Canada’s Spartan Delta Corp. is growing oil and gas production from its large position in Alberta while keeping options on the table for future M&A.

Calgary-based Spartan reported compelling results from new wells online in the oily Duvernay Shale, as well as the company’s liquids-rich gas asset in the Alberta Deep Basin.

Spartan ran a four-rig program in the first half of 2025, drilling 17.1 net wells, completing 11.4 and putting 8.6 online. The company estimates current production of about 40,000 boe/d.

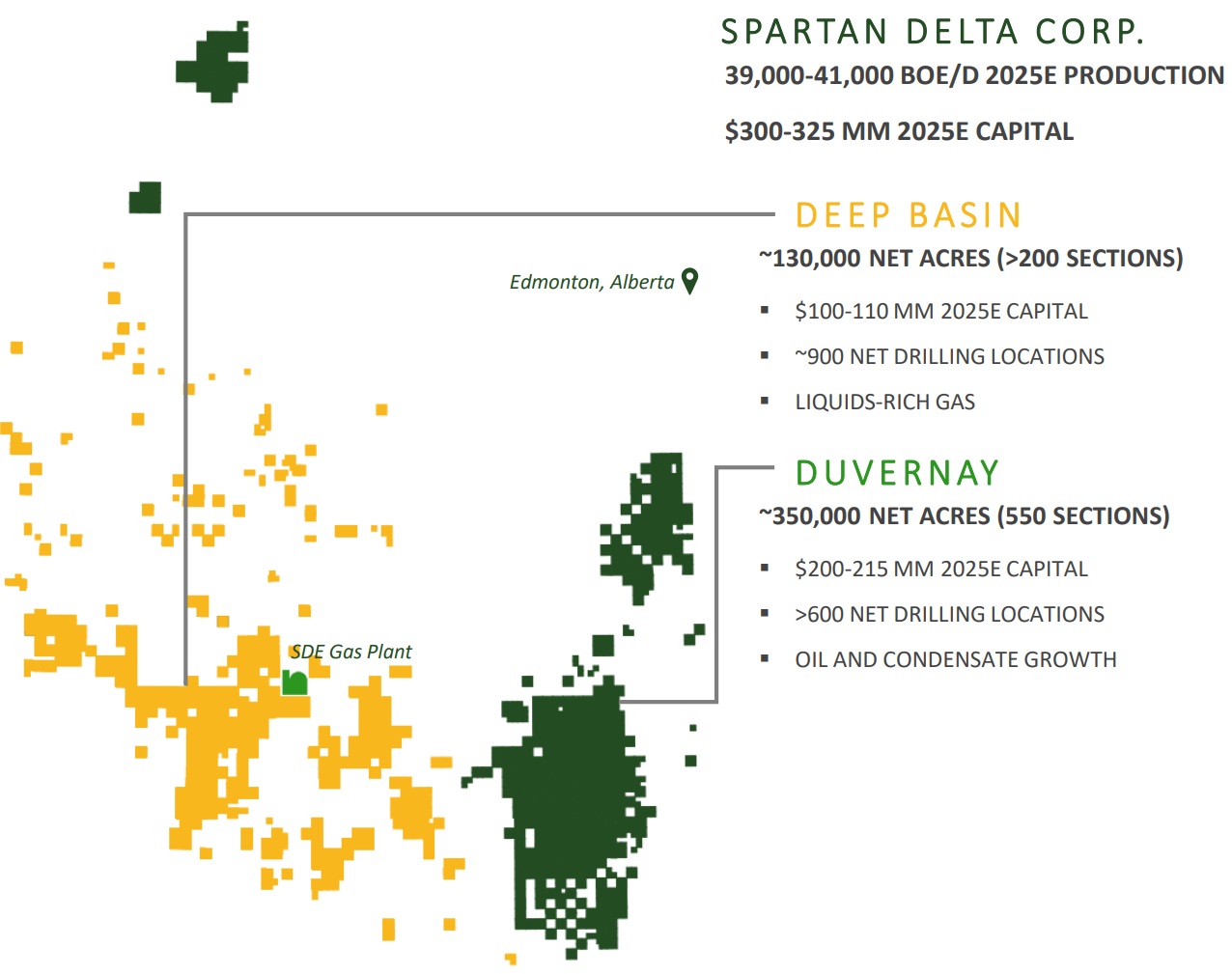

Spartan Delta Corp. holds approximately 350,000 net acres in the Duvernay Shale play. (Source: Spartan investor relations)Duvernay delivers

Spartan Delta Corp. holds approximately 350,000 net acres in the Duvernay Shale play. (Source: Spartan investor relations)Duvernay delivers

Spartan has aggregated one of the largest positions in the oil- and condensate-rich West Shale Basin Duvernay play, where it holds some 350,000 net acres and 600 net drilling locations.

Liquids production makes up about 70% of output from Spartan’s Duvernay wells, which wine-rack across the play’s upper and lower zones. The company is targeting production of 25,000 boe/d from the shale within five years.

