The cryptocurrency market moves in distinct cycles, alternating between periods where Bitcoin dominates and phases where alternative cryptocurrencies (altcoins) take center stage. For traders and investors, understanding these cycles can mean the difference between catching massive gains and missing out on some of the most profitable opportunities in crypto.

The Altcoin Season Index has emerged as the definitive metric for identifying these market phases, providing a data-driven approach to answering one of crypto’s most important questions: Are we in Altseason yet?

What is the Altcoin Season Index?

The Altcoin Season Index is a quantitative measure that determines whether the cryptocurrency market is in “Altcoin Season”—a period when altcoins collectively outperform Bitcoin. The index evaluates the performance of the top 50 to 100 cryptocurrencies (excluding stablecoins and asset-backed tokens) over a rolling 90-day period.

The 75% Rule

The index operates on a simple but powerful principle: if 75% or more of the tracked altcoins have outperformed Bitcoin over the past 90 days, the market is considered to be in Altcoin Season. Conversely, if 25% or fewer altcoins outperform Bitcoin, it’s classified as Bitcoin Season.

Index Scaling

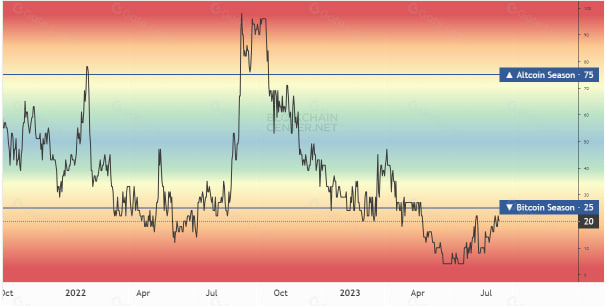

The metric is typically scaled from 1 to 100, where:

Above 75: Strong Altcoin Season

25-75: Mixed market conditions

Below 25: Bitcoin Season

Current Market Status

As of July 2025, the index sits at a relatively low 16-24, indicating that only 17 out of 100 top coins are outperforming Bitcoin over the last 90 days. This suggests the market is currently in Bitcoin Season, with Bitcoin dominance taking precedence over altcoin performance.

Understanding Altcoin Bull Seasons (Altseason)

An Altcoin Bull Season, commonly called “Altseason,” represents more than just statistical outperformance—it’s a period of intense market activity where altcoins experience rapid and significant price increases that often dwarf Bitcoin’s gains.

Characteristics of Altseason

During these periods, several key dynamics emerge:

Capital Rotation: Investors shift funds from Bitcoin to altcoins, seeking higher returns and diversification opportunities.

FOMO Dynamics: Fear of missing out drives additional buying pressure as investors chase rapidly appreciating altcoins.

Increased Trading Volumes: Altcoin trading volumes surge dramatically, sometimes exceeding Bitcoin’s volume.

Sector Rotations: Different altcoin categories (DeFi, memes, layer-1s, etc.) may take turns leading the market.

Compressed Time Frames: Altseasons typically last weeks to months, not years, making timing crucial for maximizing gains.

Historical Context: Learning from Past Cycles

The 2020-2021 Bull Run

The most recent significant Altseason occurred during the 2020-2021 bull market, providing valuable insights into how these cycles develop:

Bitcoin Dominance Drop: Bitcoin’s market dominance fell from 70% to 38%

Market Cap Explosion: Total cryptocurrency market capitalization doubled

Index Peak: The Altcoin Season Index reached 98 on April 16, 2021

Sector Breakouts: DeFi tokens, NFTs, and meme coins like Dogecoin and Shiba Inu saw unprecedented growth

The Pattern Recognition

Historical analysis reveals that Altseasons often follow a predictable pattern:

Bitcoin experiences a significant price run-up

Bitcoin price stabilizes or consolidates

Investors begin seeking higher returns in altcoins

Capital rotation accelerates, driving altcoin prices higher

FOMO amplifies the trend until market exhaustion

The Methodology: How Different Platforms Calculate the Index

While the core concept remains consistent, different platforms use slightly varying methodologies:

Blockchain Center Approach

Tracks top 50 coins

Excludes stablecoins and asset-backed tokens

Uses 75% threshold for Altseason determination

90-day rolling performance window

CoinMarketCap Method

Monitors top 100 coins

Same exclusions for stablecoins and wrapped tokens

Applies identical 75% threshold

Daily refresh of calculations

Excluded Assets

Most platforms exclude:

Stablecoins (USDT, USDC, DAI)

Asset-backed wrapper tokens (WBTC, stETH, cLINK)

These exclusions ensure the index reflects actual altcoin performance rather than pegged assets

The Limitations: Why the Index Isn’t Perfect

Reactive Nature

The Altcoin Season Index is inherently reactive, confirming Altseason after it has already begun. This lag can mean missing optimal entry points, as the best gains often occur in the early stages of altcoin runs.

Methodology Variations

Different platforms using varying numbers of coins (50 vs. 100) and slightly different exclusion criteria can lead to discrepancies in index values, potentially causing confusion for traders.

