WASHINGTON — President Donald Trump continued to publicly attack Federal Reserve chair Jerome Powell and the central banking system’s Board of Governors over his frustration that the Fed has held off cutting interest rates as it waits to assess what effect the president’s sweeping tariff policies will have on inflation.

What You Need To Know

President Donald Trump continued to publicly attack Federal Reserve chair Jerome Powell and the central banking system’s Board of Governors over his frustration that the Fed has held off cutting interest rates as it waits to assess what effect the president’s sweeping tariff policies will have on inflation

In an appearance on Fox News’ “Sunday Morning Futures” this weekend, Trump called Powell “a stupid person” and reprimanded him for not lowering rates to less than 2%

Powell, who was first appointed as chair in 2018 by Trump, said last week that the Fed expects “tariff inflation to show up more” in the coming months and “we really don’t know how much of that’s going to be passed through the consumer. We have to wait and see”

Trump has threatened to attempt to fire Powell, urged him to resign and begun openly speculating about successors

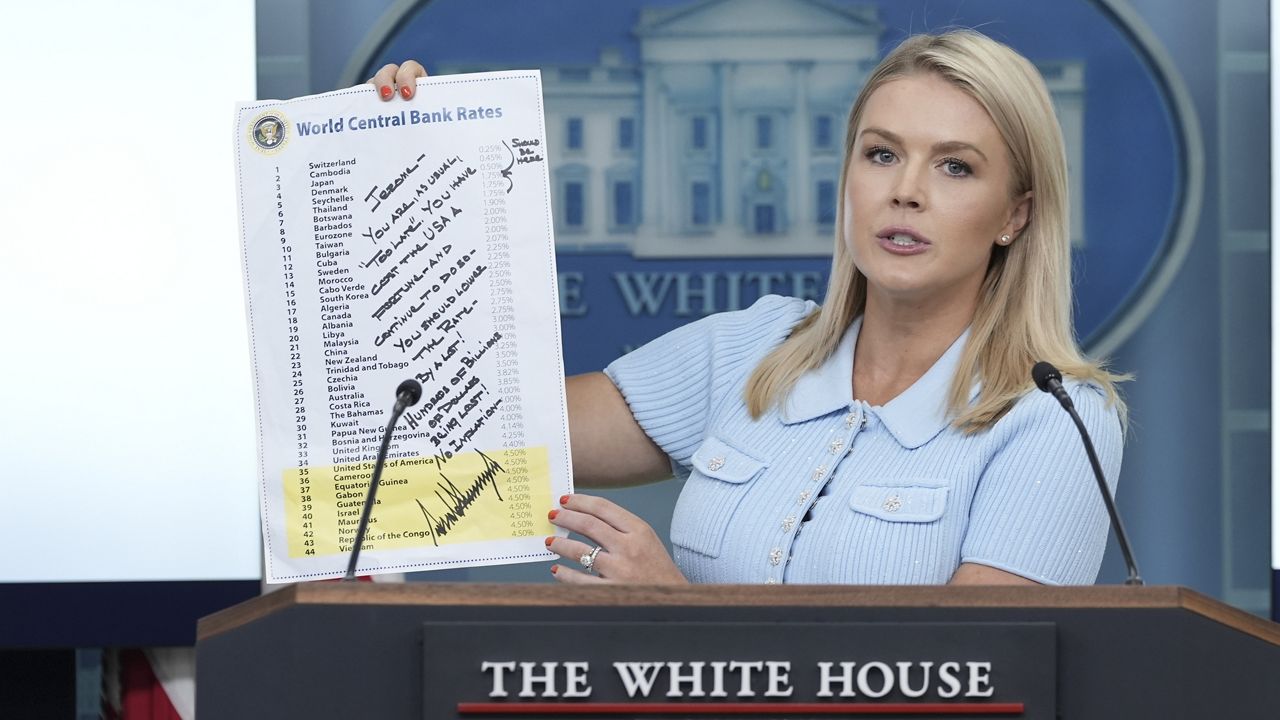

“Jerome ‘Too Late’ Powell, and his entire Board, should be ashamed of themselves for allowing this to happen to the United States,” Trump wrote on his Truth Social platform, alongside a photo of a critical note to Powell he wrote. “They have one of the easiest, yet most prestigious, jobs in America, and they have FAILED — And continue to do so. If they were doing their job properly, our Country would be saving Trillions of Dollars in Interest Cost. The Board just sits there and watches, so they are equally to blame. We should be paying 1% Interest, or better!”

