The price of West Texas Intermediate (WTI) is currently trading above the $68 per barrel mark, approaching $70 per barrel. The rising price of the commodity, being backed by renewed tensions in the Middle East, is a boon for the exploration and production activities of ConocoPhillipsCOP.

The upstream energy major has low-cost resources both internationally and in the United States. ConocoPhillips is more confident in its resources within the United States, which it refers to as the Lower 48, comprising major shale plays like the Permian Basin, Eagle Ford and Bakken. This demonstrates resilience in ConocoPhillips’ business model.

With the oil price significantly higher than the break-even price in the prolific resources, where COP is operating currently, the ongoing pricing environment of the commodity is highly favorable for the company’s overall business, thereby aiding its bottom line.

Is the Current Oil Price Favorable for XOM & EOG’s Businesses?

Exxon Mobil Corporation XOM and EOG Resources, Inc.EOG are two leading energy players, having a significant presence in upstream businesses.

XOM has a strong presence in prolific oil and gas resources in the Permian and offshore Guyana. Advantageous volume growth from both resources has been supporting ExxonMobil’s upstream activities, which contribute to the large scale of the company’s total earnings.

Having crude reserves in the United States and Trinidad, EOG Resources is among the energy majors in the domestic market. Having operations in the leading shale plays in the United States, the company is well-positioned to capitalize on the handsome crude prices.

COP’s Price Performance, Valuation & Estimates

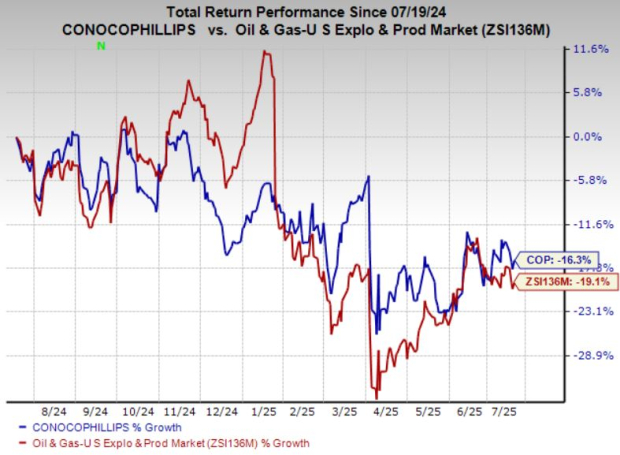

Shares of COP have lost 16.3% over the past year compared with the 19.1% decline of the composite stocks belonging to the industry.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

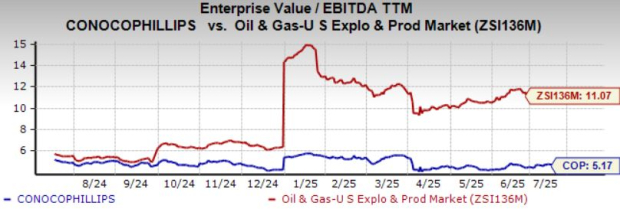

From a valuation standpoint, COP trades at a trailing 12-month enterprise value to EBITDA (EV/EBITDA) of 5.17X. This is below the broader industry average of 11.07X.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for COP’s 2025 earnings has been revised upward over the past seven days.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

COP stock currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the favorite stock to gain +100% or more in the months ahead. They include

Stock #1: A Disruptive Force with Notable Growth and Resilience

Stock #2: Bullish Signs Signaling to Buy the Dip

Stock #3: One of the Most Compelling Investments in the Market

Stock #4: Leader In a Red-Hot Industry Poised for Growth

Stock #5: Modern Omni-Channel Platform Coiled to Spring

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor. While not all picks can be winners, previous recommendations have soared +171%, +209% and +232%.

Download Atomic Opportunity: Nuclear Energy’s Comeback free today.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

ConocoPhillips (COP): Free Stock Analysis Report

EOG Resources, Inc. (EOG): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).