Czechia’s rail liberalisation is accelerating. Arriva has secured its largest Czech contract to date: a €750 million deal to run long-distance electric trains between Prague and Western Bohemia. That also unlocks €300 million for a new EMU fleet, sharply raising the stakes for state-backed Czech Railways as long-term service contracts in Czechia take off — and are increasingly opened to private rivals.

Arriva has secured a landmark 15-year, €750 million contract to operate long-distance electric services in western Czechia, marking the company’s biggest-ever win in the country. It also means the private operator has unlocked a further €300 million investment for a brand-new EMU fleet. That will go a long way towards allowing it to significantly expand in Czechia’s ever more liberalised rail market.

Starting in three years’ time, the new Arriva contract, announced on Thursday, covers high-frequency services between Prague and major cities in Western Bohemia—routes that run along one of the busiest corridors in the country and are key to both domestic and cross-border connectivity. It’s also Arriva’s most significant deal yet since its acquisition by US investment firm I Squared Capital – which is clearly backing the company’s ambitions in Central Europe’s liberalising rail markets.

One of Arriva’s trains in Czechia. © Arriva

One of Arriva’s trains in Czechia. © Arriva

The timing of the win is just as significant as the contract itself. Czechia’s rail sector is undergoing a major transformation, with all subsidised passenger services to be competitively tendered within eight years. As a result, state contracts are being opened to private operators at an accelerating pace; indeed, the country’s largest-ever rail tender—worth around €5.7 billion and covering 30 years of electric operations in the Prague region—is currently underway. And legacy national rail company Czech Railways (ČD), its market share dropping a massive 15%, is feeling the squeeze – and perhaps fearing the future as its rivals make headway.

Arriva doubles down on Czech ambitions

Awarded by the Ministry of Transport, Arriva’s new contract will begin in December 2028 and covers several strategic long-distance routes connecting Prague with Pilsen, Cheb, and Klatovy—all located in western Czechia near the German border. These routes form a core part of one of the country’s busiest rail corridors, serving both high-volume commuter flows and ever profitable cross-border traffic.

Worth €750 million over 15 years, it represents a serious leap in scale for Arriva’s Czech operations; until now, the company had focused on regional services. Having entered the market in 2013 with regional operations and, more recently, a handful of electric services in the Pilsen region, the company operated just 102 trains in 2024 — compared to CD’ thousands. But with the new deal, that’s about to change.

Another Arriva service in Czechia. © Arriva

Another Arriva service in Czechia. © Arriva

Because of the contract, Arriva can now buy 22 brand-new electric multiple units (EMUs), an additional €300 million cash injection. The trains are expected to be capable of operating at speeds of up to 200 km/h, and while the UK-headquartered transport company has not yet named a manufacturer, it’s looking for trains that can boost capacity, comfort, and performance. After all, it will be the first time the operator fields a large-scale high-speed electric fleet in the country.

“This is the largest investment Arriva has made in the Czech Republic…and we believe it will attract new customers to rail,” said Daniel Adamka, Arriva CZ’s Managing Director following the deal. And he’s not wrong to point out that there’s capital to meet demand, and fuel further expansion. I Squared Capital’s acquisition of Arriva from state-backed Deutsche Bahn in 2023, means the company has renewed access to funding — and new rolling stock — most certainly giving it a strategic edge in Czechia’s rail market with many lucrative long-term contracts on the horizon.

Czechia’s shifting railway landscape

Indeed, the Czech government is taking the EU’s new rail liberalisation rules seriously, with all state-subsidised passenger services to be subject to competitive tender by 2033. That will dramatically reshape a market once monopolised by ČD. In 2014, the state-backed company controlled over 95% of the market by train-kilometres in Czechia. By 2023, that had fallen to just above 80%, and the trend is downward.

