By Wolf Richter for WOLF STREET.

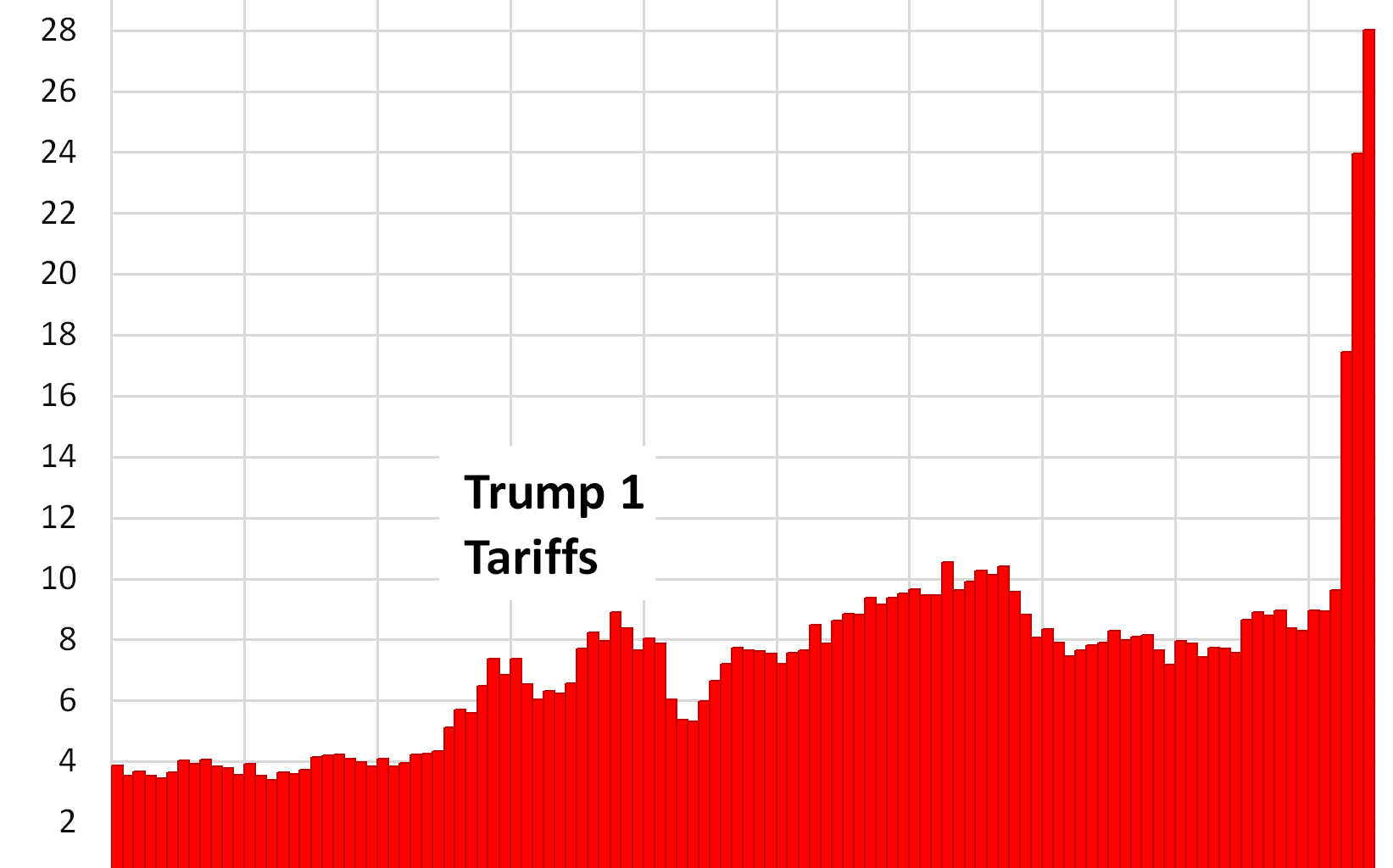

Collections from “customs and certain excise taxes” spiked to $28.0 billion in June, after hitting $24.0 billion in May, and $17.4 billion in April, according the Treasury Department’s Daily Treasury Statement today. The June total was up by 214% from February, before the new tariffs were implemented, and by 270% or by $20.5 billion year-over-year.

This $20.5 billion is additional revenues, compared to a year ago. If tariffs bring in an additional $20.5 billion a month going forward, it would amount to about $250 billion a year in additional revenues.

This $28.0 billion is the amount in customs and excise taxes that the Department of Homeland Security – which includes Customs and Border Protection – transferred in June into the Treasury Department’s checking account at the Fed, the Treasury General Account. It includes a small amount in “certain excise taxes” (in May, $1.9 billion, in April $1.1 billion). The rest is from tariffs. The Monthly Treasury Statement, which is released later, splits out tariffs separately.

