Wall Street claims that Federal Reserve official Waller’s estimate of adequate reserves is too low.

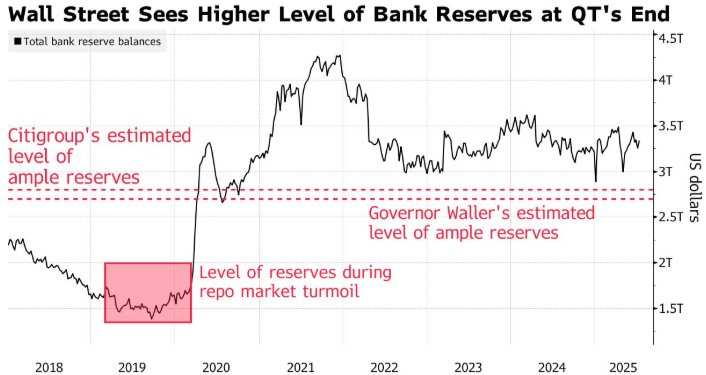

According to the Zhito Finance APP, strategy Analysts on Wall Street believe that the predicted value for adequate reserves needed in the financial system to prevent disorder should be higher. Waller stated last week that the Federal Reserve could reduce bank reserves to about 2.7 trillion dollars, whereas the current level is about 3.34 trillion dollars, which would enable the Federal Reserve to continue shrinking its balance sheet, a process known as ‘Algo Tightening.’

JPMorgan’s strategists indicated that this week, the level of reserves deemed ‘adequate’ may need to be increased without disrupting the overnight funding market. Citigroup’s global markets strategists Jason Williams and Alejandra Vazquez expressed on Monday that by the end of the year, reserves might decrease to 2.8 trillion dollars.

Market participants are closely monitoring the bank’s Cash reserves at the Federal Reserve to determine when to stop the balance sheet contraction. Now, with the U.S. Congress raising the debt ceiling, Wall Street is focusing on the U.S. Treasury’s growing Cash balance, as the Treasury is pulling excess liquidity out of the system, making the market more prone to unexpected events like the banking crisis two years ago.

Market participants are closely monitoring the bank’s Cash reserves at the Federal Reserve to determine when to stop the balance sheet contraction. Now, with the U.S. Congress raising the debt ceiling, Wall Street is focusing on the U.S. Treasury’s growing Cash balance, as the Treasury is pulling excess liquidity out of the system, making the market more prone to unexpected events like the banking crisis two years ago.

The JPMorgan strategist team wrote in a report to clients on July 11: ‘Given the regional banking crisis that occurred in March 2023 (which showed a peak in large deposit outflows) and the current regulatory framework (which places high priority on liquidity), this threshold may need to be raised.’

The latest market expectations survey from the New York Fed conducted in June showed that the median reserve balance level when the Algo Tightening policy ends is 2.875 trillion dollars.

Since June 2022, the Federal Reserve has been gradually reducing its holdings of debt Assets. In April, policymakers slowed the pace of Shareholding, reducing the monthly ceiling for US Treasury securities that are not reinvested upon maturity from 25 billion dollars to 5 billion dollars. The ceiling for mortgage-backed securities remains unchanged at 35 billion dollars.

Ultimately, policymakers are working to avoid a scenario like the turmoil in the repurchase agreement market in September 2019. At that time, as the Federal Reserve was shrinking its balance sheet, reserves had accumulated to unprecedented levels, leading to a cash shortfall, which caused a sharp increase in key lending rates and the federal funds rate, forcing the central bank to take action to stabilize the cash market.

Waller stated in a speech at the Dallas Fed last week that in September 2019, the ratio of bank reserves to GDP had fallen below 7%, whereas around January 2019 the ratio was 8%, and during that time there was “no significant stress” on the banks in the financial system. With some buffer now, Waller believes that a shortfall occurs when reserves fall below 9% of GDP.