That’s as another of Czechia’s major private operator, RegioJet, the first serious challenger to ČD’s dominance, expands: RegioJet has grown from 4% to over 6% market share in terms of train-kilometres in the last five years. And its founder and owner Radim Jančura has been more than vocal about his desire to undercut the state-backed monopoly. “I want to build the largest carrier in the Czech Republic and surpass Czech Railways,” he said last year. “All we need to do is gain three percent of the market every year. That’s forty percent in ten years.” An optimistic goal perhaps, but a possibility that is likely worrying ČD.

RegioJet looms large in Czechia. © Frantisek bezdek/ Shutterstock

RegioJet looms large in Czechia. © Frantisek bezdek/ Shutterstock

Arriva, for its part, held under 6% in 2024 in the Czech rail market and is targeting 10–15% in the coming years. As one fund partner at the company’s backer I Squared said last year, “We see genuine growth potential that can be unlocked at Arriva.” And in Czechia’s case, he’s not wrong. A separate, ongoing tender for the Prague Integrated Transport system — the largest-ever public rail contract in Czechia, valued at nearly €5.7 billion — will hand 30 years of electric train operations to the lowest-priced bidder starting in December 2029. Only RegioJet, Arriva, and ČD are competing.

If ČD loses the Prague Integrated Transport contract, the consequences will be stark. The 30-year deal covers a dense, high-frequency network in and around the capital — arguably the most strategically valuable territory in Czech rail. Analysts estimate that losing it could cost ČD up to 10 percentage points of market share, pushing it below 70% for the first time. Beyond numbers, it would also signal that even in the heart of its home market, the state operator is no longer guaranteed to win. But while Arriva may relish such an opportunity, not everyone is happy at home about liberalisation.

Unions push back as critics warn of ‘jungle’ liberalisation

Beyond what Arriva’s win means for ČD, it’s also raising eyebrows among rail workers. One of the country’s main rail unions, SOSaD, recently objected to a different contract awarded to Arriva, saying the company promised unrealistic profits and offered prices so low they called it “dumping” — a tactic to beat rivals by undercutting them. The union also accused Arriva, and ČD’s other private rival RegioJet, of hiding service delays and cancellations, and of not being held to the same performance standards as the state operator.

“The Czech rail system has become a jungle without rules,” said SOSaD chairman Jan Kadečka, warning that the patchwork approach to rail management and poor national oversight had created a system where private operators now have an unfair advantage. The union goes on to claim that ČD is held to much stricter standards than its private competitors (to be fair, RegioJet has repeatedly and successfully taken ČD to EU court over accusations that it is using its monoploy advantage to deny access to national rail infrastructure), fearing that fast-tracked liberalisation will lead to job losses, worse working conditions, and declining service quality.

In their words, it’s a system where “economically advantageous offers are turned against passengers for whom public transport is intended.”

Czechia’s liberalisation: market boon or unlearned history lesson?

