Quick overview

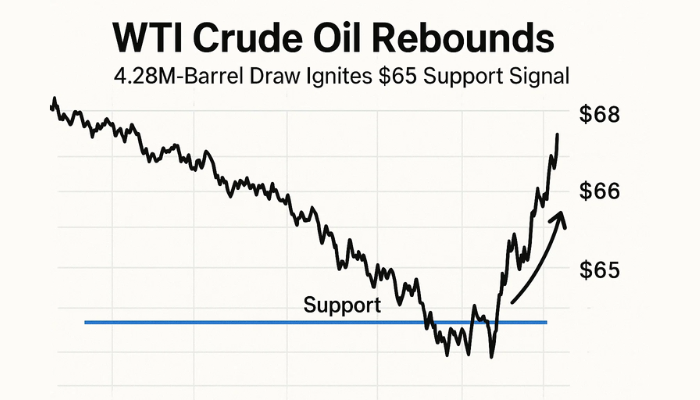

WTI Crude Oil (USOIL) prices edged higher on Wednesday, rebounding to $65.37 after a sharp $12 correction from the $77.11 high. The bounce came as investors absorbed conflicting signals out of the Middle East. A tentative ceasefire between Iran and Israel, brokered by the U.S., remains shaky, both sides have accused each other of post-truce attacks, adding fresh uncertainty to regional supply risks.

Whereas, the U.S. intelligence update demonstrated that the recent strikes on Iranian nuclear facilities may have only marginally delayed Tehran’s nuclear progress. It’s doing a little bit of ease in the long-term geopolitical pressure. This fragile equilibrium continues to inject volatility into oil markets.

Tightening Supply Adds Fuel

Beyond geopolitics, fundamentals are turning supportive. The latest American Petroleum Institute (API) data showed a 4.28 million-barrel draw in U.S. crude inventories, far exceeding expectations of just 0.6 million barrels. This marks the 4th consecutive weekly drop and the sixth in the past eight weeks, highlighting a tightening domestic supply backdrop.

However, the bullish trend might be limited in the near term as the International Energy Agency (IEA) is still holding 1.2 billion barrels in emergency reserves. In addition, some OPEC+ nations have shown willingness to deploy more capacity to stabilize prices if necessary. These factors temper the risk of runaway prices but do set the stage for opportunistic trading.

Technicals Suggest Cautious Optimism

From a charting perspective, WTI is testing a critical support region around $64.76–$65.00, which aligns with the 0% Fibonacci retracement level and a rising trendline from late May. Recent candles show long lower wicks and a spinning top pattern—classic signs of bearish exhaustion. Yet, momentum remains negative.

WTI Crude Oil Price Chart – Source: Tradingview

WTI Crude Oil Price Chart – Source: Tradingview

MACD: Still below zero, but histogram bars are shrinking, suggesting bearish momentum is fading.

50-EMA: Positioned at $69.58, this moving average represents key dynamic resistance.

Key Levels:

Immediate Support: $64.00

Upside Targets: $67.10 (23.6% Fib), $69.00, and $69.58 (EMA)

Trading Signal – USOIL:

Aggressive Long: Buy above $66.00 if a bullish engulfing candle forms. Target: $67.10–$69.00. Stop-loss: below $64.00.

Conservative Long: Wait for a retest near $64.76 and bullish reversal signal (e.g., hammer).

Bearish Bias: A break below $64.00 opens downside to $62.20 and $60.00.

Conclusion:

WTI Crude Oil sits at a pivotal inflection point. While geopolitical noise and falling inventories support a rebound case, technical confirmation is needed. Traders should stay alert to reversal candles and volume spikes before committing to the next leg.

Related Articles