Tariffs are taxes paid by businesses. Whether or not businesses can pass them on to consumers to push up consumer price inflation remains a mystery. They’re certainly trying, but may not have the pricing power to do so. If a company’s sales crater and market share shrinks, because it jacked up prices and enough pissed-off consumers shifted purchases around, then that’s an expensive lesson to re-learn all over again.

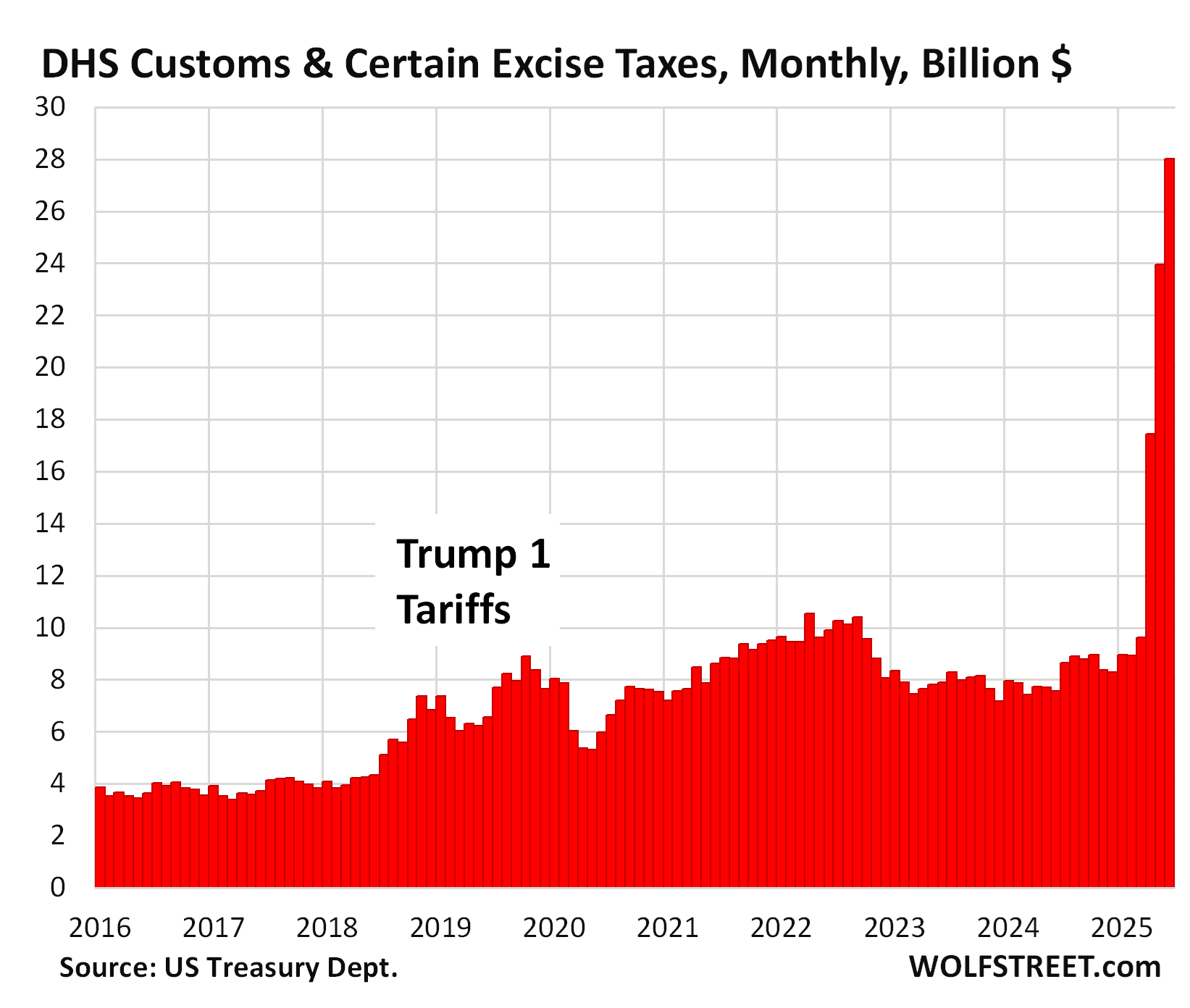

So far, there are no signs that tariffs have been successfully passed on to consumers, and consumer price inflation for durable goods, a prime target of tariffs, was 0% month-to-month in May, according to the PCE price index last week (blue in the chart below), even as durable goods prices have been on an upward trend out of their deeply negative hole for over a year (red).

