Dublin, July 21, 2025 (GLOBE NEWSWIRE) — The “Europe Mining Steel Industry Market: Focus on End-User Application, Production Methodology, End Products, and Country – Analysis and Forecast, 2025-2035” report has been added to ResearchAndMarkets.com’s offering.

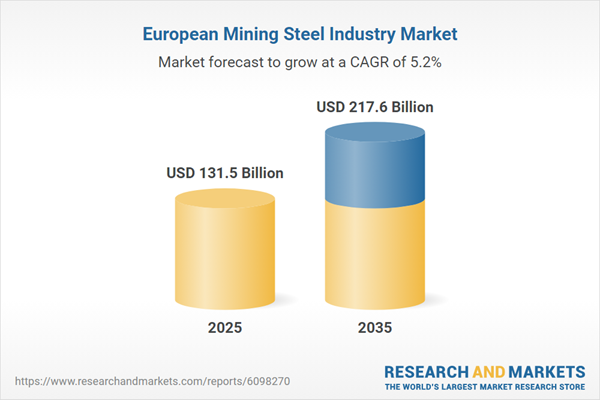

The Europe mining steel industry market was valued at $124.2 billion in 2024 and is projected to grow at a CAGR of 5.17%, reaching $217.6 billion by 2035.

The steel market in Europe is expanding steadily due to increased demand from important industries like infrastructure, automotive, and construction. The region’s drive for greener manufacturing – which includes a greater use of electric arc furnaces (EAF), direct reduced iron (DRI) technology, and the incorporation of renewable energy sources – supports this trend.

In order to support these developments, Europe is seeing an increase in investment in supply networks for raw materials, such as coking coal and iron ore, as well as breakthroughs in steel production techniques. Europe is well-positioned to solidify its place in the global mining and steel scene in the upcoming years as the industry quickens its shift to low-carbon and energy-efficient steelmaking.

Market Introduction

The mining and steel sector in Europe is essential to the growth of the region’s infrastructure, industrial base, and shift to a low-carbon economy. The European steel market continues to be a vital component of economic activity, driven by demand from important industries like machinery, building, energy, and automobiles. Despite the region’s continued reliance on imports, the mining sector guarantees a steady supply of vital raw materials including iron ore, coking coal, and key minerals.

Climate goals and environmental rules are driving a substantial transition in the business. Electric arc furnaces (EAF), hydrogen-based direct reduced iron (DRI), and circular economy techniques like steel recycling are among the sustainable production techniques that European steelmakers are progressively implementing. These initiatives are in line with EU policy frameworks that aim to improve industrial resilience and reduce carbon emissions, such as the Fit for 55 package and the Green Deal.

Automation, digitisation, and technological innovation are all contributing to increased productivity and competitiveness throughout the value chain. High energy costs, pressures from international trade, and regulatory compliance are some of the difficulties the business faces, though. Notwithstanding these obstacles, the mining and steel sector in Europe is poised for sustained expansion, bolstered by smart investments, legislative backing, and the growing need for sustainable materials.

How can this report add value to an organization?

Product/Innovation Strategy: The Europe mining steel industry market is segmented based on various applications, production methodology, and end-products, which provides valuable insights. By end-use application segment includes transportation (automotive and other transportation), building, construction, and infrastructure, consumer goods and appliances, industrial equipment and manufacturing, packaging, and others. By production methodology, the market is categorized into a blast furnace-basic oxygen furnace (BF-BOF), direct reduced iron-electric arc furnace (DRI-EAF), and other emerging technologies. Lastly, the end products include carbon steel, alloy steel, stainless steel, high-strength steel, and others.

Growth/Marketing Strategy: The Europe mining steel industry market has been growing. The market offers enormous opportunities for existing and emerging market players. Some of the strategies covered in this segment are mergers and acquisitions, product launches, partnerships and collaborations, business expansions, and investments. The strategies preferred by companies to maintain and strengthen their market position primarily include product development.

Competitive Strategy: The key players in the Europe mining steel industry market analyzed and profiled in the study include professionals with expertise in the mining and steel industry. Additionally, a comprehensive competitive landscape such as partnerships, agreements, and collaborations are expected to aid the reader in understanding the untapped revenue pockets in the market.

