Two thirds of UK companies do not expect US tariff policy to affect their business, according to a survey from the Bank of England.

The bank’s monthly decision-maker survey for June found that 29 per cent of firms said they would suffer from lower sales in the next 12 months as a result of President Trump’s trade policies, with a quarter saying their investment and capital expenditure would be adversely affected. A fifth said average prices would be lower as a result of tariffs, and 12 per cent said they were preparing for higher prices.

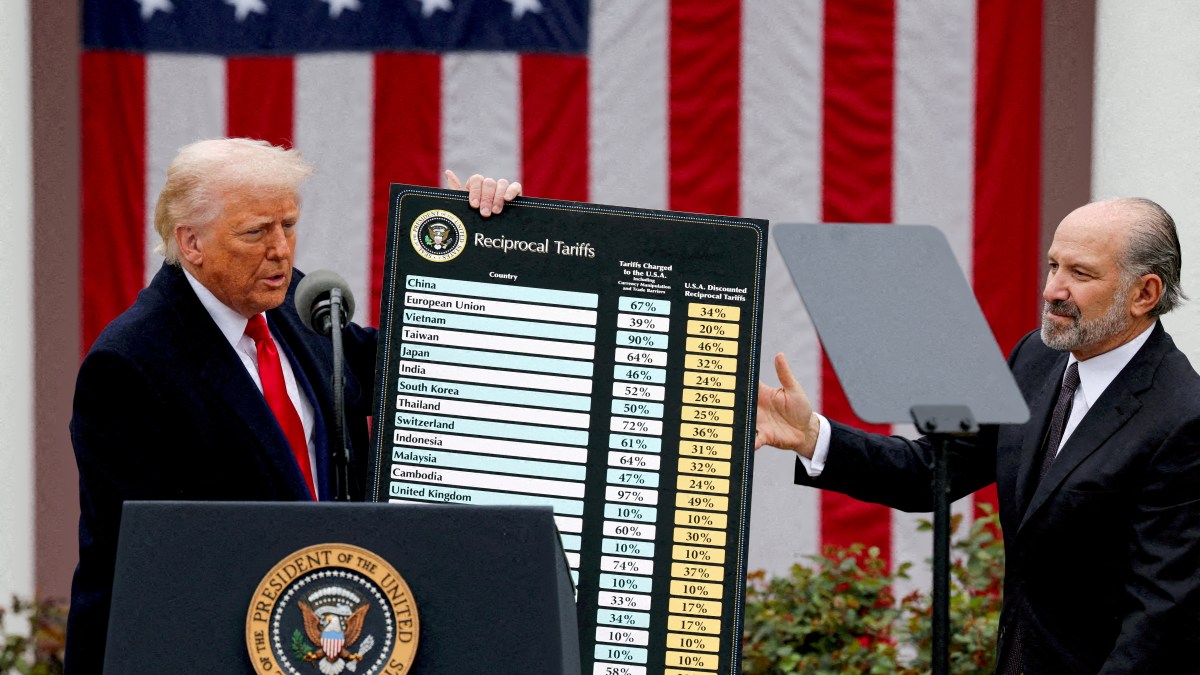

The vast majority — 66 per cent — said they did not expect any impact from the White House decision to go ahead with a minimum 10 per cent tariff across most UK goods exports. Britain signed a partial trade truce with the White House last month, exempting British steel and aluminium imports from customs levies and reducing tariffs on UK car sales to 10 per cent.

Investors and firms will have more clarity on the level of US protectionism after July 9 — when a 90-day grace period for negotiation between the administration and the rest of the world expires. Although UK firms have limited direct exposure to tariffs, economists have warned the indirect impact of uncertainty will hit the economy, if broader investment spending and hiring slows.

Tariffs are likely to raise prices for American consumers but accelerate disinflation in the rest of the world, as exporters cut their prices to serve markets outside the US.

The Bank’s survey also asked companies about their wage and inflation expectations, with measures of one-year-ahead inflation expectations dropping from 3.2 per cent to 3.1 per cent last month.

Companies said their average wage growth was 4.6 per cent in the three months to June, and expected it to fall to 3.6 per cent over the next 12 months.

• Mehreen Khan: Why the UK will not retaliate on US tariffs

In more concerning news for the Bank, companies said they would raise prices by 3.7 per cent over the next year, compared with 3.5 per cent in May’s decision-makers’ survey. This reflects “stubborn” price and inflation pressures that will lead the Bank to make only one more rate cut this year, Rob Wood, chief UK economist at Pantheon Macroeconomics, said.

Interest rates sit at 4.25 per cent and separate lending data from the Bank showed that demand for mortgages is expected to fall in the third quarter after rising between March and June.

Simon Gammon, managing partner at Knight Frank, said further rate cuts “could support mortgage activity over the summer and tee up a much busier autumn”.