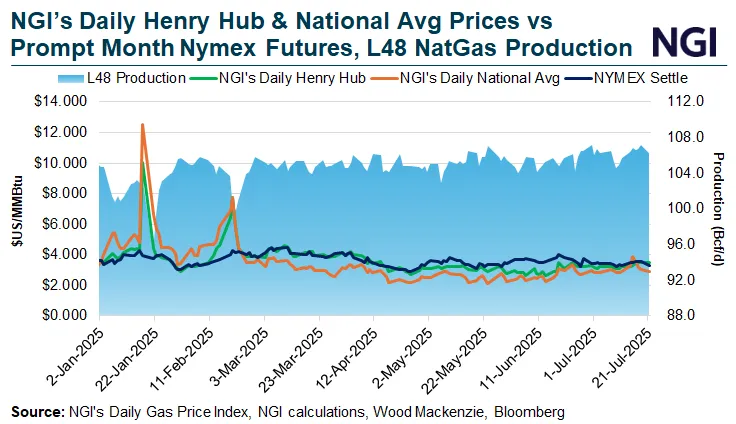

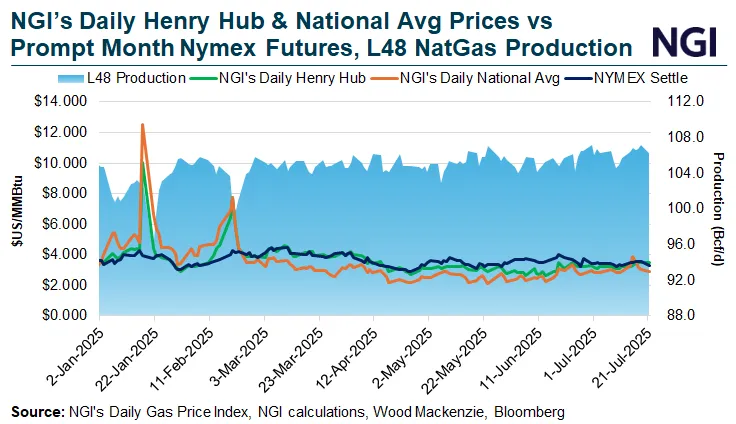

Henry Hub gains offered some support to natural gas futures, but technical charts suggest the path of least resistance remains lower, with the prompt-month contract approaching, yet still not in oversold territory.

Expand

August New York Mercantile Exchange natural gas futures settled sharply lower Monday at $3.325, giving back much of the prior week’s 25.1-cent advance.

Henry Hub spot prices which gained in seven consecutive sessions offered some support last week, said NGI’s Patrick Rau, senior vice president of research and analysis. Rau noted that NGI’s Henry Hub index climbed to $3.505 on Friday from $3.080 on July 10.