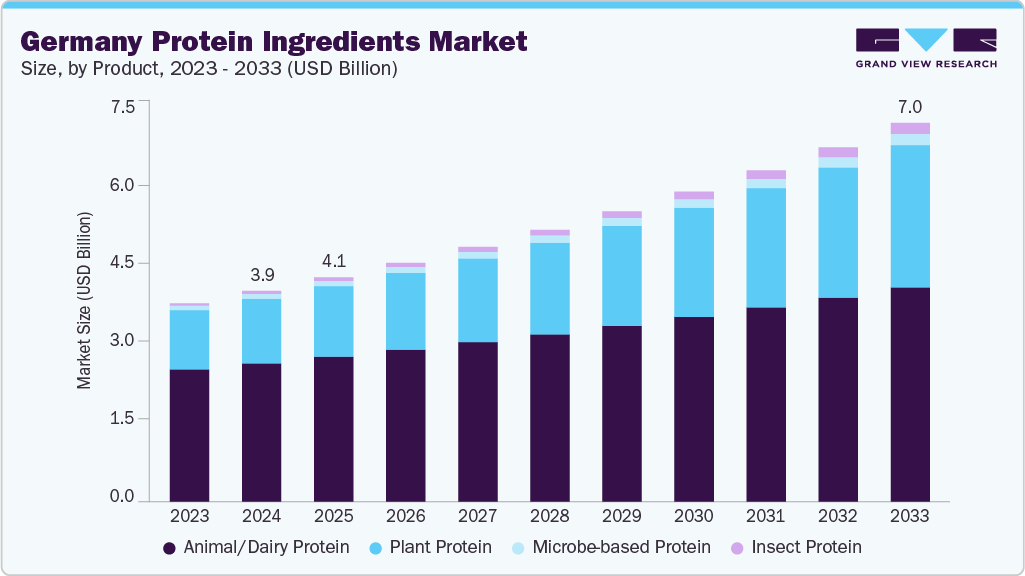

The Germany protein ingredients market size was estimated at USD 3.91 billion in 2024 and is projected to reach USD 7.02 billion by 2033, growing at a CAGR of 11.1% from 2025 to 2033. The growth is driven by rising health consciousness, increased demand for functional foods, and the country’s longstanding preference for high-protein dietary patterns.

Key Market Trends & Insights

By product, the animal/dairy protein segment held the highest market share of 65.7% in 2024.

Based on application, the food & beverages segment held the highest market share in 2024.

Market Size & Forecast

2024 Market Size: USD 3.91 Billion

2033 Projected Market Size: USD 7.02 Billion

CAGR (2025-2033): 11.1%

Manufacturers in Germany’s food and beverage sector increasingly integrate protein ingredients into functional foods and dietary supplements, driven by growing health awareness and consumer demand for high-protein products. This shift is particularly evident among active and aging population in the country seeking improved muscle health and overall wellness. However, a notable challenge lies in the taste profiles of alternative proteins, such as the beany flavor of pea protein or off-notes in soy and fermented proteins, which have prompted significant investment in flavor optimization and formulation refinement. In addition, the market is moving toward more sustainable protein sources like insects and microbes, which offer high nutritional value with a lower environmental impact.

This transition aligns with Germany’s strong focus on sustainability, animal welfare, and reducing the ecological footprint of food production. For instance, recent insights from the Good Food Institute highlight that 41% of Germans report consuming plant-based meat at least once a month, and 25% plan to increase their consumption. Furthermore, 57% of Germans and 82% of those under 25 in the country are willing to purchase cultivated meat, underscoring strong consumer openness to sustainable protein innovations.

Product Insights

On the basis of product, the animal/dairy protein segment dominated the market with a revenue share of 65.7% in 2024. The animal protein ingredient segment encompasses many products, including egg protein, whey protein concentrates and isolates, gelatin, and collagen peptides. This segment is expected to see robust growth, driven by increasing awareness and well-documented scientific evidence supporting the health benefits of these proteins. For example, collagen peptides derived from animal sources have been clinically shown to support joint health and improve skin elasticity, particularly in aging populations. Studies have demonstrated that daily collagen supplementation can reduce joint discomfort and enhance mobility in individuals with osteoarthritis, promoting dermal hydration and reducing wrinkles in middle-aged adults.

