During today’s Fourth of July speech, President Trump touched on the notion that the stock market has been doing really well lately. In fact, the S&P 500 is fresh off a new record-high market value, while the Dow Jones is also trading close to the top.

American stocks reacted well to yesterday’s jobs report, which revealed stronger-than-expected hiring in June, with 147,000 jobs added, well above the 110K forecast. Unemployment rate dipped to 4.1%, once again defying the forecast of 4.3%.

While this boost in the jobs sector can be attributed to a not-so-kind labor force participation drop—now at 62.3%, its lowest since 2022—it still gave markets a reason to cheer.

President Trump addressed this newfound market optimism during today’s speech. The Republican boasted the fact that stocks and the job market are booming, while also pledging to “keep it that way”, referring to ongoing efforts by his administration to sustain economic momentum.

Today, Trump also celebrated the approval of the “One Big Beautiful Bill” in the House. The president called the bill’s passage “the perfect birthday gift for America,” as he signed it into law during a Fourth of July ceremony at the White House.

The bill, a massive package spanning nearly 900 pages, encompasses the bulk of Trump’s 2024 campaign pledges. Officially titled the “One Big Beautiful Bill Act”, or “BBB”, it includes an array of new developments, including a sweeping tax reform, spending shifts, cuts to popular social programs like Medicaid, and an expansion to defence and immigration enforcement budgets.

As controversial as it may be, the ‘BBB’ may play a significant role in maintaining U.S. markets at the top, but not for the most obvious reasons.

A Market Fueled by Stimulus and Tariffs

Markets are now bracing for a liquidity flood. After all, the passing of the new bill also means an incredibly large debt extension, projected to add over $3.3 trillion to the national deficit over the next decade.

This influx of cash into the economy could help maintain traditional markets “inflated” as more cash rolling around means greater liquidity, looser financial conditions, and more speculative risk-taking from investors looking for returns in a low-yield environment, even if it gradually accelerates the dollar’s deterioration.

Perhaps, part of the reason why Trump’s economic team has been aggressively pressuring the Fed to lower rates, even amidst major economic uncertainties like tariff deals going south or even a major military conflict in the Middle East, is to keep the cost of borrowing low enough to sustain this liquidity-driven rally.

Lower interest rates would ultimately reduce the government’s interest burden on its increasing debt, while also offsetting the side effects of foreign trade and geopolitical instability.

Maybe for this reason, Fed rate cuts are still not out of the question for this year.

But things may not be as negative as they seem in the mid-term. The Fed is projecting inflation to hover above the 2% mark until 2026, and despite all the chaos that ensued this year, markets are still clinging to the possibility of monetary easing.

Possibly not for the next FOMC meeting in July, but investors are still pricing up to two interest rate cuts in 2025.

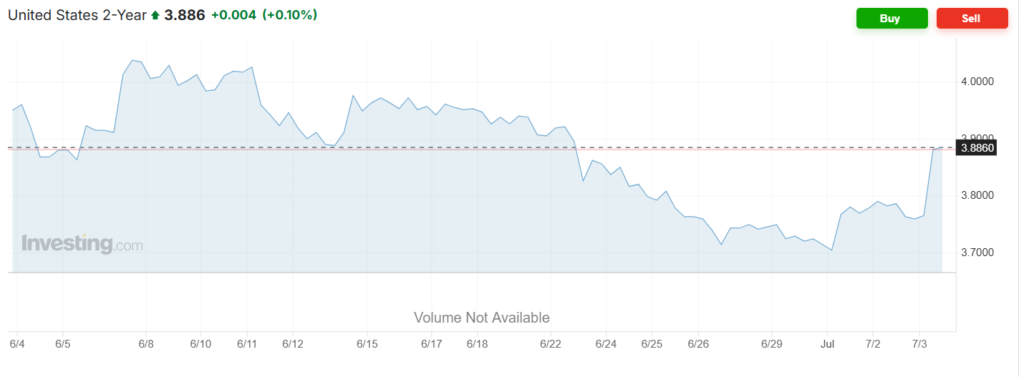

The recent jobs data pushed 2-year yields up by 10 basis points on July 3rd, reflecting a shift in rate expectations. But still, the move was modest in the grand scheme, and short-term yields remain firmly below their June 6th high.

Of course, these assumptions that the liquidity boost will maintain market momentum may fly out the window as soon as tariff deals start to unravel, or the Fed refuses to lower rates amidst uncertainty. But Bitcoin and other cryptocurrencies could benefit a lot from this scenario.

While digital assets are not primarily bound by the U.S.’s economic performance, a liquidity boost would likely inject fresh capital into speculative assets as investors become more risk tolerant. In that scenario, we could see something similar to what happened in 2020–2021, as institutional and retail investors alike piled into crypto markets amid unprecedented monetary stimulus and near-zero interest rates.

This could be your shot: $4.2M up for grabs in the WOW2025 Grand Prix, including a Cybertruck for the top finisher. Registration closes July 15th!