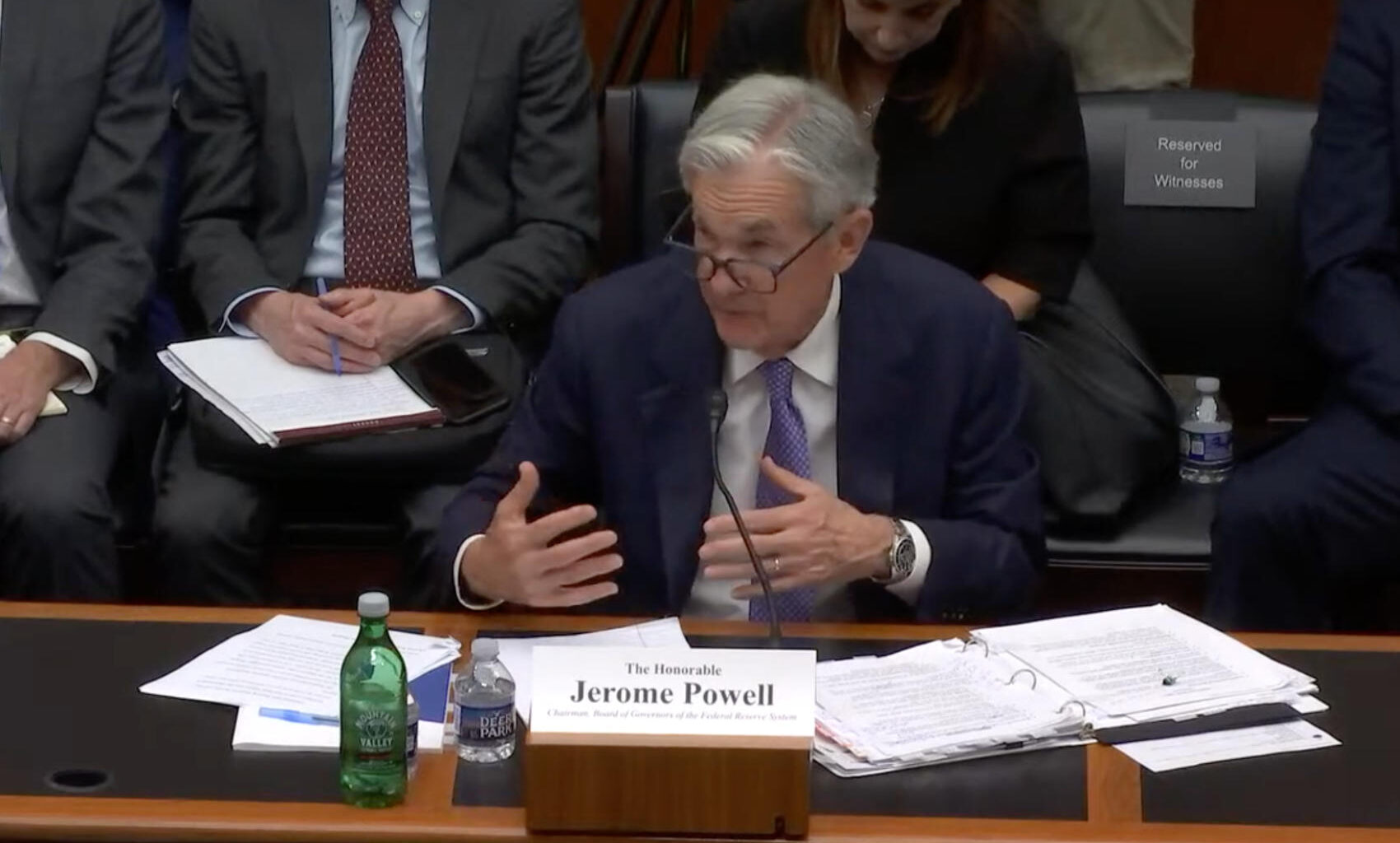

Federal Reserve Chair Jerome Powell said this week that the crypto industry is becoming more “mainstream” and expects banks to increase their engagement with the sector. He made the remarks while responding to questions during House and Senate committee hearings.

The Trump administration’s embrace of digital assets has prompted banking regulators to adopt a more accommodating stance toward the sector. In April, the Federal Reserve withdrew four crypto related advisories, and earlier this week it announced that reputational risk should no longer be part of bank supervision procedures. Republicans had accused banking regulators of using reputation as a tool to debank crypto firms and other groups.

While Republican lawmakers welcomed the policy shifts, they questioned what prompted the changes.

Lummis questions regulatory reversal

Senator Lummis noted that one of the withdrawn crypto statements said that “Issuing a token on open, public, and/or decentralized networks, or similar systems is highly like to be inconsistent with safe and sound banking practices.” She pointed out that the Federal Reserve has not withdrawn an advisory related to section 9(13) which includes a similar statement.

The Senator emphasized that the recently passed Genius Act allows banks to use distributed ledgers as books and records, and wanted to know what factors caused the Fed to change its stance.

Chair Powell responded that many previous advisories coincided with periods of turbulence and fraud in the crypto sector.

“I think what’s happening is the industry is maturing, our understanding of it is improving, and in a sense, it’s becoming much more mainstream,” he said, adding that banks could always choose their customers and take on other activities, provided they do it in a safe and sound manner. He said the section 9(13) advisory wasn’t just about crypto, so he’d have to get back to her on that.

Steil seeks clarity on reputational risk changes

Representative Steil took a similar position on reputational risks, wanting to know whether new information had prompted the Federal Reserve’s statement this week.

Chair Powell responded that there had been reports of debanking for a couple of years, which really came into focus in 2024. The Federal Reserve Board “came to the view that this was a serious problem that we need to address.”

When Steil asked whether Powell expected the withdrawal of the crypto statements to impact bank activities, he responded that he sees “a very significant change in the tone” which reflects the “evolving status of the crypto industry”. Over time, he’d expect to see more activity.

Responding to other questions, Powell stated that it was good to see progress on a legal framework for stablecoins.