Animal protein ingredients are widely recognized for their scientifically validated health benefits and have gained approval from regulatory food authorities. Growing consumer awareness and demand for these benefits drive increased animal-derived protein consumption, contributing significantly to market expansion. For instance, whey protein has the potential to elevate glutathione (GSH) levels, improve immune function, and nutritional status in cancer patients undergoing chemotherapy.

The insect protein segment is projected to experience the fastest CAGR of xx% from 2025 to 2033. The demand for these ingredients has surged in recent years, supported by expert-backed evidence of their health benefits and proactive promotion by manufacturers. For instance, crickets offer approximately 65% protein content, significantly higher than beef’s 50%, along with essential amino acids, unsaturated fatty acids, vitamins, and minerals. Insect farming has emerged as an environmentally sustainable practice, leading to its growing acceptance.

Insect exoskeletons are abundant in chitin, a compound that can be broken down by specific bacteria known to enhance plant resistance against pests and diseases. Insects are highly efficient for farming, producing up to ten times more edible protein per kilogram of feed than conventional livestock. Moreover, the byproducts of insect farming contribute to a circular food system by minimizing waste and promoting sustainable use of resources.

Application Insights

The food & beverage segment held the largest revenue share of the Germany protein ingredients market in 2024 and is expected to grow at the fastest CAGR over the forecast period. In Germany, the food and beverage sector has been witnessing a notable surge in demand for protein-enriched functional products, driven by growing consumer interest in health, wellness, and performance nutrition. German consumers increasingly seek clean-label, high-protein foods supporting muscle health, weight management, and overall well-being. As a result, dairy-based proteins like whey and casein, and emerging plant-based options such as pea, hemp, and fava bean proteins are widely integrated into beverages, snacks, and meal replacements. The popularity of protein-fortified bakery items, yogurts, and ready-to-drink (RTD) shakes is rising, particularly among urban and active lifestyle consumers. Moreover, Germany’s strong tradition of high-quality food production encourages manufacturers to innovate with novel protein sources and sustainable formulations, aligning with the country’s broader goals of health-conscious and environmentally responsible consumption.

In Germany, people are increasingly prioritizing health, wellness, and sustainable food choices, which is significantly shaping purchasing patterns in the country’s food and beverage sector. This cultural shift is expected to drive strong demand for protein-enriched functional foods such as high-protein yogurts, snack bars, and plant-based or eco-friendly protein alternatives. For example, REBBL recently launched its innovative 26 g protein shakes made with upcycled barley protein, a sustainable, ready-to-drink (RTD) beverage solution that aligns with growing consumer preferences. Surging demand is projected to further encourage manufacturers to increase the production of protein-rich foods, supporting health-conscious lifestyles and sustainable sourcing practices.

Animal feed is another prominent application segment and is expected to record the second-fastest CAGR of 10.6% during the forecast period. The animal feed sector in Germany is witnessing a notable shift in protein sourcing due to rising costs and environmental pressure associated with traditional ingredients like soybean meal and fishmeal. As a result, there is a growing preference for alternative protein sources such as insect meal, algae-based proteins, and single-cell proteins, which offer both sustainability and economic advantages. German animal feed manufacturers are increasingly focused on reducing environmental emissions in line with national and EU climate goals, thereby promoting the adoption of eco-friendly protein inputs.

