In the middle of all this morning’s other news, it would have been easy to have missed an article in the FT, which says:

The Bank of England is facing growing calls to scale back its bond-selling programme later this year, as investors warn it risks pushing up borrowing costs further and adding to pressure on a weakening UK economy.

The central bank is shrinking its portfolio of bonds accumulated during bursts of quantitative easing over the past decade and a half, as it attempts to bring its balance sheet back to a more normal size.

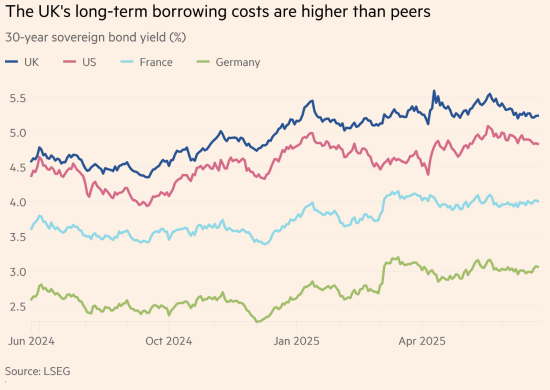

As the FT notes, this is inflating UK borrowing costs, which is a major reason for our economic stagnation, as noted by the Resolution Foundation yesterday:

There is also active opposition in the City:

“The Bank of England should stop active QT,” urged Ben Nicholl, a senior fund manager at Royal London Asset Management.

Active sales on that scale could “reignite market concerns about the total amount of gilts, particularly long maturity gilts, that the market may have to absorb this year”, he said.

Other quotes support the view.

We have suffered high interest rates in the UK for far too long, as I have consistently argued. This has been the result of deliberate, politically driven and deeply divisive choices made by the Bank of England, which have massively favoured the well off in this country, have seriously harmed the well-being of most ordinary families and have led to massive economic damage. Allowing a supposedly independent central bank to cause such harm has been a political failure on the part of all Chancellors who have allowed it.

The time for quantitative tightening has gone.

We might even need to actively force rates down again.

But what we also know is that the time for the facade of Bank of England independence is also over: this has been a disaster, and it is time for it to end.

Thanks for reading this post.

You can share this post on social media of your choice by clicking these icons:

There are links to this blog’s glossary in the above post that explain technical terms used in it. Follow them for more explanations.

You can subscribe to this blog’s daily email here.

And if you would like to support this blog you can, here: