Dublin, July 16, 2025 (GLOBE NEWSWIRE) — The “Japan Recommerce Market Intelligence Databook – 60+ KPIs, Market Size, Share & Forecast by Channel, Category & Consumer Segment – Q2 2025 Update” report has been added to ResearchAndMarkets.com’s offering.

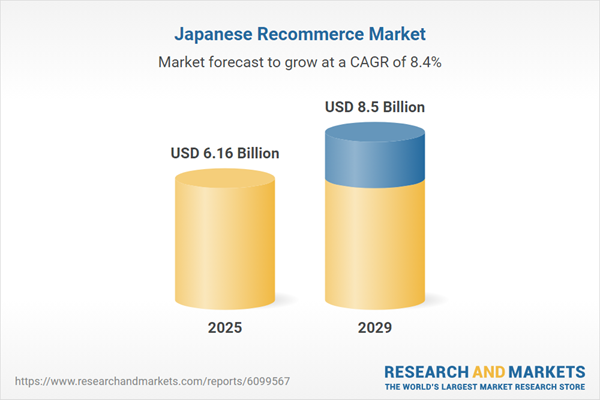

The recommerce market in Japan is expected to grow by 10.2% on annual basis to reach US$6.16 billion in 2025. The recommerce market in the country experienced robust growth during 2020-2024, achieving a CAGR of 12.7%. This upward trajectory is expected to continue, with the market forecast to grow at a CAGR of 8.4% during 2025-2029. By the end of 2029, the recommerce market is projected to expand from its 2024 value of USD 5.59 billion to approximately USD 8.50 billion.

This report provides a detailed data-centric analysis of the recommerce market in Japan, covering market opportunities and risks across consumer segments (peer-to-peer and business-led resale); product categories; sales channels; and resale formats. With over 60+ KPIs at the country level, this report provides a comprehensive understanding of recommerce market dynamics.

Recommerce in Japan Is Formalizing Through Manufacturer-Led Returns, Specialized Platforms, and Circular Design Alignment

Japan’s recommerce market is transitioning from informal peer-to-peer resale to structured, compliance-aligned, and specialist-operated ecosystems. With strong cultural foundations in repair and reuse, the sector is now scaling through OEM-controlled refurbishment programs, vertical resale platforms, and government-backed circular economy initiatives. Electronics, fashion, and home goods are leading the shift.

Japan’s recommerce ecosystem is consolidating around domestic platform champions, OEM resale programs, and retail enablers. Government policy and circular economy goals are reinforcing the growth of structured resale networks. Electronics and fashion recommerce in Japan are entering a phase of formal consolidation. Manufacturers, telcos, and resale platforms are scaling refurbishment and resale infrastructure in response to policy alignment and consumer demand. Government compliance and platform specialization will be the defining features of Japan’s recommerce evolution over the next 2-4 years.

Electronics Recommerce Is Being Institutionalized by OEM-Controlled Trade-In and Refurbishment

Major Japanese OEMs like Panasonic and Sony are embedding trade-in, refurbishment, and resale services into their consumer electronics lifecycle. SoftBank and NTT Docomo operate structured smartphone trade-in and resale channels through in-store and online resale programs.Japan’s Electrical Appliance Recycling Law (2001, revised 2023) obligates manufacturers to collect and recycle end-of-life electronics. The Ministry of Economy, Trade and Industry (METI) supports OEM-led take-back and resale to enhance product traceability and material recovery.OEM-led resale channels will expand under policy alignment. Domestic refurbishment hubs and telco resale programs are expected to capture growing share of used device circulation.

Apparel Recommerce Is Expanding Through Department Store Partnerships and Platform-Led Models

Apparel recommerce in Japan is expanding through collaborations between fashion brands, department stores, and recommerce platforms. Beams and United Arrows have hosted resale events in coordination with Mercari. Isetan Mitsukoshi and Lumine are testing secondhand shop-inside-store models.Japan’s secondhand fashion market exceeded 500 billion in 2023 (Japan Reuse Business Journal, 2024). Demand is being driven by Gen Z and millennials seeking quality resale goods, sustainability values, and price-conscious alternatives to fast fashion.Department stores and platforms like Mercari and Rakuma will expand branded resale collaborations. Hybrid formats combining new and secondhand apparel will become common in urban retail settings.

Competitive Landscape in Japan Is Being Shaped by Platform Leaders and Policy-Aligned Resale Infrastructure

Resale operations will be integrated into OEM and retailer logistics systems.Government-backed compliance incentives will favor platforms with traceability, certification, and refurbishment capabilities.Physical retail will continue playing a critical role in take-back and resale through loyalty integration and reverse logistics hubs.

Domestic Platforms Are Scaling Recommerce Through Category Specialization

General goods: Mercari leads C2C recommerce with over 20 million active users. In 2024, it expanded its B2C model via “Mercari Shops” and opened an authentication center in Chiba to enhance quality control.Fashion: Second Street, operated by GEO Holdings, runs over 700 secondhand stores and offers both in-store and online resale. It specializes in lifestyle and fashion categories.Electronics and Media: BookOff and HardOff continue to lead in refurbished electronics and physical media recommerce. These chains operate refurbishment centers alongside buy-sell outlets nationwide.

OEMs and Retailers Are Partnering on Take-Back and Refurbishment

Panasonic and Sony are piloting structured resale aligned with the Circular Economy Roadmap under METI’s oversight.NTT Docomo and SoftBank operate device trade-in and resale services across affiliated stores.Aeon and Bic Camera offer trade-in counters linked to loyalty ecosystems, encouraging in-store resale adoption.

Scope

Japan Recommerce Market Size and Growth Dynamics

Gross Merchandise Value (GMV) Trend AnalysisAverage Transaction Value Trend AnalysisTransaction Volume Trend Analysis

Japan Recommerce Market Size and Forecast by Sector

Retail ShoppingHome ImprovementOther Sectors

Japan Recommerce Market Size and Forecast by Retail Category

Apparel & AccessoriesConsumer ElectronicsHome AppliancesHome Decor & EssentialsBooks, Toys & HobbiesAutomotive Parts & AccessoriesSports & Fitness EquipmentOther Product Categories

Japan Recommerce by Channel

Consumer-to-Consumer (C2C)Business-to-Consumer (B2C)Retailer Trade-In & Buyback Programs

Japan Recommerce by Sales Model

ResaleRentalRefurbishment & Certified Pre-Owned

Japan Recommerce by Digital Engagement Channel

Website-Based ResaleApp-Based ResaleSocial Media Driven Resale

Japan Recommerce by Platform Type

Generalist MarketplacesVertical-Specific Platforms

Japan Recommerce by Device and OS

Mobile vs DesktopAndroid, iOS

Japan Recommerce by City Tier

Tier 1 CitiesTier 2 CitiesTier 3 Cities

Japan Recommerce by Payment Instrument

Credit CardDebit CardBank TransferPrepaid CardDigital & Mobile WalletsOther Digital PaymentsCash

Japan Recommerce Market Share Analysis

Market Share by Key PlayersCompetitive Landscape Overview

Japan Recommerce by Consumer Demographics

Market Share by Age GroupMarket Share by Income LevelMarket Share by Gender

Key Attributes:

Report AttributeDetailsNo. of Pages83Forecast Period2025 – 2029Estimated Market Value (USD) in 2025$6.16 BillionForecasted Market Value (USD) by 2029$8.5 BillionCompound Annual Growth Rate8.4%Regions CoveredJapan

For more information about this report visit https://www.researchandmarkets.com/r/b6g92k

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.