Europe Mining Steel Industry Market Trends, Drivers and Challenges

Trends

Shift toward low-carbon steel production using EAFs and hydrogen-based DRIIncreasing use of recycled steel and circular economy practicesAdoption of digital technologies like AI, automation, and IoT in mining and steel plantsGrowth in demand from construction, automotive, and renewable energy sectorsStrategic partnerships and joint ventures for raw material securityRising investment in domestic mining to reduce reliance on imports

Drivers

EU Green Deal and Fit for 55 initiative pushing for decarbonizationStrong demand for high-quality, sustainably produced steelGovernment incentives and funding for green steel technologiesGrowing infrastructure development and renewable energy installationsExpansion of electric vehicle production boosting advanced steel demandFocus on resource efficiency and energy optimization in manufacturing

Challenges

High energy and operational costs compared to global competitorsRegulatory complexities around environmental and carbon complianceDependency on imported raw materials like iron ore and coking coalTrade pressures due to global steel overcapacity and tariffsNeed for large-scale investment in clean production technologiesWorkforce upskilling required to adapt to digital transformation

Market Segmentation

End-Use Application

Transportation (Automotive and Other Transportation)Building, Construction, and InfrastructureConsumer Goods and AppliancesIndustrial Equipment and ManufacturingPackagingOthers

Production Methodology

Blast Furnace-Basic Oxygen Furnace (BF-BOF)Direct Reduced Iron – Electric Arc Furnace (DRI-EAF)Other Emerging Technologies

End Products

Carbon SteelAlloy SteelStainless SteelHigh-Strength SteelOthers

Region

Europe: Germany, France, Austria, Italy, U.K., and Rest-of-Europe

Key Market Players and Competition Synopsis

ArcelorMittalthyssenkrupp AGSalzgitter AG

Key Attributes:

Report AttributeDetailsNo. of Pages123Forecast Period2025 – 2035Estimated Market Value (USD) in 2025$131.5 BillionForecasted Market Value (USD) by 2035$217.6 BillionCompound Annual Growth Rate5.1%Regions CoveredEurope

Key Topics Covered:

1 Markets

1.1 Trends: Current and Future Impact Assessment

1.1.1 Automation in Mining and Steel Production Processes

1.1.2 Increased Demand from Emerging Markets

1.2 Supply Chain Overview

1.2.1 Value Chain Analysis

1.2.1.1 Key Iron Ore Producing Nations and Mining Capacity

1.2.1.2 Key Coking Coal Exporting Nations

1.2.2 Supply Chain Constraints

1.2.3 Pricing Analysis

1.2.4 Market Map (Stakeholder Mapping across Value Chain)

1.3 Patent Filing Trend (by Country, Company)

1.4 Market Dynamics Overview

1.4.1 Market Drivers

1.4.1.1 Urbanization and Infrastructure Growth

1.4.1.2 Public-Private Investments in Infrastructure

1.4.2 Market Restraints

1.4.2.1 Volatility in Raw Material Prices

1.4.2.2 Geopolitical and Trade Tensions

1.4.3 Market Opportunities

1.4.3.1 Growing Demand for Specialty Steel Products

1.4.3.2 Technological Innovation in Steelmaking

1.5 Steel Production Scenario

1.5.1 Production Capacity Outlook (2024-2034)

1.5.2 Regulatory Landscape

1.5.3 Stakeholder Analysis

1.5.4 Installed Capacity by Production Process (Blast Furnace-BOF and DRI-EAF)

1.5.5 Upcoming Projects and Capacity Additions (2025-2035)

1.5.6 Ongoing Investments

1.5.7 Scrap Recycling Market Overview

1.5.8 Emission Reduction Initiatives (Mining Steel Industry Transition)

1.6 Green-Steel Market Outlook

1.6.1 Market Size and Growth Forecast (2024-2034)

1.6.2 Impact of Green Steel on Conventional Steel Market

1.6.3 Challenges and Enablers for Green-Steel Adoption

1.6.4 Key Green-Steel Projects and Initiatives

2 Regions

2.1 Regional Summary

2.2 Europe

2.2.1 Markets

2.2.1.1 Key Market Participants in Europe

2.2.1.2 Driving Factors for Market Growth

2.2.1.3 Factors Challenging the Market

2.2.2 Application

2.2.3 Product

2.2.4 Mining-Steel Industry Production Scenario

2.2.5 Europe (by Country)

2.2.5.1 Germany

2.2.5.1.1 Application

2.2.5.1.2 Product

2.2.5.1.3 Installed Capacity and Production by Process

2.2.5.1.3.1 Upcoming Projects

2.2.5.1.3.2 Ongoing Investments

2.2.5.1.3.3 Scrap Recycling Overview

2.2.5.1.4 Raw Material Analysis (Iron Ore, Coking Coal, Scrap)

2.2.5.1.4.1 Consumption by Key Companies

2.2.5.1.4.2 Import Locations/Countries

2.2.5.2 France

2.2.5.3 Austria

2.2.5.4 Italy

2.2.5.5 U.K.

2.2.5.6 Rest-of-Europe

3 Markets – Competitive Benchmarking and Company Profiles

3.1 Next Frontiers

3.2 Geographic Assessment

3.3 Company Profiles

3.3.1 Overview

3.3.2 Top Products/Product Portfolio

3.3.3 Top Competitors

3.3.4 End-Use Industry

3.3.5 Key Personnel

3.3.6 Analyst View

3.3.7 Market Share, 2023

4 Research Methodology

For more information about this report visit https://www.researchandmarkets.com/r/nbztii

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

European Mining Steel Industry Market