Dublin, July 03, 2025 (GLOBE NEWSWIRE) — The “Crude Oil Carrier Market 2025-2034” report has been added to ResearchAndMarkets.com’s offering.

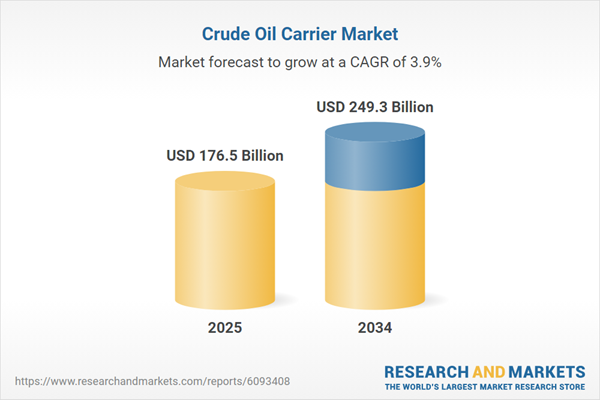

Crude Oil Carrier Market is valued at USD 176.5 billion in 2025. Further the market is expected to grow by a CAGR of 3.9% to reach global sales of USD 249.3 billion in 2034

The crude oil carrier market is a crucial segment of the global shipping and energy industries, providing the primary means of transporting crude oil from production sites to refineries and other processing facilities. These carriers range in size from smaller Aframax and Suezmax tankers to massive Very Large Crude Carriers (VLCCs) and Ultra Large Crude Carriers (ULCCs), each designed to efficiently and safely move vast quantities of crude oil across the world’s oceans. As a vital link in the global energy supply chain, the market’s performance is closely tied to oil production levels, international trade flows, and geopolitical dynamics.

In 2024, the crude oil carrier market saw a mixed performance influenced by fluctuating crude oil prices, shifting trade routes, and regulatory changes. The global push for decarbonization led to tighter emissions regulations, prompting carriers to adopt cleaner fuels and more energy-efficient technologies. While traditional trade routes, such as those linking the Middle East to Asia and Europe, remained significant, the growing importance of U.S. shale oil exports and alternative supply sources introduced new patterns in crude oil shipping. Additionally, investments in fleet modernization and digitalization allowed operators to improve operational efficiency and enhance safety standards.

Looking ahead, the crude oil carrier market is expected to face both challenges and opportunities. The ongoing transition to cleaner energy sources will gradually alter crude oil demand, potentially reducing long-term shipping volumes. However, emerging economies in Asia and Africa are likely to drive continued demand for crude oil transportation in the near term.

Advances in vessel technology, including LNG-powered carriers and digital optimization tools, will enable operators to meet increasingly stringent environmental standards while maintaining competitiveness. The market’s future will be shaped by how quickly the industry adapts to evolving energy policies, trade patterns, and technological advancements.

Key Insights Crude Oil Carrier Market

Adoption of cleaner fuels and energy-efficient technologies.Shift in trade routes due to changing production and export patterns.Modernization of fleets with digital optimization and enhanced safety features.Increased investment in LNG-powered crude oil carriers.Rising focus on compliance with stricter emissions regulations.Ongoing global demand for crude oil, particularly in emerging economies.Expansion of alternative oil supply sources such as U.S. shale.Regulatory incentives and subsidies for adopting cleaner technologies.Technological advancements improving vessel efficiency and reducing operating costs.Potential long-term decline in oil demand due to energy transitions.High costs of compliance with environmental regulations and fleet upgrades.Geopolitical risks impacting trade routes and shipping stability.

Key Attributes:

Report AttributeDetailsNo. of Pages150Forecast Period2025 – 2034Estimated Market Value (USD) in 2025$176.5 BillionForecasted Market Value (USD) by 2034$249.3 BillionCompound Annual Growth Rate3.9%Regions CoveredGlobal

Companies Featured

China Shipping Tanker Co. Ltd.Maersk Tankers A/SKuwait oil Tanker Company S.A.KEssar Global Fund LimitedOSG Ship Management Inc.Alaska Tanker Company LLCKeystone Shipping Co.Shipping Corporation of India Ltd.Frontline Ltd.Tsakos Energy Navigation LimitedNational Iranian Tanker CompanyEuronav NVTankers International LLCSFL Corporation Ltd.Nordic American Tankers LimitedAET Tanker Holdings Sdn BhdTeekay CorporationAngelicoussis Shipping Group Limited.Mitsui OSK Lines Ltd.Scorpio Tankers Inc.DHT Holdings Inc.Ardmore Shipping Corp.Oman Shipping Company S.A.O.C.Ocean Tankers Ltd.Diamond S Shipping Inc.Dynacom Tankers Management Ltd.Gener8 Maritime Inc.Hafnia LimitedInternational Seaways Inc.PAO SovcomflotMaran Tankers Management Inc.Navios Maritime Partners L.P

Crude Oil Carrier Market Segmentation

By Vessel Type

SuezmaxAframaxUltra Large Crude Carrier (ULCC)Panamax

By Dead Weight Tonnage

180,000 MT -320,000 MT25,000 MT-50,000 MT50,000 MT-75,000 MT75,000 MT-120,000 MTAbove 320,000 MT

By Hull Type

By Application

GasolineAviation Turbine FuelOther Applications

By Geography

North America (USA, Canada, Mexico)Europe (Germany, UK, France, Spain, Italy, Rest of Europe)Asia-Pacific (China, India, Japan, Australia, Vietnam, Rest of APAC)The Middle East and Africa (Middle East, Africa)South and Central America (Brazil, Argentina, Rest of SCA)

For more information about this report visit https://www.researchandmarkets.com/r/fe7dqv

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.