“Never let a good crisis go to waste.”

— Winston Churchill

Since gaining independence, Ukraine’s strategic trajectory remained unclear—both politically and economically—until the Revolution of Dignity. While the countries of Eastern Europe promptly set their strategic course toward integration into European structures—namely NATO, the EU and eventually the eurozone—Ukraine continued to oscillate between Europe and the post-Soviet construct dominated by Russia. Only in 2014, following the second Maidan and Russia’s occupation of parts of Donbas and Crimea, did the new Ukrainian government officially declare European integration and distancing from the emerging Russian empire as the country’s strategic objective. However, the declaration was not accompanied by rapid and radical political or economic reforms. Some segments of society resisted reform efforts, while Ukraine’s northern neighbor actively employed both conventional and hybrid tools to destabilize the political situation and undermine the economy, particularly in the eastern regions. The government failed to implement the full scope of the economic and financial reforms outlined in its cooperation program with the International Monetary Fund, which was ultimately terminated prematurely.

The full-scale war launched by Russian imperialist forces has left Ukraine, as an independent state, with no viable alternatives for its continued existence. Ukraine must now pursue full integration into European structures as swiftly as possible—even within its current territorial boundaries—or risk ceasing to exist as a sovereign state and becoming subsumed into the so-called “Russian world.” Naturally, for the former scenario to be realized, the war must be brought to an end under terms that are, as much as possible, acceptable for Ukraine under current circumstances.

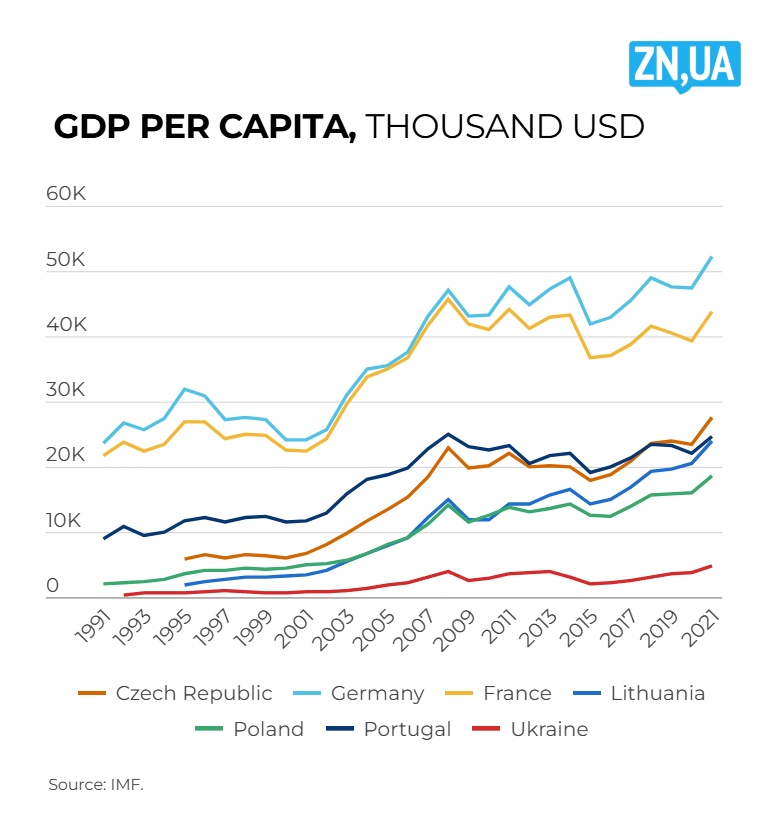

At the same time, the acceleration of global fragmentation—particularly since the advent of the new US administration—necessitates a fundamental reassessment of the pathways and mechanisms of political, economic and financial integration, even amid wartime. In the case of the European Union and Ukraine, the political and economic prerequisites have shifted dramatically. Before the war, Ukraine’s accession to European institutions was primarily hindered by the weakness of its political institutions and its comparatively low level of economic development (see figure). Additionally, Russia’s occupation of Crimea and part of Donbas following the 2014 Maidan significantly slowed Ukraine’s progress toward EU integration.

In turn, Europeans demanded that Ukraine set out on a long process of institutional and economic transformation to meet the EU’s initial accession requitements. However, the geopolitical shift following Russia’s full-scale invasion of Ukraine—and the military threat this posed to Europe—prompted a fundamental reassessment of the EU’s relationship with Ukraine. The prospect of Europe’s military and economic enlargement through embracing Ukraine, particularly amid the weakening of political and economic ties with the United States, is now viewed by many European policymakers not as an economic burden but as a gain. Obviously, such enlargement will enhance Europe’s defense capabilities, increase competitiveness and broaden markets for goods and services—precisely what the EU needs in the current context.

