Business outlooks have declined in the oil and gas fields of Oklahoma, Colorado, northern New Mexico and Wyoming, according to a new Kansas City Fed energy survey.

Among the participants, $64/bbl oil and $3.79/MMBtu gas is the average they need to be profitable, according to the results.

To increase D&C meaningfully, participants said they need an average of $83 oil and $5.01 gas.

However, they don’t see oil exceeding $70 again for two years and they expect it to be in the $70s through the rest of the decade.

For gas, they expect the $4 threshold to be crossed sometime after first-half 2026 and for it to remain in the $4s the rest of the 2020s.

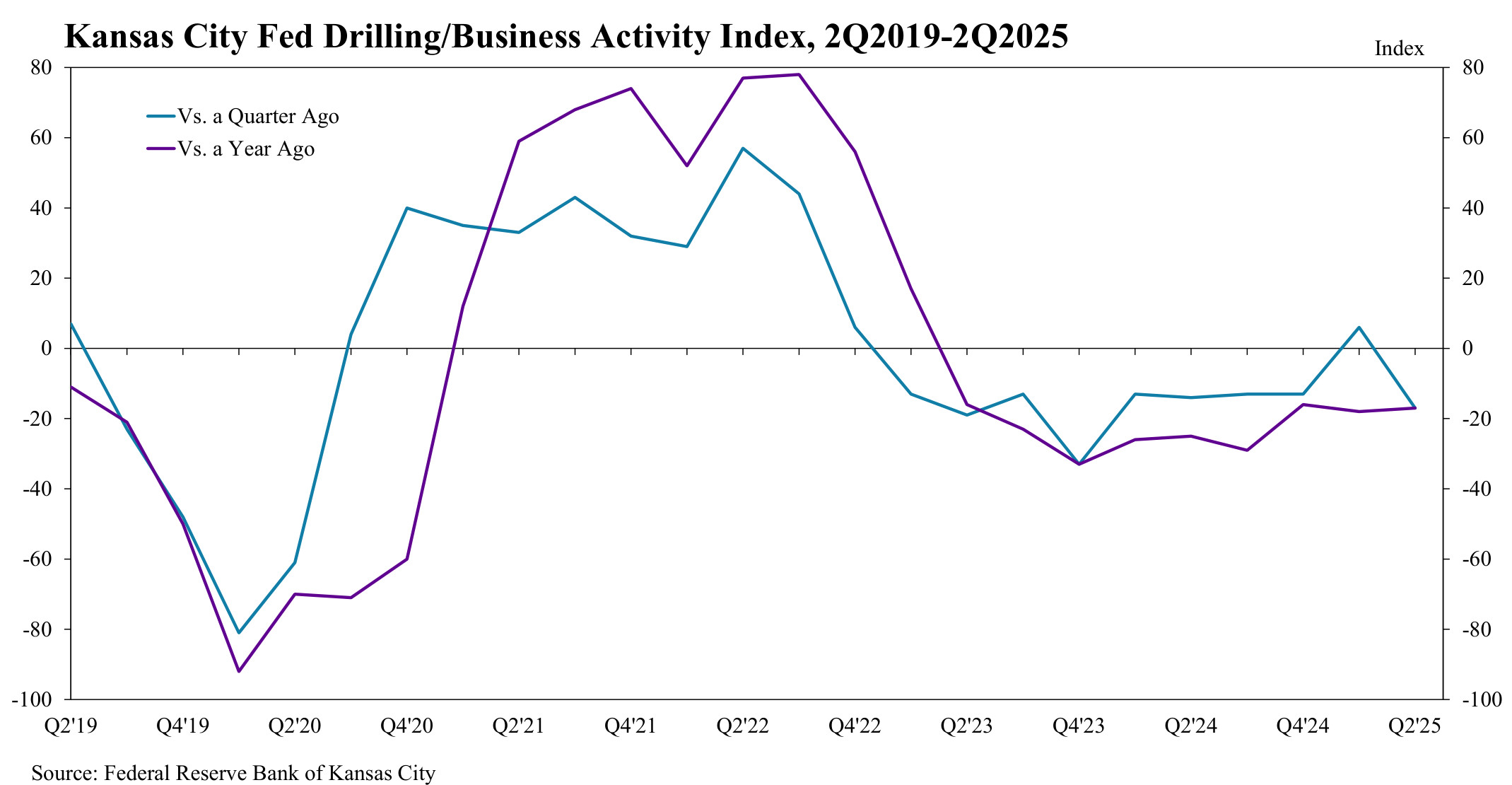

“The quarter-over-quarter drilling and business activity index was -17 in the second quarter, down from 7 in the first quarter and from -13 in the fourth quarter,” the Fed reported.

“Revenues and profit continued to decline at -10 and -17, respectively. The employment index also decreased at -7 following previous positive readings.”

The survey was conducted between June 16 and June 30; 30 oil and gas producers and oilfield services operators in the Kansas City region responded.

“Firms do not expect activity to rebound in the coming six months with the index falling from 21 to 0 in the second quarter,” the Kansas City Fed reported.

“Further, revenues are expected to increase minimally while capital expenditures, employment, employee hours and oil prices are all expected to decline further.”

Meanwhile, the oil and gas industry’s second-quarter activity “fell moderately,” said Megan Williams, the Kansas City Fed’s associate economist and survey manager.

After a first quarter “Trump bump” in the oil and gas activity index for Oklahoma and the Rockies, the index fell in the second quarter back to the negative territory of the second half of the Biden administration. (Source: Federal Reserve Bank of Kansas City)Muted response

After a first quarter “Trump bump” in the oil and gas activity index for Oklahoma and the Rockies, the index fell in the second quarter back to the negative territory of the second half of the Biden administration. (Source: Federal Reserve Bank of Kansas City)Muted response

The report was muted in comparison with what oil and gas producers in Texas, North Louisiana and southern New Mexico told the Dallas Fed in its second-quarter survey, which was conducted between June 18 and June 26.

The Dallas-based district consists of Texas, North Louisiana and southern New Mexico.

In that survey, an operator said, “It’s hard to imagine how much worse policies and D.C. rhetoric could have been for U.S. E&P companies.

“We were promised by the [Trump] administration a better environment for producers but were delivered a world that has benefitted OPEC to the detriment of our domestic industry.”

But another wrote, “Thank God the [Biden] administration is gone and so are their anti-energy policies!”

Israel and Iran were at war during part of the Dallas and Kansas City surveys, pushing WTI to $78 and then falling back into the $60s when the countries agreed to a ceasefire.

Among the 136 participants in the Dallas Fed’s survey, 91 were oil and gas producers and 45 were OFS firms.

The survey’s uncertainty index clocked in at 47.1, the third-highest recorded. The highest was 63.8 in March 2020 at the start of the COVID-19 pandemic, followed by 62.6 in March 2023 as the Russia-Ukraine war oil and gas price bumps subsided.