Market Evolution

The cryptocurrency market continues to evolve rapidly. New asset classes, changing market structures, and shifting investor behavior may require adjustments to the index methodology over time.

Historical Bias

Past performance patterns don’t guarantee future results. Market conditions, regulatory changes, and technological developments can alter traditional cycle patterns.

Complementary Indicators: Building a Complete Picture

Smart traders don’t rely solely on the Altcoin Season Index. Instead, they combine it with other leading and lagging indicators:

Bitcoin Dominance

Bitcoin’s market cap share relative to the total crypto market often provides earlier signals than the Altcoin Season Index. Declining Bitcoin dominance frequently precedes Altseason.

Trading Volume Ratios

Comparing total altcoin trading volume to Bitcoin’s volume can indicate growing interest in altcoins before it shows up in price performance.

Stablecoin Reserves

Spikes in stablecoin reserves, particularly Tether (USDT), can signal prepared buying power ready to flow into altcoins. Historical data shows increased stablecoin reserves often coincide with altcoin rallies.

Social Sentiment Metrics

Social media buzz, Google search trends, and community engagement levels can provide early indicators of shifting investor interest toward altcoins.

Strategic Implications for Traders and Investors

Position Sizing During Different Seasons

Understanding market cycles can inform portfolio allocation strategies:

During Bitcoin Season (Index

Maintain higher Bitcoin allocation

Research and accumulate quality altcoins at lower prices

Focus on fundamental analysis for long-term holds

During Mixed Markets (Index 25-75)

Balanced approach between Bitcoin and altcoins

Monitor for signals indicating direction change

Implement risk management strategies

During Altseason (Index > 75)

Consider taking profits on altcoin positions

Remain cautious of FOMO-driven investments

Prepare for potential cycle reversal

Risk Management in Volatile Cycles

The Importance of Timing

Altseasons can be incredibly profitable but also extremely volatile. Proper risk management becomes crucial:

Entry Strategy

Avoid chasing pumps when the index is already high

Use dollar-cost averaging during accumulation phases

Set clear entry and exit criteria before making trades

Exit Strategy

Take profits systematically during strong altcoin performance

Don’t assume Altseason will continue indefinitely

Maintain discipline even during FOMO periods

Portfolio Diversification

Spread risk across different altcoin categories

Maintain some Bitcoin allocation even during Altseason

Consider correlation risks between altcoins

Current Market Analysis: Where We Stand in July 2025

Bitcoin Season Indicators

Current market conditions suggest we’re in a Bitcoin-dominated phase:

Altcoin Season Index: 16-24

Only 17 out of 100 top coins outperforming Bitcoin

Bitcoin dominance likely increasing

What This Means for Investors

Quality altcoins may be available at attractive prices

Patience required for next Altseason development

Focus on fundamental research and accumulation strategies

Potential Catalysts for Change

Several factors could shift the market toward Altseason:

Bitcoin price stabilization after recent movements

Increased institutional adoption of altcoins

Regulatory clarity for specific altcoin categories

Technological breakthroughs in particular sectors

Looking Ahead: Preparing for the Next Altseason

Building Watchlists

Use the current Bitcoin Season to research and identify promising altcoins:

Focus on projects with strong fundamentals

Consider different sectors (DeFi, Layer-1s, gaming, etc.)

Monitor development activity and community growth

Accumulation Strategies

Dollar-cost average into quality projects

Set price alerts for significant movements

Maintain discipline during accumulation phases

Risk Preparation

Plan exit strategies before entering positions

Set realistic profit targets

Maintain emergency funds for unexpected opportunities

The Psychology of Market Cycles

Emotional Challenges

Different market phases present unique psychological challenges:

During Bitcoin Season

Patience as altcoins underperform

Resistance to FOMO on Bitcoin gains

Maintaining conviction in altcoin research

During Altseason

Greed management during rapid gains

Resistance to overtrading

Maintaining profit-taking discipline

Cycle Transitions

Recognizing when conditions are changing

Adapting strategies to new market phases

Avoiding anchoring to past performance

Conclusion: Navigating the Cycles

The Altcoin Season Index serves as a valuable tool for understanding cryptocurrency market cycles, but it’s most effective when combined with other indicators and sound investment principles. While the index can confirm when Altseason is occurring, successful crypto investors focus on preparation, patience, and disciplined execution regardless of current market conditions.

As we navigate the current Bitcoin Season in July 2025, remember that markets are cyclical. Today’s underperforming altcoins may become tomorrow’s breakout stars, while maintaining perspective on risk management and realistic expectations remains crucial for long-term success.

The key to profiting from these cycles isn’t just knowing when Altseason arrives—it’s being prepared for it before it does. By understanding the Altcoin Season Index, monitoring complementary indicators, and maintaining disciplined investment strategies, traders and investors can position themselves to benefit from the inevitable shifts in cryptocurrency market dynamics.

Whether you’re a seasoned trader or new to crypto, the Altcoin Season Index provides a data-driven framework for understanding one of the most important dynamics in cryptocurrency markets. Use it wisely, combine it with other analysis tools, and remember that in the volatile world of cryptocurrency, preparation and patience often matter more than perfect timing.