Whether or not, and to what extent tariffs can be passed on to consumers is unpredictable and depends on whether or not companies will have the pricing power to raise prices without crushing their sales – they had this pricing power during the free money era in 2021 and 2022 but then lost it as the free money ran out – so we’ll be watching this closely:

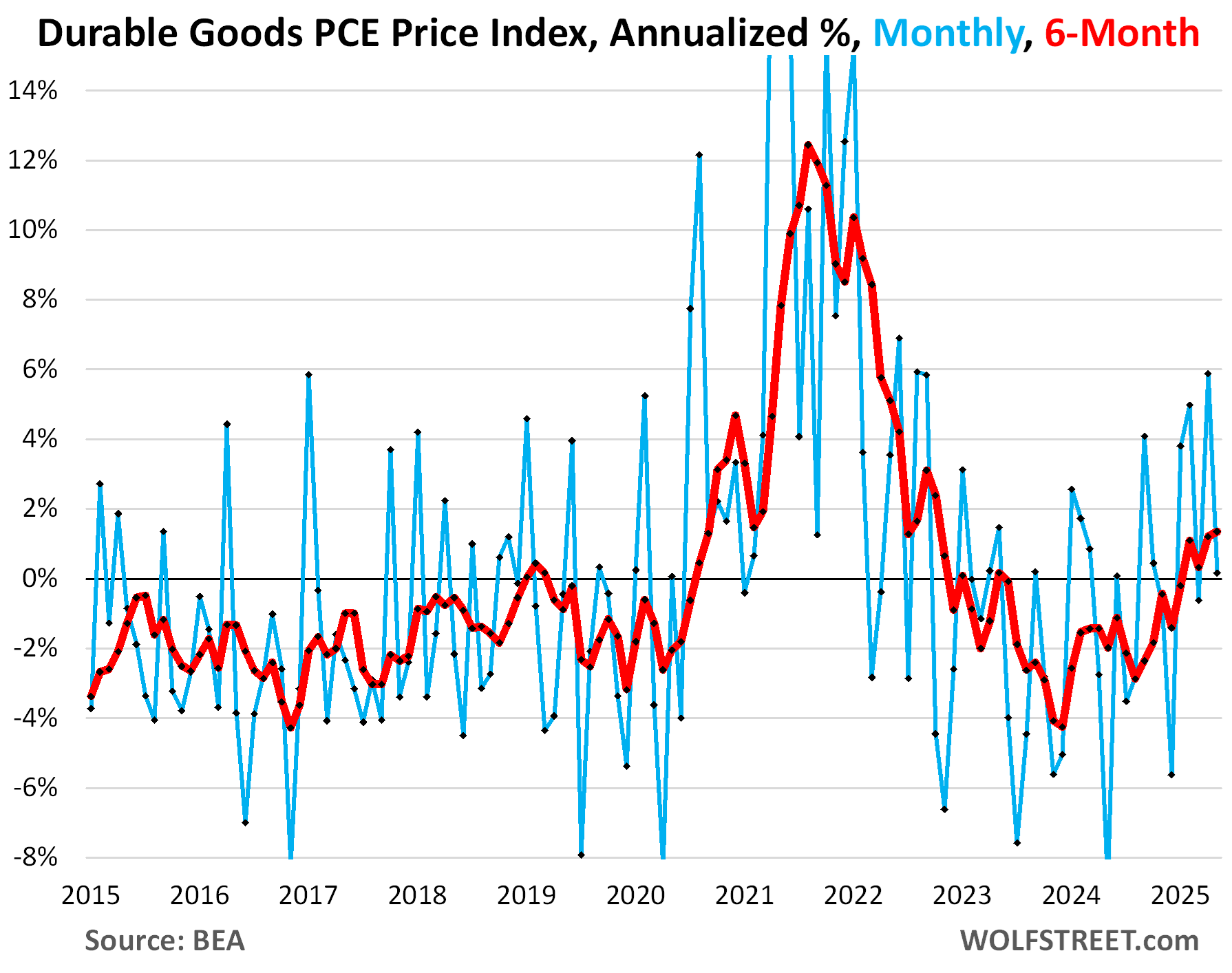

Companies have lots of room to eat the tariffs: Profits at “nonfinancial” corporations – the companies more likely engaged in imports – were at an annual rate of nearly $3.0 trillion in Q1, having exploded by 122% since Q1 2020. This profit explosion was made possible by pricing power that companies suddenly found they had when consumers were swimming in free money and were willing to just pay whatever. But that free money-era is over.

At the current rate, tariffs would barely dent aggregate profits, though they would hit individual companies harder. For example, GM which imports cars from Mexico, China, Korea, and Canada, and which imports many components of vehicles it assembles in the US, has no room to raise prices without killing its sales, and so said that it expects a $5 billion hit to its profits in 2025.