In the handwritten note, scrawled on a printout of different countries’ “central bank rates” that showed the U.S. has roughly the 35th lowest rate. Bracketed at the top, Trump wrote that the U.S. “should be here” with countries like Switzerland, Cambodia, Japan and Denmark with rates ranging from near zero to 1.75%. In an appearance on Fox News’ “Sunday Morning Futures” this weekend, Trump called Powell “a stupid person” and reprimanded him for not lowering rates to less than 2%.

“We should be at 1% or 2%. If you look at Switzerland, they’re the lowest right now. They’re at much less than one point,” Trump said. “And, frankly, we should be there too, because, without the United States, the whole world doesn’t work.”

The president has posted a Sharpie-written note to Federal Reserve Chair Jerome Powell about interest rates.

“Should be here.”https://t.co/KNvl0ZENLc pic.twitter.com/fcuVA1NdhF

— Taylor Popielarz (@TaylorPopielarz) June 30, 2025

The Fed’s key interest rate — the federal funds rate, or the interest rate U.S. banks pay when borrowing money from each other — currently sits at about 4.3% and, when lowered as Trump desires, generally results in lower interest rates for individuals and businesses borrowing money from financial institutions, including mortgages, auto loans, credit cards, and business loans.

But in an economy still grappling with the inflation of the last few years, Powell is concerned rapidly lowering the rate — particularly to the low level the president is demanding — could contribute to further inflation as U.S. consumers are already facing the spectre of rising costs as Trump implements his tariffs on trading partners large and small across the globe.

Powell, who was first appointed as chair in 2018 by Trump, told a congressional committee last week that the Fed expects “tariff inflation to show up more” in the coming months and “we really don’t know how much of that’s going to be passed through the consumer. We have to wait and see.”

After stops and starts, many of Trump’s tariffs are set to take effect on July 9 and he said on Fox News that he likely wouldn’t pause them again. According to the president, deals have been cut with certain countries, including China and the U.K., but he may just end up sending other countries “a letter, a very fair letter, saying, congratulations. We’re going to allow you to trade in the United States of America. You’re going to pay a 25% tariff or 20% or a 40 or 50%. I would rather do that.”

Trump has threatened to attempt to fire Powell, urged him to resign and begun openly speculating about successors. The Supreme Court and Powell have suggested that a president likely could not legally remove a Fed chair and, for the moment, Trump has said he won’t fire him before his term is up in May 2026.

“Reporters ask me, ‘I mean, do you have other names?’ I say, ‘yes, I do, anybody but Powell,’” Trump said on Fox News, calling the Fed chair “a bad person.” The president has not publicly detailed his short list, but Treasury Secretary Scott Bessent told Bloomberg TV on Monday that he would “do what the president wants” if Trump nominated him for the role.

An investment banker with a stint in the George H.W. Bush administration’s Treasury Department, Powell was first nominated to the Fed’s board in 2012 by President Barack Obama, nominated as chair by Trump in 2018 and reappointed by President Joe Biden in 2022. His latest term as chair ends next year and his tenure on the board is set to expire in 2028. The president nominates and the Senate confirms the Fed’s chair and board members, but they are intended to act independently of the president or Congress as they serve as stewards for the broader U.S. economy with the goals of supporting “maximum employment and stable prices.”

Over the last 50 years, presidents have largely avoided pressuring or publicly criticizing the Fed, but Trump has long railed against the central bank, sparking concerns on Wall Street and in Washington that he will attempt to undermine its independence.

“I would remind the Fed chair, and I would remind the entire world that this is a president who was a businessman first, and he knows what he is doing,” White House press secretary Karoline Leavitt said on Monday. “He has a proven economic formula that worked in his first term as president, and it is working again. The one problem that remains is high interest rates for the American people. The American people want to borrow money cheaply and they should be able to do that, but unfortunately, we have interest rates that are still too high.”