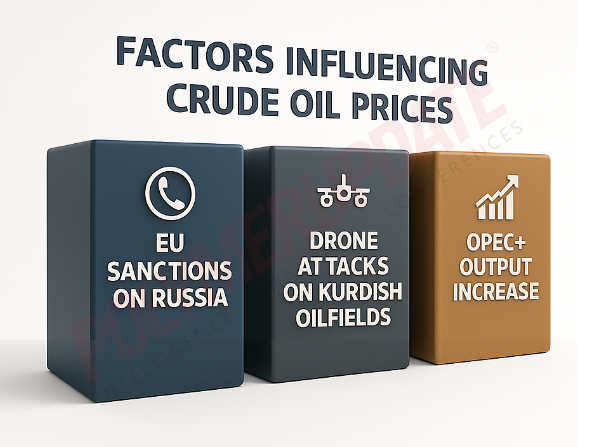

Crude oil prices declined marginally on Friday, weighed down by mixed U.S. economic growth signals that pointed to a turbulent demand outlook in the world’s largest economy. This offset the bullish sentiment sparked by the European Union’s imposition of new sanctions on Russian energy exports. series of drone attacks by suspected militants on Kurdish oilfields failed to trigger an upward momentum in crude prices, at least for now, as increased production from the Organization of the Petroleum Exporting Countries and its allies (OPEC+) helped balance temporary supply concerns arising from Russia and Iraq.

Data compiled by Polymerupdate Research showed that benchmark Brent crude futures for near-month delivery on the Intercontinental Exchange (ICE) settled 0.3 percent lower, or by US$ 0.24 a barrel, at US$ 69.28 a barrel on Friday, compared to US$ 69.52 a barrel on Thursday. Similarly, West Texas Intermediate (WTI) Cushing futures for near-month delivery on the New York Mercantile Exchange (Nymex) declined by 0.3 percent, or US$ 0.20 a barrel, to US$ 67.34 a barrel, from US$ 67.54 a barrel the previous day. Both benchmarks registered a weekly decline of approximately 2 percent.

An analyst from Reliance Securities Ltd stated, “Crude oil prices continued to show weakness after President Trump refrained from imposing new sanctions, despite the European Union announcing fresh restrictions on Russian oil exports. Trump merely threatened potential future tariffs on Russia if the Kremlin does not agree to a ceasefire and indicated that the U.S. might impose tariffs on countries purchasing Russian oil, such as China and India. Additionally, oil prices were pressured by a rally in the dollar index.”

The analyst added, “Meanwhile, OPEC+’s latest report projected a stronger global economy in the second half of 2025, with rising oil demand expected from India, China, and Brazil, alongside continued recovery in the U.S. and the EU.”

New EU sanctions

New EU sanctions

The European Union on Friday imposed new sanctions on Russian energy sources, targeting Indian oil refiner Nayara Energy Ltd—a joint venture between Russian energy giant Rosneft (which holds a 49.13 percent stake) and an investment consortium through a Special Purpose Vehicle (SPV) of Kesani Enterprises Company, which also holds a 49.13 percent stake in Nayara. Kesani is owned by Russia’s United Capital Partners (UCP) and Hara Capital Sarl, a wholly owned subsidiary of Mareterra Group Holding (formerly Genera Group Holding S.p.A.). Nayara owns and operates a 20 million tonne-per-year oil refinery at Vadinar in Gujarat, along with a retail network of over 6,750 petrol pumps.

The fresh sanctions, imposed over Russia’s ongoing war in Ukraine, include new banking restrictions, a revised (lowered) price cap on Russian crude, and curbs on fuels derived from Russian sources. This latest round of sanctions, aimed directly at the Russian economy, builds upon previously imposed restrictions, which have so far had limited impact.

Despite sanctions, the Russian economy has continued to generate revenue by selling discounted crude oil to countries such as China, India, and Brazil. Meanwhile, Russia’s energy ministry reported that the country’s crude oil production declined by 3.5 percent year-over-year to 211 million metric tonnes, while gas production fell by 3 percent to 290 billion cubic metres during the January–May period, reflecting lower output amid OPEC+ production cuts.

