No other region exerts such a concentrated influence on tanker operations as the Middle East. From state-aligned crude exporters to sanction-resilient carriers navigating under alternative registries, the region’s tanker trade is under continual adjustment. Decades of geopolitical friction, regulatory constraints and infrastructural transformation have forged a maritime environment that is both commercially indispensable and logistically unstable. Recent developments indicate this duality will continue to define the Middle East’s role in global tanker deployment.

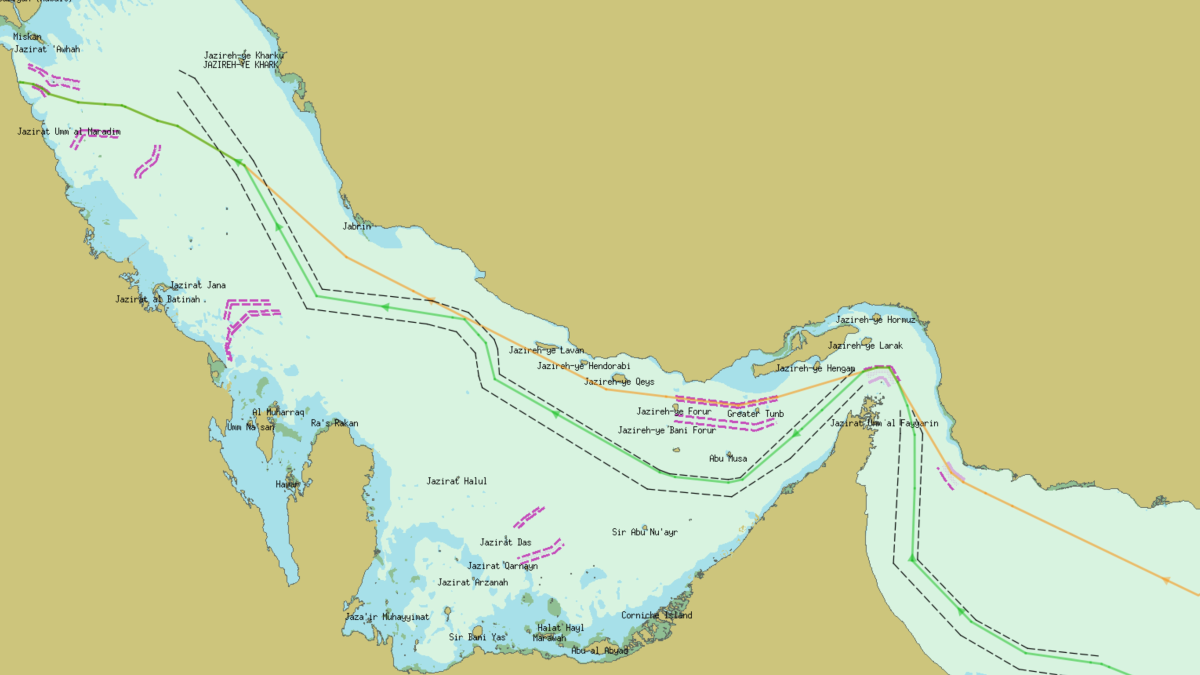

The Strait of Hormuz remains the most exposed chokepoint. Approximately one fifth of global crude oil flows through its narrow waters, making even speculative threats to access a cause of freight rate volatility. In June 2025, VLCC rates from the Gulf to Asia rose by more than 40% following escalated regional tensions. The increase was not driven by sentiment alone. Routing data indicated a marked rise in vessel U-turns as tankers abandoned transit through the Strait. According to MarineTraffic analytics cited by Riviera: “The number of tankers avoiding the Strait of Hormuz altogether increased during periods of heightened tension.”

Shell’s chief executive told The Guardian there would be a “huge impact to trade” if regional escalation disrupted flows. Drewry’s assessment, however, cautioned against assuming a full closure. “Iran has previously threatened to block the Strait,” the consultancy stated, “but has refrained from doing so, aware that its own oil exports also depend on its continued operation.”

Beyond the Gulf, tankers transiting the Bab-el-Mandeb Strait and Red Sea face operational risk from the conflict in Yemen. This has prompted some VLCCs to reroute via the Arabian Sea and Cape of Good Hope. The resulting detours impact voyage economics and fuel use, and these risks are increasingly priced into fixtures. Insurance premiums have also increased. In some cases, rates for vessels passing through designated high-risk areas have doubled.

Sanctions enforcement remains a defining feature of Middle East tanker strategy. The US has resumed action against Iran-linked shipping networks, with the US Department of the Treasury recently identifying entities operating or owning NITC-linked VLCCs and LPG carriers. These include firms registered in Liberia, the Marshall Islands and the UAE. The Treasury reported that “Iran continues to leverage its petroleum sales to fund destabilising regional activities.” The targeting of intermediaries signals a renewed focus on financial architecture as well as flagged assets.

“Regulatory constraints and infrastructural transformation have forged a maritime environment that is both commercially indispensable and logistically unstable”

Operators such as the National Iranian Tanker Company and Sovcomflot have established new business models to maintain access to regional trade. Sovcomflot has shifted operational control of tankers to Dubai-based affiliates. NITC has focused on technical compliance and retrofit investment, with a reported emphasis on Tier II engine upgrades.

These pressures coincide with structural shifts in fleet ownership and trading patterns. ADNOC Logistics & Services, Bahri and KOTC are expanding their fleets while diversifying into non-crude segments. Meanwhile, private and foreign-controlled operators have used UAE jurisdictions to enter Middle East trades. Together, these developments illustrate how the regional tanker sector has evolved into a complex blend of state control, commercial agility and regulatory navigation.