Will Trump’s trade war finally start affecting US inflation? • FRANCE 24 English

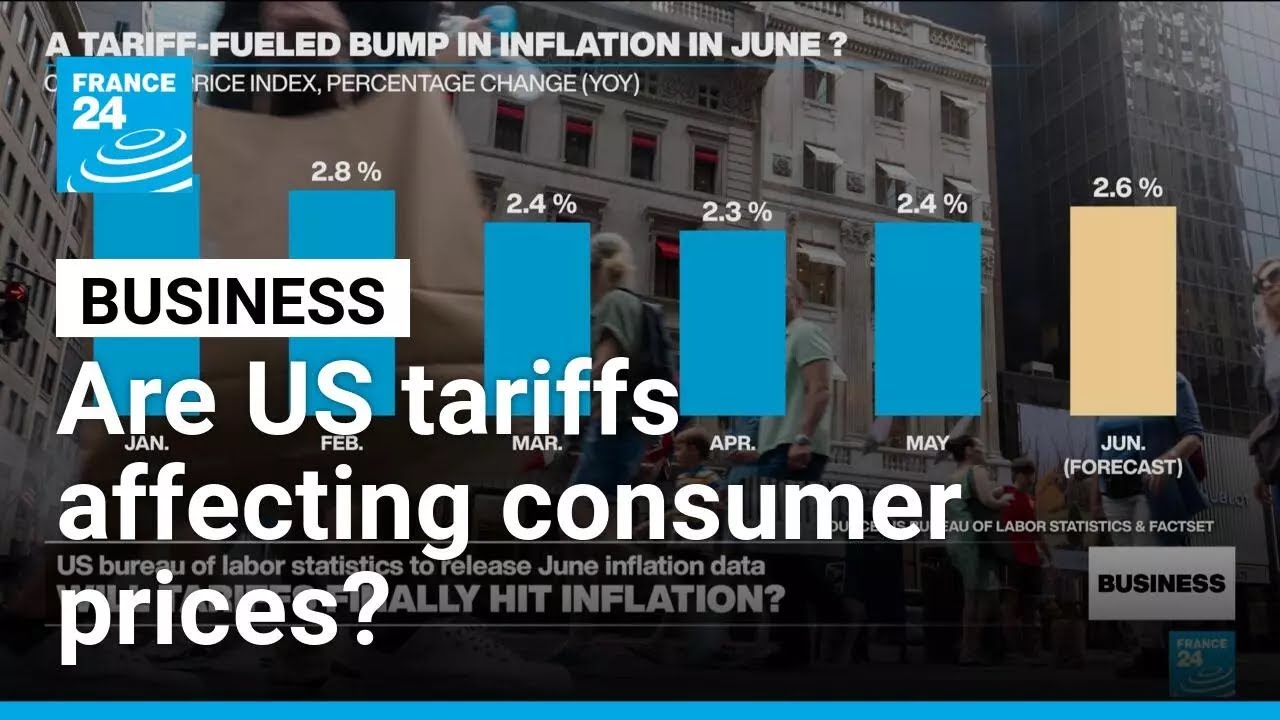

Well, it’s time for our business segment now with Charles Pelagan. Charles, you’re focusing on the US economy. That’s right, Caris. Later this Tuesday, the US Department of Labor Statistics is expected to release its June inflation data, the Consumer Price Index. This is a gauge that is followed extremely closely, especially in the current context of Donald Trump’s global trade war. Uh the consensus thinking on tariffs is that they eventually fuel a rise in prices as importers tend to reflect the higher costs of bringing in goods from abroad onto their consumers. But inflation data has been cooler than expected since Donald Trump took office in January. As you can see there, hovering around the 2.3 or 2.4% mark since March, just above the Federal Reserve’s target of 2%. But forecasts for the month of June in yellow there are signaling a slight uptick to 2.6% 6% as tariffs start having an impact on a range of consumer goods like electronics or appliances. So, what’s at stake here? Well, the US president’s word. Donald Trump’s ran a campaign promising he’d put an end to inflation for US consumers. Earlier, I spoke to Nella Richardson and asked her for her take on inflation in the US. Well, inflation has been very sticky in the United States. there’s been a tremendous progress in declining the pace of higher prices, but the but it has been sticky for several months mainly because of services. So here’s the question when it comes to new tariff policy at least in the short term. Will we start to see a rise not only in the service inflation that we’ve become accustomed to in the United States but also in goods inflation? And remember that imported goods, it’s not just about the final consumer goods that you’ll see in the CPI. It’s also the intermediate goods that show up in the production process. So, we won’t get a read on that right away. That’s probably a longer term uh trend and impact in inflation over time. Why haven’t hasn’t that uh tariff policy showed up yet on the readings so far? What have importing companies done to delay that impact? Well, we saw uh early on both for consumers and producers some pull forward spending. So, uh inventories swelled at the beginning of the year. Even consumers uh went ahead and bought goods that they thought would be subject to tariffs. So, you know, the the question here for economists is whether uh tariffs, which is a tax on imported goods, is a one-time hit to inflation or if it triggers escalating inflation. And you can see that even in within the profession, there’s a split um association of whether tariffs will have a short-term impact or a longer term impact over time. I think as the trade and global trade system adjusts to new policies that frankly haven’t yet been set, we’ll have more information on the direction of travel. But for right now, in the short term, it’s likely that inflation increases a bit. All right, Charles, take us through what’s happening