India stands to benefit

In a way, India stands to benefit from these restrictions, as Russia may be compelled to sell crude oil to trade partners, including Indian buyers, at a revised price cap currently under consideration—between US$ 45 a barrel and US$ 50 a barrel, compared to the existing cap of US$ 60 per barrel. At present, Russian supply accounts for around 40 percent of India’s crude oil consumption. Additionally, the Nord Stream pipeline, a key conduit for Russian energy exports, has been banned by the European Union.

Announcing the new sanctions on Russia, European Union Foreign Policy Chief Kaja Kallas stated in a post on X, “For the first time, we’re designating a flag registry and the biggest Rosneft refinery in India. We’re standing firm. The EU just approved one of its strongest sanctions packages against Russia to date. We’re cutting the Kremlin’s war budget further—going after 105 more shadow fleet ships, their enablers, and limiting Russian banks’ access to funding.”

Back in December 2022, the Group of Seven (G7) nations, led by the United States, imposed a US$ 60 per barrel price cap on Russian oil sold to third countries, along with several other sanctions, including Russia’s exclusion from the SWIFT cross-border payment system. Under this mechanism, Western insurance and shipping services could only be used if the oil was sold at or below the capped price. The aim was to restrict Russia’s oil revenues while preserving stability in global energy supplies. However, the cap was widely criticized for being largely ineffective in achieving its intended goals.

Drone attacks on Kurdish oilfields

A flurry of explosive-laden drone attacks severely disrupted the Tawke and Peshkabir oilfields operated by Norway’s DNO, resulting in a decline of Kurdish oil output by 200,000 barrels per day (bpd)—more than one-third of the region’s estimated production of 285,000 bpd. These attacks have reignited geopolitical tensions in the Middle East, just weeks after a brief period of calm. Drone strikes on oilfields in Iraqi Kurdistan continued for a fifth consecutive day on Friday, targeting critical energy infrastructure.

Several oilfields ceased operations following the attacks due to significant infrastructure damage, which also endangered the safety of civilian workers in the energy sector. Gulf Keystone Petroleum, a major crude oil producer, said in a statement, “We have shut production at the Shaikan field—one of the largest oil discoveries in Iraq’s Kurdistan region—due to attacks in the vicinity. As a safety precaution, GKP has temporarily shut in production and taken measures to protect staff. The company’s assets remain unaffected.”

Gulf Keystone holds a production-sharing contract with the Kurdistan Regional Government (KRG) and maintains an 80 percent working interest in the Shaikan license, located approximately 60 kilometres (37 miles) northwest of the regional capital, Erbil. Norwegian oil and gas firm DNO, operator of the Tawke and Peshkabir oilfields in the Zakho area near the Turkish border, also reported a temporary suspension of operations following the explosions. While the blasts caused no injuries, they did result in material damage. According to DNO, three bomb-laden drones targeted its oilfields.

OPEC+ to unwind output

Adding pressure to prices, OPEC+ agreed earlier this month to boost output by 548,000 barrels per day (bpd) in August—marking the fourth consecutive monthly increase and surpassing analysts’ expectations. This move will restore nearly 80 percent of the 2.2 million bpd in voluntary cuts made by eight OPEC+ members. The participating countries—Saudi Arabia, Russia, Iraq, the United Arab Emirates (UAE), Kuwait, Kazakhstan, Algeria, and Oman—met virtually on Saturday to review global market conditions and the near-term outlook.

The coalition decided to raise output by a cumulative 548,000 bpd in August 2025, relative to the required production level for July 2025. OPEC+ output had already risen by 270,000 bpd in June, driven primarily by Saudi Arabia, while Iraq’s underproduction partially offset the overall increase. The latest hike marks the fourth in a series of monthly increases.

The decision was based on a stable global economic outlook and strong market fundamentals, reflected in low oil inventories. It aligns with the agreement reached on December 5, 2024, to begin a gradual and flexible restoration of the 2.2 million bpd in voluntary cuts, starting April 1, 2025.

Outlook

Crude oil prices are likely to remain range-bound with an upward bias in the short term due to temporary supply disruptions. However, OPEC+’s decision to raise output and fully unwind the 2.2 million bpd in voluntary cuts may cap any sudden price surges.

DILIP KUMAR JHA

Editor

dilip.jha@polymerupdate.com