At the same time, the current geopolitical crisis has served as a powerful catalyst for Ukraine, compelling it to accelerate institutional, legislative and economic reforms in order to speed up integration into European structures. This has become an existential matter for Ukraine: a question of whether it will continue to exist.

The integration of Ukraine’s financial sector into the European financial space is a central pillar of the broader integration process. These issues were at the heart of discussions at the international conference Economic and Financial Integration in a Stormy and Fragmenting World, held in Kyiv in late June by the National Bank of Ukraine and the National Bank of Poland, with support from the German Agency for International Development Cooperation (GIZ) and the International Monetary Fund.

Two interrelated trajectories—the accelerated European integration of Ukraine and the strengthening of the European Union’s own resilience—are increasingly seen as mutually reinforcing. A common defense strategy should serve as the foundation cementing the joint political, economic and financial edifice of a future Ukraine–EU bloc, particularly in light of the persistent Russian threat. As a result, the notion that Ukraine is no longer merely a recipient of military and financial aid but a European state with agency and influence—capable of shaping the future security and economic paradigm of a united Europe—is increasingly gaining traction.

Let us now turn to the key ideas discussed at the conference, voiced by distinguished speakers, such as Christine Lagarde, President of the European Central Bank, Andrew Bailey, Governor of the Bank of England, Kenneth Rogoff, Professor at Harvard University and former IMF Chief Economist, representatives of central banks from various countries, as well as Ukrainian officials from the National Bank of Ukraine (NBU), the Ministry of Finance and the Ministry of Economy.

A deeper and faster integration of Ukraine into European structures is expected to bring swift and positive benefits to both the economy and society. However, it also entails risks if mismanaged or pursued without prudence. Reforms must be unrelenting and consistent, and they must yield prompt and positive results for the society as a whole. Without broad-based societal support, any reform agenda is bound to fail.

The deepening of economic ties among EU member states and other European countries, including Ukraine, will enhance the resilience of the European economy and help mitigate the risks of global market turbulence. For Ukraine, in particular, the European Union is already its largest economic partner, accounting for over half of its foreign trade in goods.

Among the principal risks of accelerated integration are mismatches in the pace of integration in the real and financial sectors, as well as in the tradable goods and services sectors and the rest of the economy. One key example is the Balassa–Samuelson effect, which suggests that labor productivity—and hence wages—in the tradable sector tend to rise more rapidly, thereby exerting upward pressure on wages in lower-productivity sectors, ultimately fueling inflation. Another major risk stems from capital inflows during periods of economic boom, especially when accompanied by expansionary fiscal policy. If accompanied by sudden capital outflows and an inability to finance both external and internal imbalances, this leads to crises.

Access to cheap external credit and unjustified consumption growth also pose serious risks in the integration process, as evidenced by the experiences of Greece and several other European economies.

The successful experiences of new EU members such as Poland and the Czech Republic offer important lessons. These include directing foreign investment toward high-productivity sectors, pursuing robust industrial strategies, embedding domestic industries into value chains linked to stronger economies and multinational corporations, implementing balanced monetary policies, absorbing excess foreign capital and maintaining a stable financial system.

Ukraine must take all of these factors into account during its integration process.

As for the experience of central banks, several principles are worth emphasizing.

Central bank independence is independence from government decisions that may violate the bank’s mandate—not independence from the public. In fulfilling its mandate to ensure price and financial stability, a central bank must remain transparent and accountable to society.

Effective communication by central banks, tailored to reach all segments of society, is crucial for maintaining price stability. Anchoring inflation expectations close to monetary policy targets is currently the most effective monetary transmission channel, especially amid current uncertainty and turmoil.

There is no strict hierarchy between the goals of price stability and financial stability. On the one hand, high inflation erodes confidence in the national currency and the banking system. On the other hand, financial instability raises inflation expectations and undermines trust in the currency, ultimately accelerating inflation.

In the world markets, the role of the US dollar as a reserve currency is gradually diminishing. Rising US public debt and the uncoordinated tariff policies of the new American administration have contributed to growing distrust in the dollar. While the dollar is likely to remain dominant for some time, the world is moving steadily toward a system of several competing reserve currencies. In this context, the international role of the euro—in terms of foreign exchange reserves and cross-border settlements—is set to grow.

In conclusion, Ukraine’s accession to the European community should be seen as a complex process—a journey without a clearly defined finish line because the European Union itself is evolving alongside Ukraine. This also means that the candidate country must move faster and more decisively. On this path, Ukraine must strive to strike a prudent balance between a strong state and a vibrant civil society.

Read this article in Ukrainian and russian.

Noticed an error?

Please select it with the mouse and press Ctrl+Enter or Submit a bug

Stay up to date with the latest developments!

Subscribe to our channel in Telegram