on the markets then. Well, equities in the Asia-Pacific mostly rising this Tuesday after China’s GDP grew higher than expected in the second quarter at 5.2% 2% though weaker than in the first quarter 5.4%. Good news with regards to concerns over the trade war with the US and the country’s issues with low consumer demand and a real estate uh crisis. You can see the Hansen and Hong Kong up 3/4 of a percent. And in Europe at the open uh we’re seeing positive trading in equities as well boosted by those China GDP numbers and also shrugging off Trump’s new tariff threat of 30% uh against the EU. That’s a deadline for August 1st, obviously. And here in France, Charles, we’re about to know more about France’s French government plans to cut its deficit. Prime Minister Fran, who we expected to outline his plans in a speech this afternoon. The goal here to find 40 billion euros in savings in order to slash the deficit and cat tackle the country’s growing debt. He’ll also have to contend with a fractured parliament. One of the solutions being considered is that of an anlounge or a spending freeze. So keeping spending at the same level as this year in 2026. So not taking into account inflation. This could have an outsized impact on pensioners. As Simon Muritz and our colleagues at France do explain. Who will lose out if the French government chooses a spending freeze that would match 2026 public spending to 2025. The measure, which could save money by budgeting without taking inflation into account, would see pensioners lose an average of €350 a year, according to a study, an unacceptable amount for this retired restaurant worker whose pension is €1,600 a month. After a 44-year career, which is long in a difficult profession, we’re told that at the end of the day, you will earn less and receive less. This is annoying, and above all, it means a loss of purchasing power. bill and housing benefits. According to the French Economic Observatory or OFCE, if one partner in a couple receives housing benefits and the other is employed, the household income would reduce by €15 on average. Amelia Kger has just found a job near Strawburg and is still receiving benefits for lowincome workers. They’re playing with the money of people who need benefits, the people who need it most. Why freeze benefits for those who truly need it. Taking the current income tax scale into account, the savings made during the freeze for the next budget would come to 6.2 billion in total. But this could also have a negative impact on the economy. If you go through with a year-long spending freeze with 6 billion in savings, that’s 6 billion less for households. It means higher taxes, fewer benefits, and less income and therefore less consumer spending. Overall, the proposal has received harsh criticism in the assembly national from across the political spectrum from national rally to Republicans and also France unbounded. Prime Minister France BU will unveil his proposal on July 15th and we will have more on Frana’s announcements later in the day. Thank you, Charles.