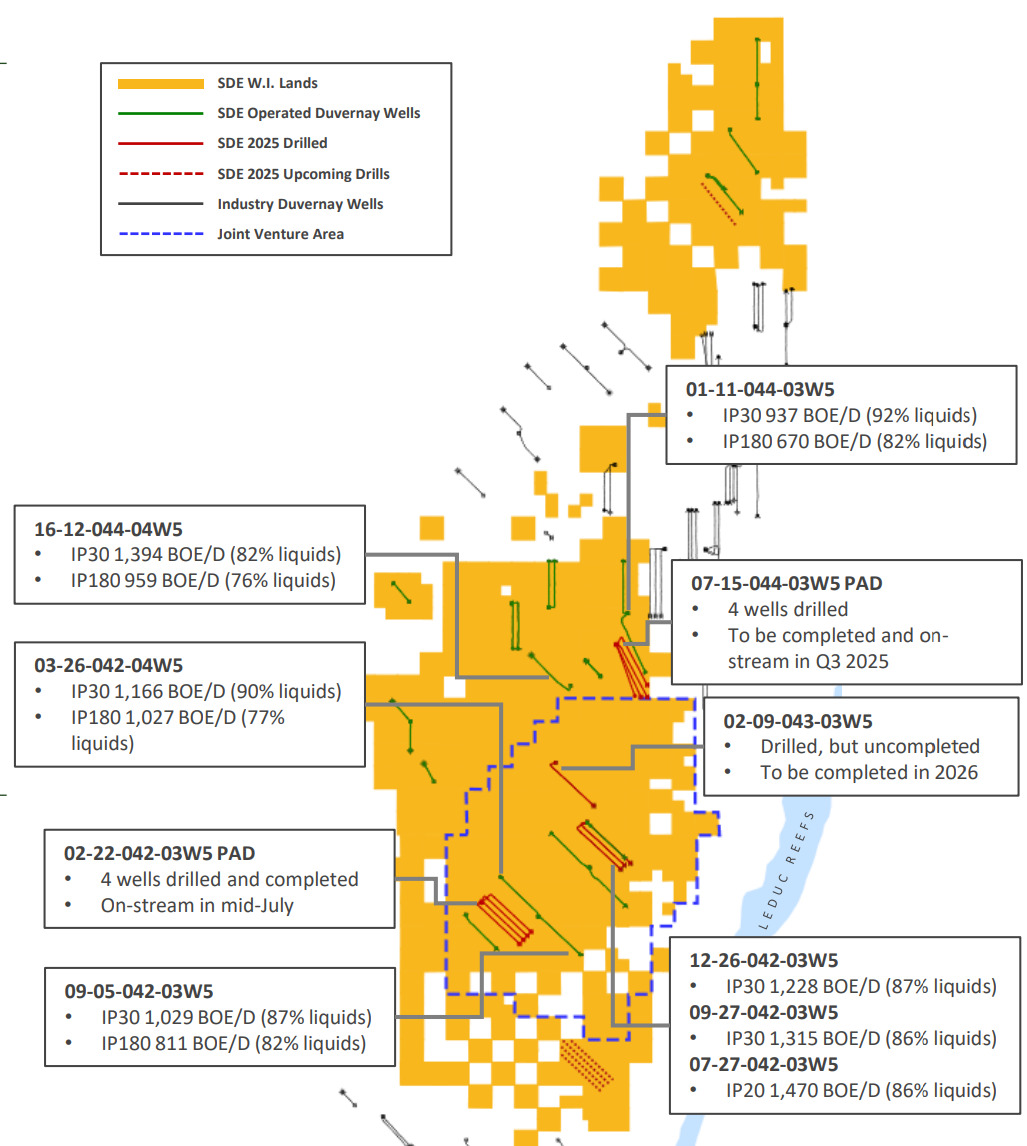

IP-30 rates from Spartan’s first seven Duvernay wells this year averaged 1,220 boe/d (87% liquids). IP-180 rates for the first four Duvernay wells have averaged 867 boe/d (79% liquids).

Spartan’s recent Duvernay wells are delivering strong, oil-weighted results. Three horizontal wells (2.1 net) were brought online from an eight-well pad between May and June, with average laterals of 12,635 ft.

The trio were all producing more than 85% liquids, with crude oil volumes topping 1,000 bbl/d. The 07-27-042-03W5 well averaged 1,470 boe/d over 20 days at 86% liquids, including 1,202 bbl/d of oil.

Another 4 wells (2.8 net) are expected online at the 02-22-042-03W5 pad in mid-July.

Spartan is seeing oil- and liquids-rich production from the Duvernay Shale play in Alberta. (Source: Spartan)

Spartan is seeing oil- and liquids-rich production from the Duvernay Shale play in Alberta. (Source: Spartan)

Costs to drill, complete and equip Spartan’s Duvernay wells range between CA$11 million and CA$12.5 million (US$8 million to US$9.1 million).

