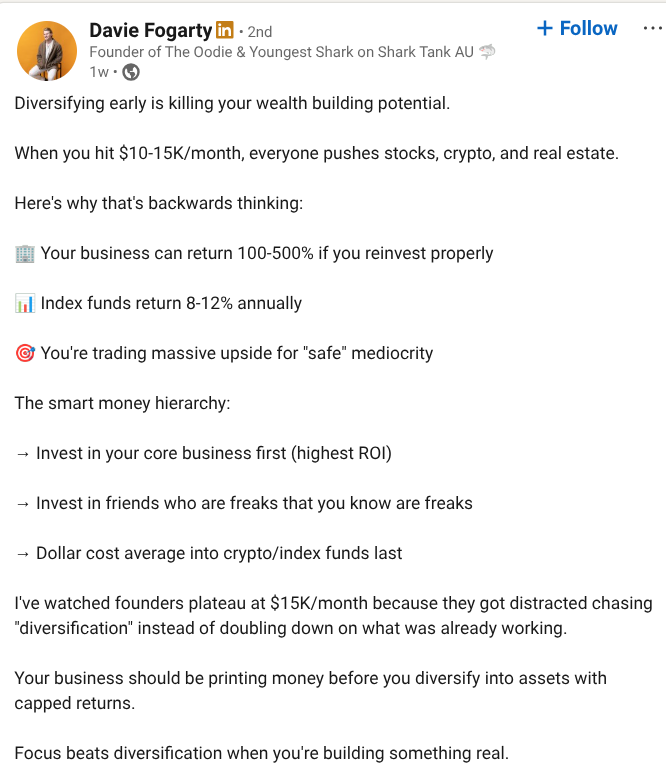

Last week, Davie Fogarty, Shark Tank panelist and founder of Australia’s super hit e-commerce brand The Oodie, posted this on LinkedIn:

His advice captured the scrappy, all-in spirit of entrepreneurship — and for many stages of growth, it’s spot-on.

Related Article Block Placeholder

Article ID: 317751

But blanket rules can be dangerous.

As an accountant who works with scores of Australian e-commerce founders, I’ve watched businesses skyrocket and flame out.

Rags to riches to rags.

Over the past 18 months alone, more than a dozen once-celebrated direct-to-consumer labels have entered administration.

The point of this article is not to be all doom and gloom, but rather to offer a framework for business owners on how to balance their business finances as well as their personal finances.

Building a successful financial story in AND outside your business

As an accountant and business owner, the question I always ask myself is this:

How do I build a successful financial story outside of my business, but at the same time give my business every ounce of time and capital it needs to grow and build equity value?

The fact is: piling your hard-earned money into your young and capital-consuming business is a high-risk asset class.

If you are going to invest every single dollar you have into a high-risk asset class — that is, your business — you need to balance that risk.

Here’s how I think about it.

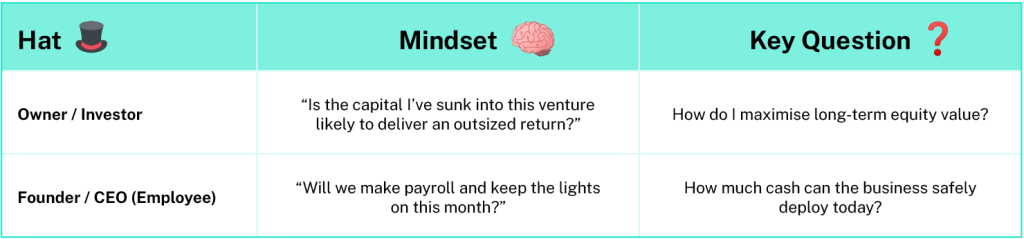

The two financial hats

Every founder wears two financial hats. The first is the ‘owner’ hat. As the owner, you effectively wear the hat of an investor.

The investor considers your startup capital injected just like the shares bought on the stock market or real estate investments. You want to ensure the capital and time invested in your business will provide you with a financial return in the future.

The second hat you wear as the founder or CEO is an ‘employee’ hat. As the CEO, it’s up to you to ensure your company is well-managed financially, ie, your employees get their paycheque and you don’t run out of money.

As a CEO, you, too, are an employee of your company. You should get a paycheque just like everyone else working in your business.

These two roles will often conflict. As the owner, your motivation is to maximise the financial return from your business. To generate a return on the investment of capital and time you have contributed while building it. The dilemma you will face is the trade-off between taking income now as a CEO versus long-term wealth creation for your role as an investor.

Related Article Block Placeholder

Article ID: 318496

You earn present income from the salary you make as an employee, as well as dividends the business may pay you as an investor. Yet, the more present income you draw from the business now, the less capital there is to invest in the business to create long-term value.

On the other hand, drawing the minimal amount of present income leaves more capital to create higher long-term value (if re-invested wisely) — but at the cost of your current standard of living outside of the business.

Source: SmartCompany

Source: SmartCompany

These incentives inevitably clash. Pay yourself too much and you starve growth; pay yourself nothing and you risk burnout (or default on your mortgage). The sweet spot is deliberate, not accidental.

Entrepreneurs are masochists

Starting and growing a business requires a level of resilience and tolerance for risk that is not for the faint of heart.

The problem is that we can get caught up in this behaviour where we invest every single dollar into our high-growth, high-risk business, and neglect the most important piece of the entire puzzle — paying ourselves as well.

As a founder, the art of financial management is finding a balance that gives you enough present income to support the lifestyle and savings buffer you need, while still providing the business with the funds it needs to fuel healthy growth.

So, what’s a realistic, happy middle ground? Here’s what I recommend.

It’s about knowing your minimum viable lifestyle.

The minimum viable lifestyle

You may be familiar with the Silicon Valley term Minimal Viable Product (MVP). This phrase was popularised by startup guru Eric Ries in his legendary book Lean Startup. The MVP thesis is designed around building the cheapest and smallest product possible, with just enough features to satisfy the early customers. The idea is to work within a cost constraint that achieves the most viable outcome.

The MVP principle can be adapted to disciplines outside of the product development and software world. As an accountant, I like to apply it to your lifestyle and personal finances. Let’s call it the ‘minimum viable lifestyle’ (MVL).

The idea behind the MVL is to design your lifestyle so that you are living on the lowest viable cost, which still yields the highest impact to satisfaction. The core principle is you only spend money on things that have a high personal utility.

The process involves an audit of your personal monthly lifestyle expenses and eliminating unnecessary or impulse purchases. The monthly result is your MVL.

From a business accounting perspective, figuring out your MVL provides a guide of what minimum monthly salary you should draw before investing any surplus cash back into your business. Remember, we want to make sure that you pay yourself first, so your personal finances don’t suffer.

Related Article Block Placeholder

Article ID: 317326

If you’re drawing over and above this monthly salary and your business can support it, then it’s okay to leave it. Consider this surplus as savings, and invest it outside of your company.

If your current salary is below this MVL, maybe you can use this calculation as a justification to give yourself a bit of a pay rise.

The added benefit of calculating your MVL salary is it mentally draws a line in the sand. Rather than taking money from the business as you need it, it helps you to stick to a fixed monthly salary. Surplus profit in the company can be paid as a dividend, not to be pinched when you feel fit.

Business growth and personal wealth aren’t mutually exclusive

Fogarty’s mantra to reinvest relentlessly certainly has merit, but only when paired with a system that protects the person wearing the founder hat.

By defining your minimum viable lifestyle, respecting the clash between your two financial roles, and hedging against optimism bias, you give both you and your company the best odds of long-term success.

Never miss a story: sign up to SmartCompany’s free daily newsletter and find our best stories on LinkedIn.