It’s being said—again—that the U.S. will soon reach “peak oil” output.

It was said in 1956 about post-1970 U.S. production; that turned out to be correct.

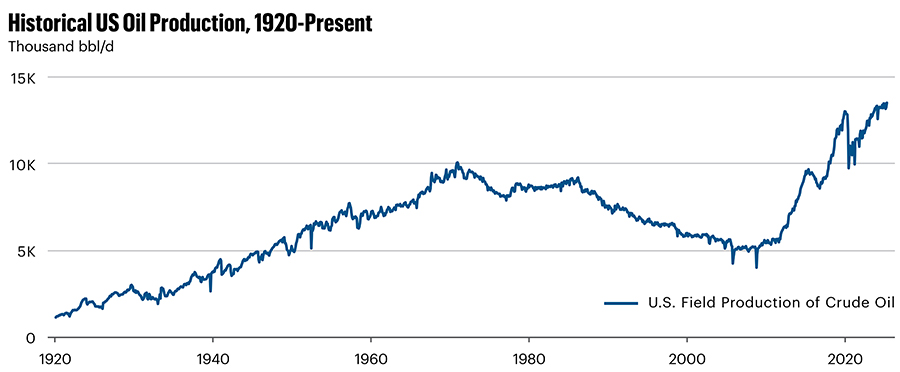

U.S. oil wells gave up some 10 MMbbl/d that year and began a steady decline to as few as 5 MMbbl/d in 2008, according to U.S. Energy Information Administration (EIA) archives. (This excludes the 4 MMbbl/d in the fall of 2005 and again in 2008 while offshore wells were shut in by hurricanes.)

And it was said again in the early 2000s.

That turned out to be incorrect.

Today, like in 2005, what the audience isn’t hearing are the last few words of the outlook: “at current commodity prices.”

Source: U.S. Energy Information Administration

Source: U.S. Energy Information Administration

U.S. oil production grew steadily until 1970 at some 10 MMbbl/d, then declined to as few as 5 MMbbl/d by 2008, but shale technology turned it around to nearly 14 MMbbl/d today.

Travis Stice, executive chairman of Diamondback Energy, which produces some 500,000 bbl/d from the Permian Basin, used those words in his much-cited letter to shareholders May 5.

Stice wrote, “On an inflation-adjusted basis, there have only been two quarters since 2004 where front-month oil prices have been as cheap as they are today,” excluding 2020 when the pandemic drove WTI into the $20s.

“Therefore, we believe we are at a tipping point for U.S. oil production at current commodity prices,” Stice said.

At the time of his letter, WTI was $58.50/bbl.

Oil and gas investor Wil VanLoh warned in June on future U.S. oil output, as well.

VanLoh, who founded Houston-based investment firm Quantum Capital Group, has raised and invested more than $30 billion in the oil and gas industry since 1998.

Like Stice, he modified his outlook by noting it’s only correct “at anything close to current prices,” he told attendees at the Energy Capital Conference hosted by Hart Energy in Houston.

Peak oil “really depends on the price,” he said. “So, at current prices, we’re probably pretty close to peak oil at the low $60s.”

At the time, WTI was $63.

But the U.S. could produce as much as 2 MMbbl/d more than its current 13.5 MMbbl/d with “significantly higher prices,” he added.

Energy investor Kimmeridge Energy Management, which also owns an Eagle Ford-focused oil and gas producer, published a paper May 5, the day of Stice’s remarks to Diamondback shareholders.

Based on $70 oil and $3.50/MMBtu gas, Kimmeridge estimated the Delaware Basin has 24,000 more future-well locations; the Midland Basin, 4,500; and the Eagle Ford and Austin Chalk of South Texas, 2,400.

Using Kimmeridge’s metrics—recycle ratios—a Hart Energy analysis showed more than 100,000 potential new U.S. wells if the oil price reaches $100/bbl at current gas-to-oil wellhead ratios and current D&C costs.

