Syllabus: Economy

Source: DD News

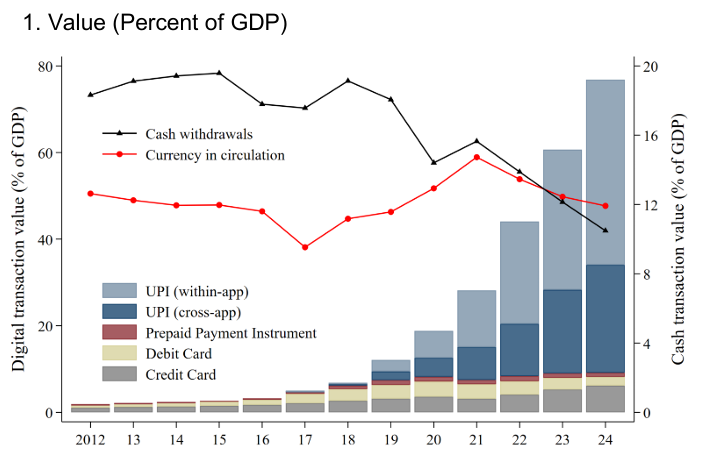

Context: India has become the global leader in real-time payments as UPI processed 18.39 billion transactions in June 2025, according to an IMF-supported report.

About India Becomes Global Leader In Fast Payments – IMF Report:

What the Report is?

Jointly developed by the International Monetary Fund (IMF) and FIS Global, this Fast Payments Report 2025 analyses global public digital infrastructure.

It uses a new metric: Faster Payment Adoption Score (FPAS) to benchmark digital payment adoption.

India’s Achievements:

Top Global Rank (FPAS: 87.5%): India leads 30 countries, surpassing Brazil, Singapore, UK, and USA.

UPI Scale: Processes over 640 million transactions daily, serving 491 million individuals and 65 million merchants via 675 banks.

Speed and Cost: Delivers payments within 5 seconds, with near-zero cost per transaction.

Global Reach: UPI is now operational in 7 countries, including France, UAE, and Singapore.

BRICS Integration: India is advocating UPI as a cross-border payment standard among BRICS+ nations.

Key Features of India’s UPI Ecosystem:

Interoperability: Unified interface across banks and apps like PhonePe, GPay, Paytm.

Inclusiveness: Aadhaar-linked, USSD-enabled, multilingual access—enabling rural digital payments.

Innovation Stack: Built atop India Stack (Aadhaar, eKYC, DigiLocker, Account Aggregator).

Security Protocols: Real-time fraud detection, tokenisation, and regulatory compliance.

Govt–Private Partnership: NPCI + fintech startups + RBI = scalable, resilient digital infrastructure.

Limitations of UPI:

Low Offline Penetration: UPI still requires internet connectivity for most users, limiting adoption in remote or low-bandwidth areas.

Interoperability Gaps Abroad: Despite global expansion, UPI’s cross-border utility is constrained due to lack of uniform regulatory standards and infrastructure in partner countries.

Data Privacy Concerns: The report warns of inadequate user data protection laws, raising concerns about misuse or over-collection of personal financial data.

Fragmented Dispute Resolution: Complaint redressal remains weak and unstandardized across UPI apps and banks, reducing user trust in case of failed or fraudulent transactions.

Overdependence on Mobile-First Access: UPI is not fully accessible to senior citizens, non-digital natives, or those without smartphones, risking digital exclusion.

Way Ahead:

Build Robust Offline Capability: Expand USSD and NFC-based UPI Lite+ to ensure reach in rural, low-connectivity zones.

Global Regulatory Alignment: Collaborate with central banks to harmonize data security, authentication, and settlement systems for UPI’s cross-border use.

Strengthen Legal Frameworks: Introduce a comprehensive Digital Payments Consumer Protection Act to address data misuse and transaction failures.

Inclusive Design Principles: Promote accessibility features (voice-assisted UPI, vernacular UIs) for elderly, disabled, and digitally illiterate populations.

Unified Grievance Redressal Platform: Create a central, AI-assisted resolution portal for UPI complaints, integrated with NPCI and RBI systems.

Conclusion:

UPI’s rise as a global digital payments model showcases India’s innovation in public digital infrastructure. However, bridging accessibility, legal, and global compatibility gaps is crucial to sustaining this success. A future-ready, inclusive, and secure UPI can be a blueprint for the world’s digital economies.