangement will consider in detail the core issues underpinning Northern Ireland’s finances, including the full recommendations of the Holtham Review, the potential for greater fiscal devolution and borrowing powers for bodies like the Housing Executive to tackle the housing shortage.

Overall, the spending review should improve decision making across NI Government, but there is no free lunch, and the additional funding has come at the cost of higher taxes.

Chief Constable Jon Boutcher indicated last week that the PSNI was critically under-funded as it required outside assistance to manage street disorder (Brian Lawless/PA)

Chief Constable Jon Boutcher indicated last week that the PSNI was critically under-funded as it required outside assistance to manage street disorder (Brian Lawless/PA)

A well functioning economy generates additional tax revenue from economic growth, but unfortunately the tax policies of the current UK Government are stifling the economic growth required to generate that additional revenue

The Chancellor of the Exchequer seems to be caught in a vicious cycle. She wanted to increase spending, so she raised tax rates, but this has impacted economic growth which has reduced tax revenue and so now she is planning further tax rises.

This highlights an important economics lesson, raising tax rates doesn’t always increase tax revenues. Hopefully someone within the Treasury is advising: “when you are in a hole, stop digging”.

As a consequence, in the absence of a return to pro-growth economic policies, the trend of constrained public finances looks set to continue.

Therefore, whilst the additional funding secured is welcome, it is not a silver bullet, but it does present an opportunity for the Executive to move beyond crisis management and begin the difficult work of transforming public services for a sustainable future.

Gareth Hetherington is director at the Ulster University Economic Policy Centre (UUEPC). The views expressed are his own