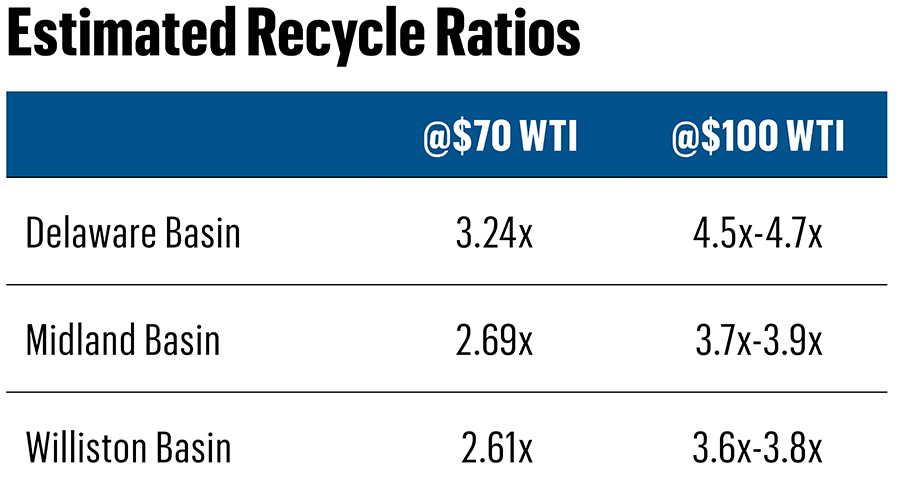

Kimmeridge’s 2024 recycle ratio of 3.24x for Delaware Basin wells at $70 would grow to up to 4.7x at $100 in the Hart Energy analysis; the Midland Basin, from 2.69x to up to 3.9x; and the Williston Basin, from 2.61x to up to 3.8x.

Source: Kimmeridge Energy Management and Hart Energy Analysis

Source: Kimmeridge Energy Management and Hart Energy Analysis

At $70 oil, Kimmeridge Energy Management estimates the Delaware, Midland and Williston basins have recycle ratios of between 2.61x and 3.24x. At $100 oil, a Hart Energy analysis indicates ratios of between 3.6x and 4.7x.

“The front-end threshold is shifting,” Kimmeridge reported. In 2010, it was 1.3x and grew to 2.9x by 2021 as best practices were perfected in D&C and operations.

“Since 2021, the front-end threshold has gradually decreased … to its 2023-2024 position of some 2.6x.

“This decrease reflects a rate of EUR-per-foot degradation associated with core-interval-area exhaustion that is beginning to outpace the rate of capex-per-foot improvements associated with extending lateral lengths.”

The firm concluded, “We believe these trends will continue and that the front-end threshold will be some 1.8x by 2034.”

But it ended the sentence with “barring major technological improvements.”

As for that, it has been said that all of the oil and gas in the U.S. has already been found.

But it hasn’t all been produced already.

The tight-rock Bakken, Wolfcamp, Eagle Ford, Woodford, Niobrara and other formations were long known. Horizontal holes and fracture stimulation made them economic producers.

Until new technology makes new oil prospects, a higher oil price alone will convert the marginal to PDP.

Meanwhile, Kimmeridge reported that at $70 oil, “even though North American inventory quality and duration have begun to decline, our inventory work gives us confidence that there are still plenty of great investment opportunities out there, some that the general market sees the value of and some that it does not.

“We believe those who can appreciate the varying factors of its past and present will maintain a competitive edge in unlocking value into the future.”

On an inflation-adjusted basis, today’s $70 oil is the equivalent of $36 in 2000, which is what WTI happened to be in that year, according to EIA archives.

The shale oil revolution began that year with a first fracture-stimulated, horizontal Bakken well in the Williston Basin.

While D&C technology cracked the code in the past 25 years, a key part of the recipe going forward will simply be “Just Add Dollars.”