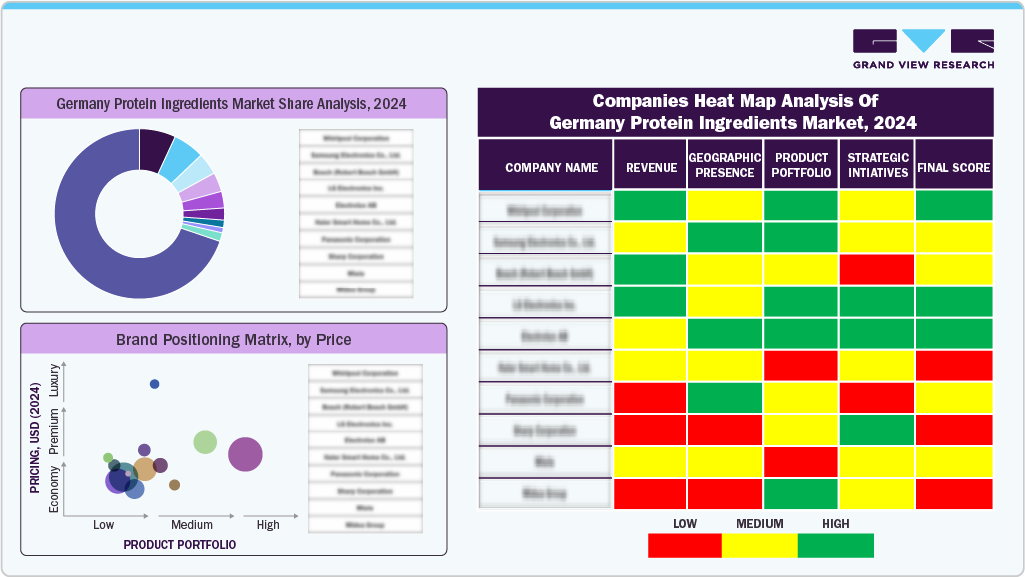

Key Germany Protein Ingredients Company Insights

Some of the key players in the Germany protein ingredients industry include DMK Group, Müller Group, and ADM. These companies prioritize acquisitions, geographic expansion, and increased R&D investments to enhance product quality and strengthen their market position.

DMK Group processes over 5 billion kg of milk annually and offers a wide range of dairy products under brands like MILRAM and Humana. The company is increasingly focusing on high-quality protein ingredients such as whey and casein for use in sports nutrition, infant formula, and functional foods, with a strong emphasis on innovation, sustainability, and strategic collaborations.

Müller Group offers products like yogurt, milk, desserts, and functional beverages. It focuses on high-protein formulations, including Greek-style yogurts and protein-rich drinks, catering to health-conscious consumers. The company also provides private-label manufacturing and innovative dairy solutions for retail and foodservice markets across various international regions.

DMK GROUP

Müller Group

MEGGLE Group GmbH

ADM

BENEO

IGV GmbH

Hans Kupfer & Sohn GmbH & Co. KG

Protix

CropEnergies AG

Recent Developments

In January 2025, ADM partnered with AgriTech company Klim to expand its regenerations program across Germany. The initiative offers financial incentives and agronomic support to farmers adopting regenerative agriculture practices such as conservation tillage, cover cropping, and biodiversity enhancement, which aim to boost soil health, achieve climate resilience, and develop a sustainable food system.

In April 2025, Unternehmensgruppe Theo Müller acquired UK-based Biotiful Gut Health to strengthen its functional dairy portfolio and expand its presence in the UK and European health-focused food market. The move supports Müller’s strategy to meet rising demand for probiotic and protein-rich products.

Germany Protein Ingredients Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.15 billion

Revenue forecast in 2033

USD 7.02 billion

Growth rate

CAGR of 11.1% from 2025 to 2030

Actuals

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application.

Key companies profiled

DMK GROUP, Müller Group, MEGGLE Group GmbH, ADM, BENEO, IGV GmbH, Hans Kupfer & Sohn GmbH & Co. KG, Protix, CropEnergies AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Germany Protein Ingredients Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Germany protein ingredients market report based on product, application:

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 – 2033)

Plant Protein

Cereals

Wheat

Rice

Oats

Oat Protein Concentrate

Oat Protein Isolates

Hydrolyzed Oat Protein

Legumes

Soy

Soy Protein Concentrates

Soy Protein Isolates

Textured Soy Protein

Hydrolyzed Soy Protein

HMEC/HMMA Soy Protein

Pea

Pea Protein Concentrates

Pea Protein Isolates

Textured Pea Protein

Hydrolyzed Pea Protein

HMEC/HMMA Pea Protein

Lupine

Chickpea

Others

Roots

Ancient Grain

Hemp

Quinoa

Sorghum

Amarnath

Chia

Others

Nuts & Seeds Protein

Canola

Almond

Flaxseeds

Others

Animal/ Dairy Protein

Egg Protein

Milk Protein Concentrates/Isolates

Whey Protein Concentrates

Whey Protein Hydrolysates

Whey Protein Isolates

Gelatin

Casein/Caseinates

Collagen Peptides

Microbe-based Protein

Algae

Bacteria

Yeast

Fungi

Insect Protein

Coleoptera

Lepidoptera

Hymenoptera

Orthoptera

Hemiptera

Diptera

Others

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 – 2033)

Food & Beverage

Bakery & Confectionary

Beverages (Non-Dairy Alternatives)

Breakfast Cereals

Dairy Alternatives

Beverages

Cheese

Snacks

Others

Dietary Supplements/Weight Management Others

Snacks (Non-Dairy Alternatives)

Sports Nutrition

Others

Infant Formulations

Clinical Nutrients

Animal Feed

Others