Analysis hosted on: Pivolx https://www.pivolx.com/analysis-15#popup=stepmckqicfb668h2

Data source: FRED (Federal Reserve Economic Data) https://fred.stlouisfed.org/series/GFDGDPA188S

Posted by FridayTea22

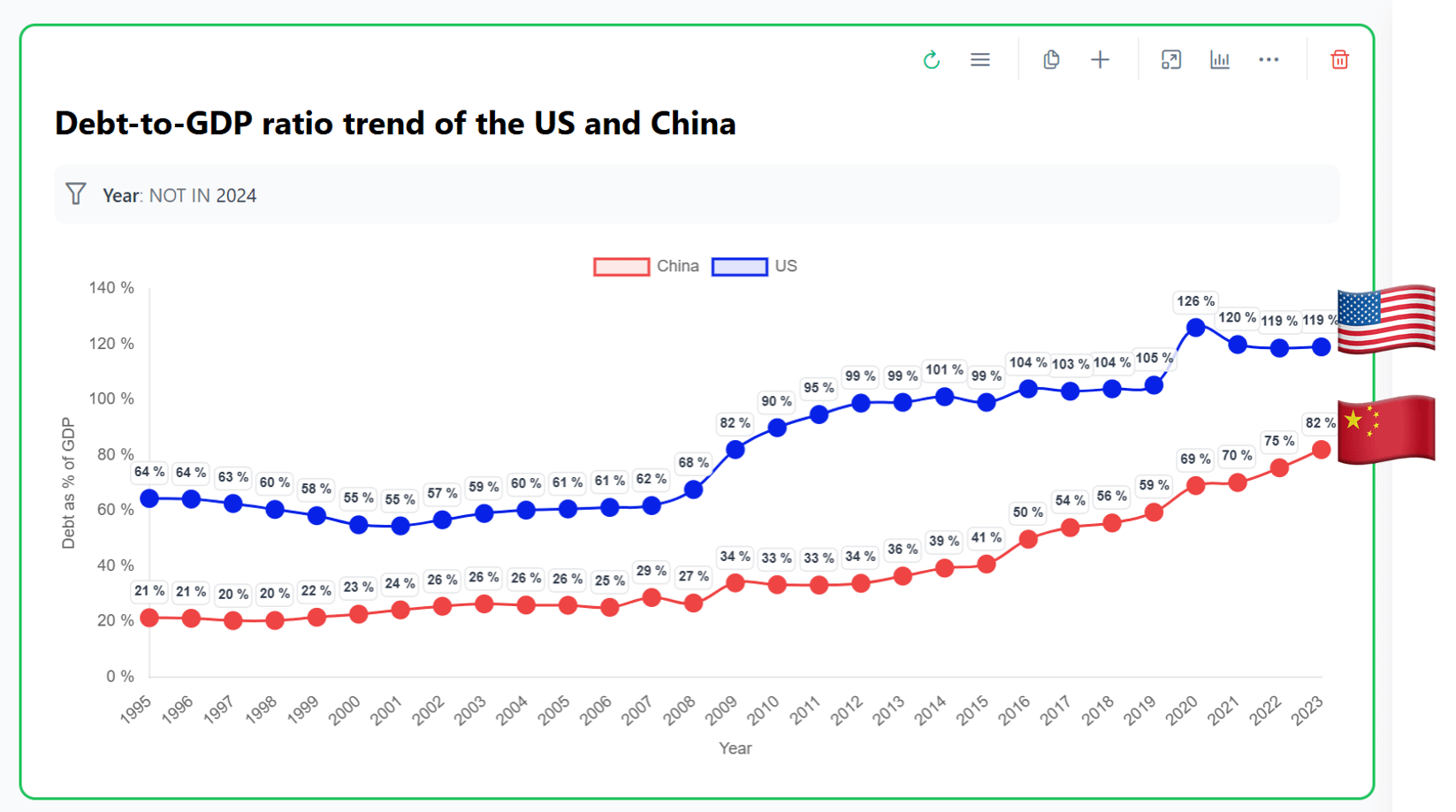

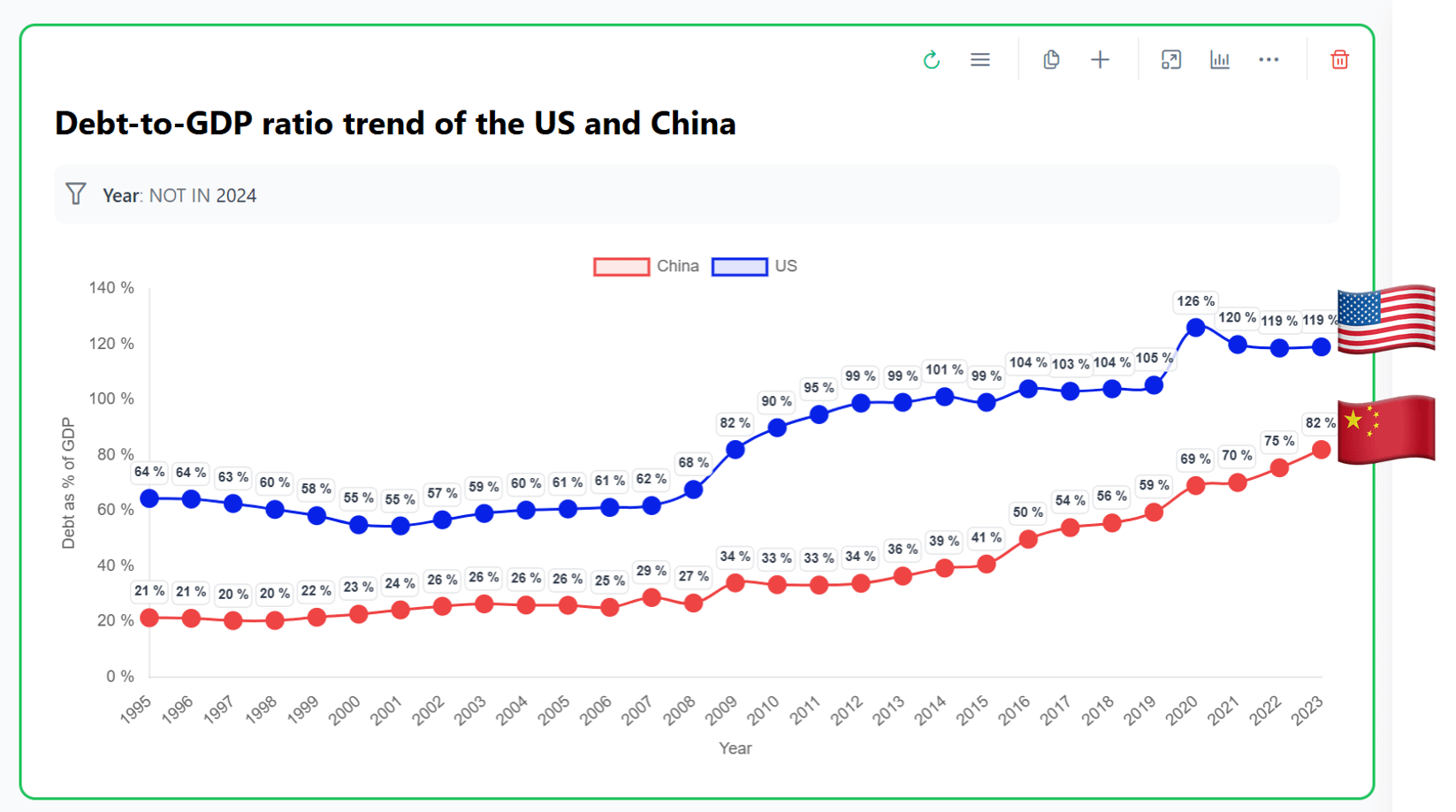

![How much debt is too much? Debt-to-GDP ratio trend of the US and China [OC]](https://www.europesays.com/wp-content/uploads/2025/07/zjvyedemiaaf1.png)

Analysis hosted on: Pivolx https://www.pivolx.com/analysis-15#popup=stepmckqicfb668h2

Data source: FRED (Federal Reserve Economic Data) https://fred.stlouisfed.org/series/GFDGDPA188S

Posted by FridayTea22

13 comments

Jesus that’s china’s *federal* debt too

Not great for a system built on pushing the debt off to local governments….

Won’t be able to answer this question with those two metrics alone.

Need a chart that includes chinas provincial debt otherwise it’s apples to oranges.

Too much debt is bad.

Unless, of course, the gov’t that has a lot of it tells us it’s really OK and not a big deal. /s

A country has too much debt when their bonds won’t sell. Or when servicing the debt eats into their revenue so much they have to cut services.

I’m curious what the debt to GDP was for the Soviet Union 1980-1991.

Amatuers , Japan is the real champion at 236.70% of gdp

It depends on the interest rate. If it is 0%, then all debt is good. If it is 10%, then even a 50% debt-to-GDP ratio is too high.

Would be interesting to see this compared to household debt, also. Median household debt is like 131% of median household income.

Apparently the dollar being the global reserve currency helps America deal with having more debt than everyone else. I’m not entirely sure how this works other than it means everyone is invested in keeping America economically healthy. Anyone able to explain?

I believe “as much as you can reliably sell” is always the answer here

The problem now that I see is the huge interest payments that’s like a big portion of the annual budget

GOP will bring this back above 130%. They have years to wreck this country, give it time

Comments are closed.