(Bloomberg) — Wall Street’s tolerance for shock is becoming heroic.

Most Read from Bloomberg

First came the inflation angst, then the tariff crash, then the war in the Middle East. At this point, it’s hard to imagine what could still rattle the investor class.

Speculative spirits were on display again this week, even as President Donald Trump escalated threats against major trading partners, including a 35% tariff on Canadian goods and a 50% levy on copper. Bitcoin surged past $118,000, bond volatility fizzled, stocks held near records and retail traders unleashed risky wagers anew.

It’s a form of investor resilience, built by facing down threats and emerging stronger — where even the prospect of a renewed US-led trade conflict gets brushed aside, in favor of bullish bets across the board.

JPMorgan Chase & Co. CEO Jamie Dimon has a different word for it: complacency. But for traders sitting on fattening profits in crypto, tech, leveraged ETFs, commodities and beyond, it’s feeling like vindication.

“We absolutely believe the recent bullish price action in risk assets makes sense,” said Max Kettner, chief multi-asset strategist at HSBC. “Bear in mind this is no longer just equities but spreading across virtually all risk assets. So if anything, we’d argue investors are once again under-exposed and continue to fight the rally.”

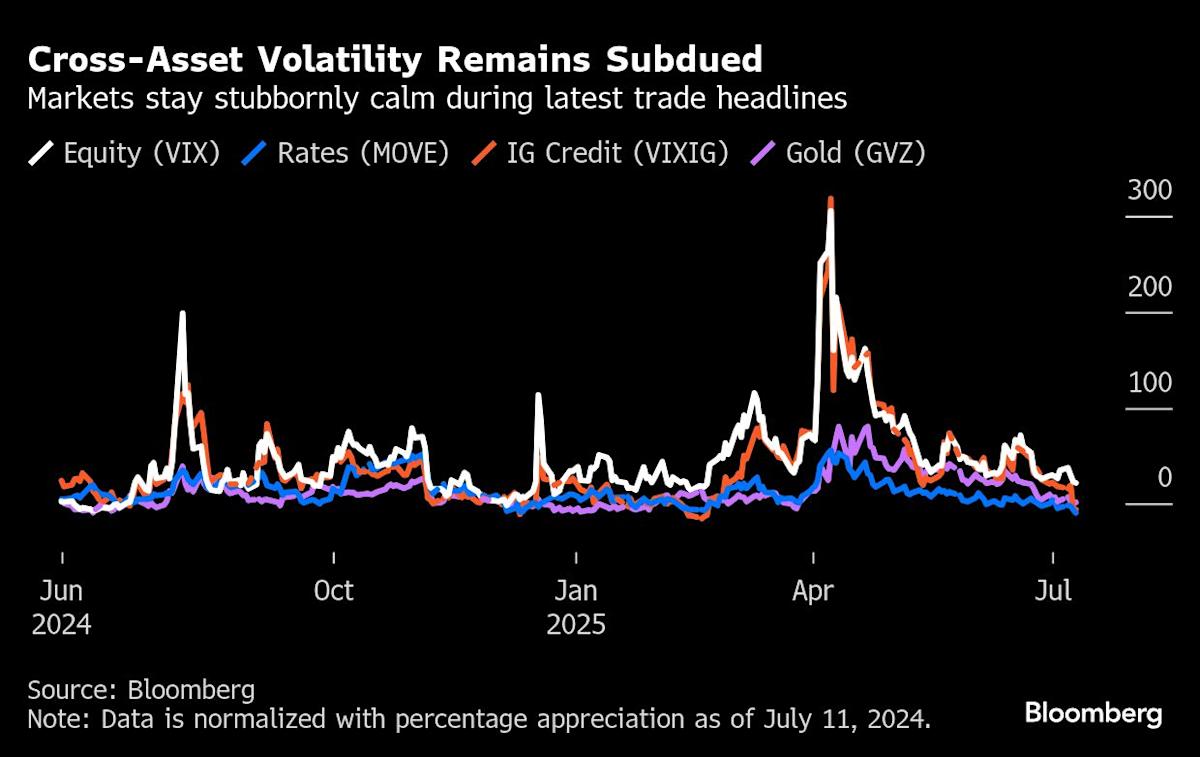

Traders are getting harder to frighten even as measures that presaged past market stress climb. A global trade policy uncertainty index tracked by Bloomberg is rising, just as it did in the months before April’s global market meltdown.

The S&P 500 closed Friday marginally below its record. Risk premiums tracking US corporate bonds hovered around their lowest level of the year. Bitcoin exchange-traded funds continued to see inflows. Volatility receded, with a gauge of US Treasury swings hitting its lowest level in nearly 3 1/2 years as measures of stocks. Oil and gold turbulence remained subdued.

And yet, Trump warned this week that new and higher rates will kick in Aug. 1, unless countries negotiate better terms. The announcement of a 35% tariff on some Canadian goods came the same day the S&P 500 hit its all-time high.

“The market has consistently shrugged off any issues, including tariffs, and even the brief conflict between Israel and Iran,” said Josh Kutin, head of multi-asset solutions, North America at Columbia Threadneedle Investments. “If the market is not overall responding negatively to any of those issues, I have a hard time seeing how that happens in the near-term.”

Story Continues