The US Bureau of Labor of Statistics will be releasing its June inflation data this Tuesday, with economists forecasting a slight uptick in consumer prices because of the impact of tariffs. FRANCE 24 spoke to Nela Richardson, Chief Economist at ADP, about the impact of import duties on US inflation. Also in this edition: the French government considers a spending freeze in a bid to find €40 billion in savings and cut the deficit.

##inflation ##tariffs ##USA

Read more about this story in our article: https://f24.my/BJaU.y

🔔 Subscribe to France 24 now: https://f24.my/YTen

🔴 LIVE – Watch FRANCE 24 English 24/7 here: https://f24.my/YTliveEN

🌍 Read the latest International News and Top Stories: https://www.france24.com/en/

Like us on Facebook: https://f24.my/FBen

Follow us on X: https://f24.my/Xen

Bluesky: https://f24.my/BSen and Threads: https://f24.my/THen

Browse the news in pictures on Instagram: https://f24.my/IGen

Discover our TikTok videos: https://f24.my/TKen

Get the latest top stories on Telegram: https://f24.my/TGen

19 comments

It started long time ago, the European Central Bank pushed inflation too that’s why they didn’t notice

I'm a US Expat. I've been living in France for 9 years. I don't buy anything made in the US, period. Everything I buy in France comes from my local marché or stores. My children who still live in the US, say prices have gone up about 10% since Trump started his tariff shenanigans.

Its too early to gauge the effect of tariffs because they have not been fully implemented .And who knows what the situation is like when Trump changes his mind again in 6 months time.

Not sure this Lady actually says anything substantial.

make French senators and other public elected officials responsible for balancing the economy or face personal finacial responsibility ….trust me…. budgets would always be balanced.

All these government index’s are handled by Trump’s goon squads. Trump will never allow the real inflation figures be released.

Yes. But not like that. Late June, July is where we will to see the effect, but it will not become a problem until that Supply runs out or at least low, then the new stock (which will be limited) is also with a 10% Tariffs so the prices will go up more than if it were just a shipping disruption. But then there are no deals, and the Tariffs are going up to 30%, 45%, so by October America will look like a flaming bag of dogshit. From US. 😀

2% a month increase? that is 24% inflation a year aint it?

Yes, of course it will, tariffs are nuts

I'm a U.S. expat living in France for the last 4 years. My cost of living has increased about 10%, not from rising prices in France (there has been some), but from the collapse of the U.S. dollar vs. the euro, thanks to Trump's economic "policy". The exchange rate has changed from around $1.06 to 1 € to $1.17 to 1 € today. All of my income is pension checks auto-deposited in my U.S. bank. I transfer that money to my U.S. dollar account in my French bank. When I need to top off my euro account, I do an internal transfer between my accounts. Ever euro I spend is now buying 10% less than it used to.

Things are getting much more expensive and this is just the beginning! I'm worried.

49 days left for Europeans to stop buying Russian energy and food or else they will have 100% secondary sanctions imposed. That’s what devious cheaters get for financing the war Russia started in Ukraine.

Reciprocal tariffs and the declining U.S. dollar will be the double whammy for American consumers.

Tariffs are a tax on the American people.

The expectation in the US is that tariffs will hit by the end of the year.

If all nations unite, it's not about inflation, it's shortage and will cause chaoes.😂

No, there's no merchandize available and affordable that will help to calm down the inflation.🤔🤣🤣🤣

It already has.

For Rupees 84 you can fill your tummy in India but at America you can't get a full meal even at roadside at less than 5 Dollars

The majority of 27 trillion American economy is standing on their domestic consumption. Now imagine the prices of daily use items which generates that level of economy.

May God save the common citizen of America from the expected inflation invited by the Self Declared Greatest Lord of the earth Trump

Comments are closed.