Nike jacked up prices during the free-money era and is now struggling with falling sales because its prices are too high, and it cannot raise prices; it needs to cut prices to revive sales. It put the dent to its profits from tariffs at around $1 billion. Other companies have their own figures. But they made huge amounts of money during the era of the profit explosion.

Consumers, willing to suddenly pay whatever starting in late 2020, paid for this historic spike in corporate profits, and the new tariffs are petty cash in comparison:

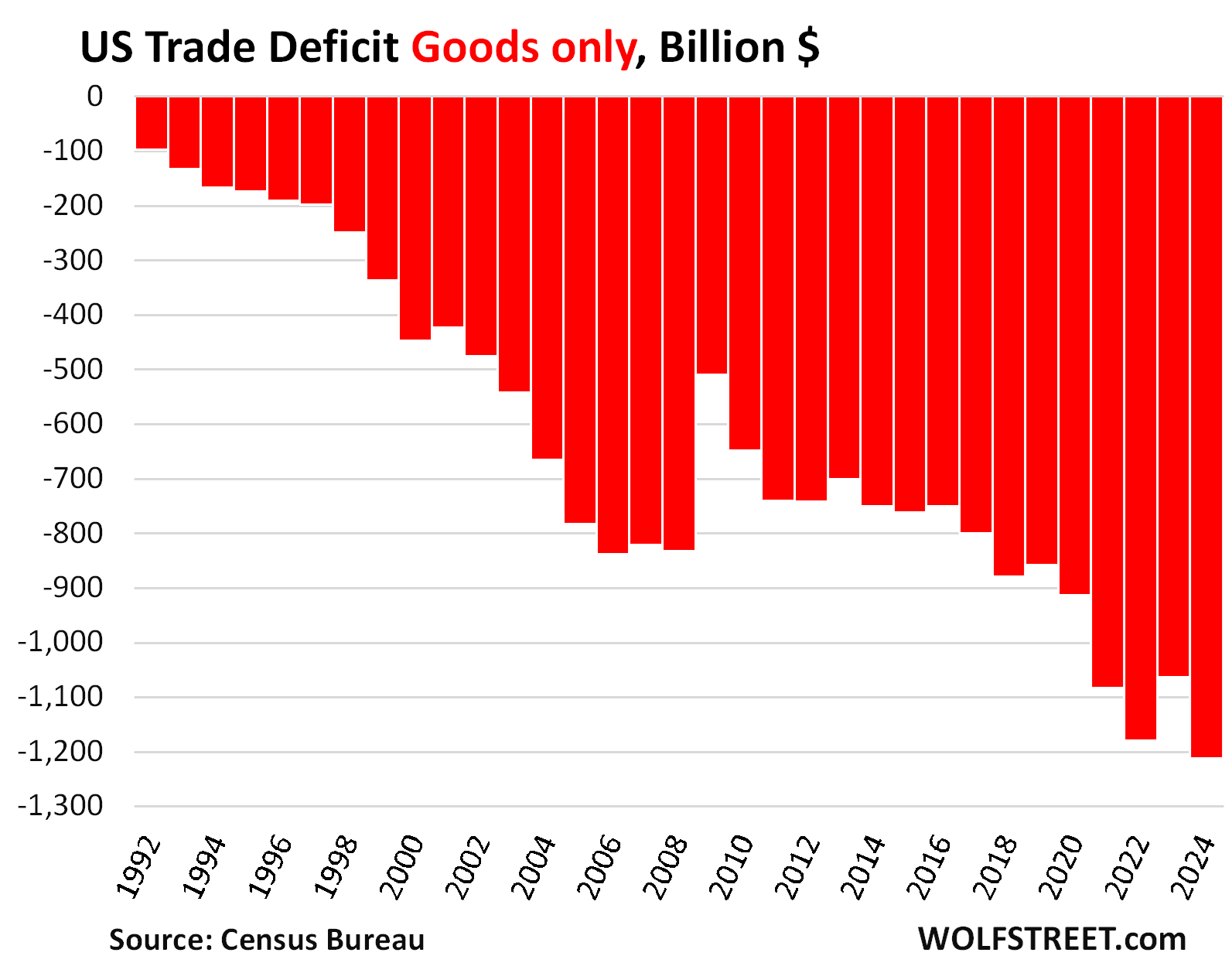

Companies can dodge the tariffs by producing in the US. Numerous big companies have laid out plans to shift production back to the US, which is the primary purpose of tariffs. Shifts that involve expanding existing factories in the US, or building new factories, will take years to complete. But these efforts, from investments in the US to production in the US, and everything that goes along with it, are immensely valuable to the US economy, and generate lots of new tax revenues for all levels of government. But there is a very long and hard way to go:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the mug to find out how:

![]()