RELATED

CEO: Ovintiv Passes on Permian Prices for More Montney Condensate

Alberta Deep Basin

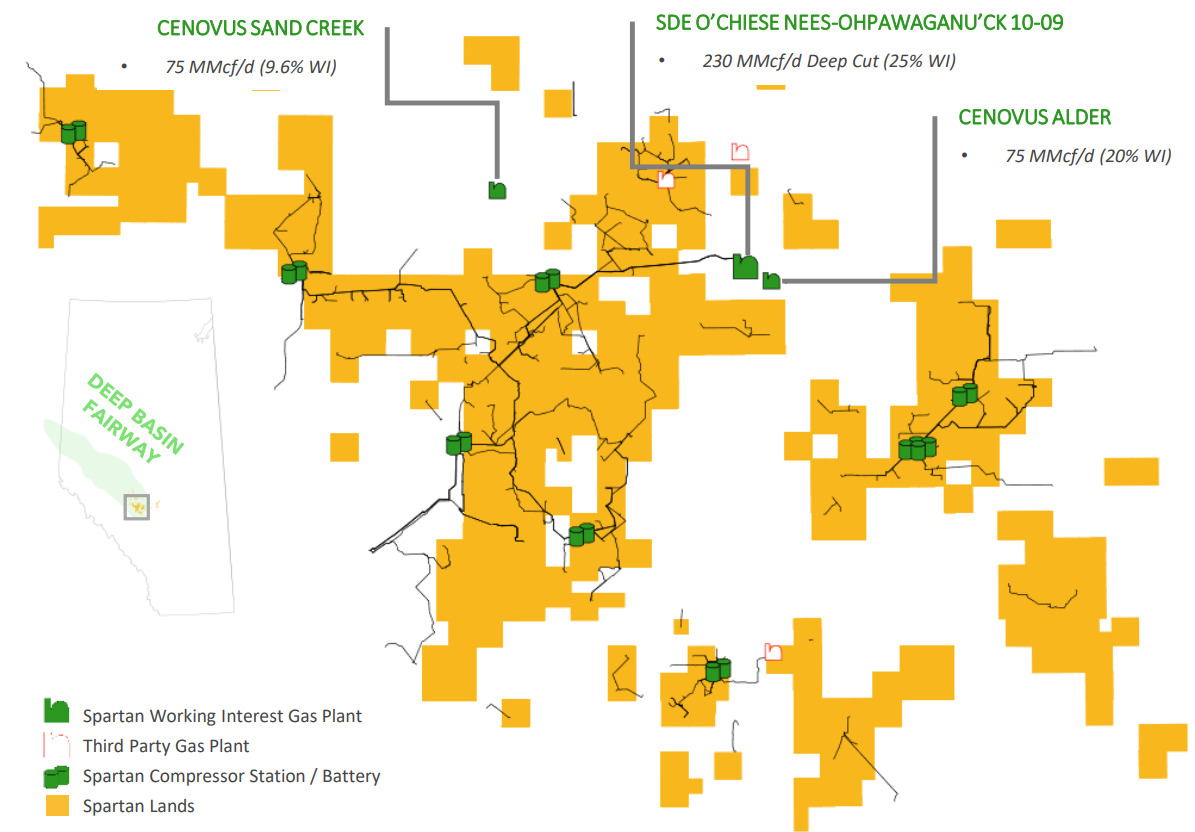

Spartan also holds 130,000 net acres in the Alberta Deep Basin, a multi-bench tight natural gas sand play area.

Spartan is targeting the Deep Basin’s delineated liquids-rich Spirit River and the oil- and condensate-rich Cardium formations. Liquids output from the Deep Basin averages about 31%.

The company completed 8 wells (6.5 net) in the Deep Basin during the first half of 2025, with two wells targeting Spirit River.

Spirit River wells 08-21-045-11W5 and 10-20-043-09W5 delivered gas-weighted results, with average IP30 rates of 1,657 boe/d and IP90 rates of 1,254 boe/d per well. Liquids yields averaged around 25%.

The three-well 03-07-045-09W5 Cardium pad produced average IP30 rates of 482 boe/d and IP90 rates of 566 boe/d per well (42% liquids). In mid-June, Spartan brought online the three-well 14-08-044-08W5 Cardium pad.

Spartan said it could look to boost spending in the Deep Basin in the second half of the year to capture rising natural gas prices.

Spartan has 130,000 net acres and gas-handling investments in the Alberta Deep Basin. (Source: Spartan)Deep Basin M&A

Spartan has 130,000 net acres and gas-handling investments in the Alberta Deep Basin. (Source: Spartan)Deep Basin M&A

Spartan also aims to do more M&A in the Deep Basin. The company “has a proven consolidation and integration record and a clean balance sheet position” to execute on potential deals, Spartan said.

The Deep Basin remains highly fragmented between producers and existing infrastructure is underutilized, the company said.

Offset operators in the Deep Basin include Tourmaline Oil, Cenovus Energy, Canadian Natural Resources, Whitecap Resources, Vermillion Energy and other Canadian E&Ps.

The natural gas-rich fairway is “poised for consolidation,” Spartan said in investor materials.

RELATED