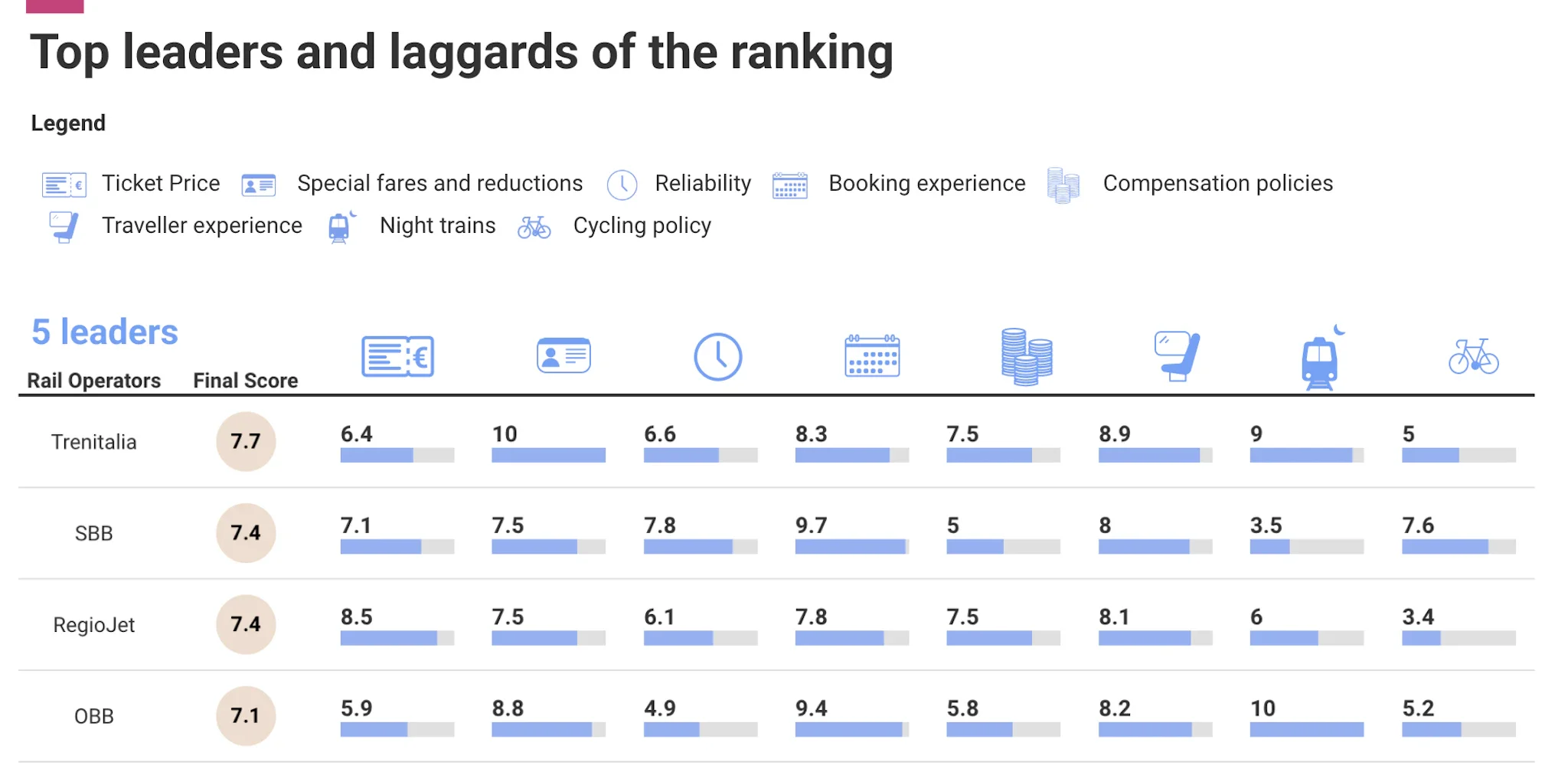

But supporters of the market opening point to rising ridership and stronger service on private routes in many European countries, including Czechia. Home-grown RegioJet, for example, came third out of 27 European rail operators in Transport & Environment’s December 2024 ranking, partly due to its strong customer experience. And the EU in its latest report on rail liberalisation pointed to a direct correlation between higher ridership and more services offered by private companies, particularly in nations like Spain where liberalisation is being fast-tracked.

T&E’s original ranking of 27 European operators. © T&E

T&E’s original ranking of 27 European operators. © T&E

Still, cautionary tales linger, particularly around the private rail company now expanding in Czechia. Arriva’s UK operations have often drawn fire from passengers and politicians alike. In fact, the performance of its Northern franchise was so poor that operations were nationalised in 2020, back when the UK still had a hard-right government.

Essentially, for some, Arriva represents the worst risks of liberalisation: cost-cutting, short-term contracts, and service gaps. For others, apparently including Czechia’s transport ministry, it’s a symbol of modernisation and cross-border investment. But with Czechia pushing full steam ahead into a competitive rail future, Arriva and its private rivals are essentially looking to prove their supporters right — and clean up in the Czech rail market. And if yesterday’s €750 million contract is anything to go by, they’re already on their way.

Read more:

Already have a subscription? Log in.

Or

Want to read this article for free?

You can read one free article per month. Enter your email and we’ll send you a free link to access the full article. No payment required.