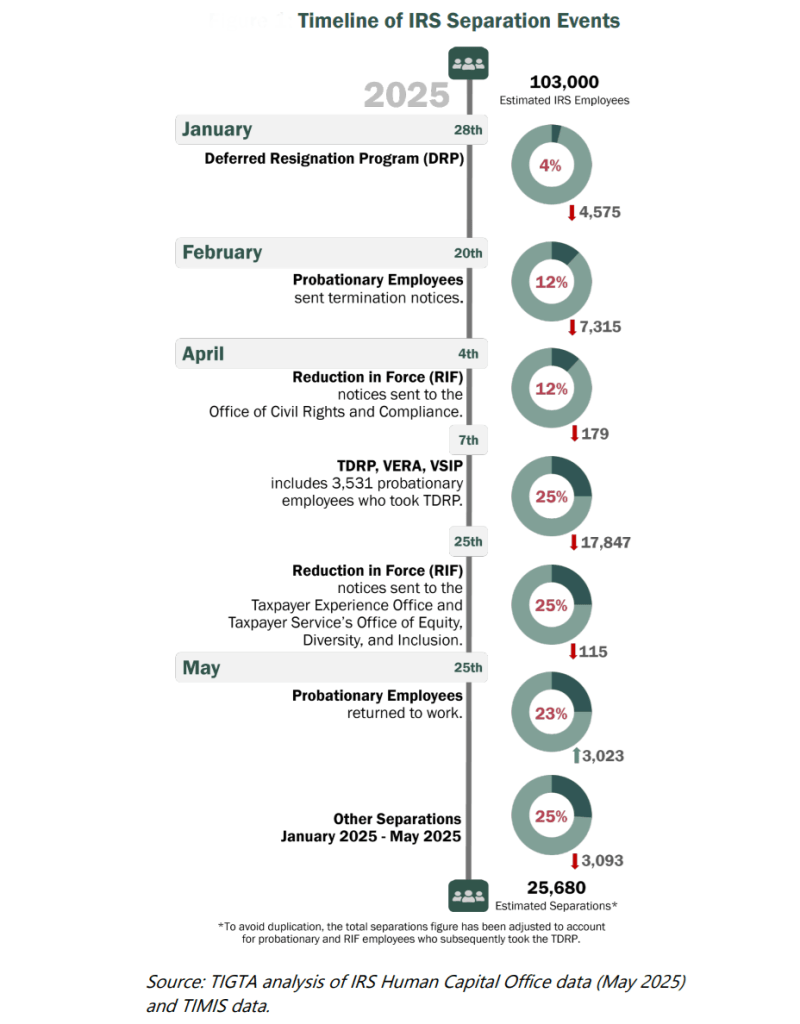

The IRS workforce has been slashed from approximately 103,000 employees in January when Donald Trump began his second term as president to 77,428 in May, a 25% reduction, with some of the biggest job cuts among tax examiners and revenue agents, according to a new report from the Treasury Inspector General for Tax Administration.

According to IRS records, 25,386 employees separated, took a deferred resignation program (DRP) offer from the Trump administration, or used some other incentive to leave, TIGTA said. Another 294 employees were sent termination notices as part of a reduction in force.

“These departures represent 25 percent of the IRS’s workforce and impact certain business units more than others,” TIGTA said in its report.

The report shows that 27% of tax examiners, responsible for reviewing and processing federal tax returns to ensure compliance and accuracy, and 26% of revenue agents, who conduct audits by reviewing financial records of individuals and businesses to verify what is reported, have separated from the IRS.

As part of the Trump administration’s efforts to reduce the size of the federal government’s workforce, the administration in January offered a DRP, which allowed federal employees to resign with pay through Sept. 30, 2025, or later, if the employee’s retirement date was between Oct. 1 and Dec. 31, 2025. The IRS also offered Voluntary Early Retirement Authority (VERA) and Voluntary Separation Incentive Payment (VSIP) to encourage employees to leave federal service. As of May, a total of 4,575 employees were approved for the DRP and are currently on administrative leave with pay and benefits until their separation.

Then in April, the IRS partnered with the Treasury Department to offer a second and final DRP to its employees. This iteration mirrors January’s DRP, including paid leave and benefits, with a separation date of no later than Sept. 30, 2025. According to the IRS, some employees who assist with filing season, including taxpayer services and contact representatives in collection, couldn’t be placed on administrative leave until June 30, 2025.

Along with the second DRP, also called the TDRP, the IRS offered VERA, which temporarily lowers the age and service requirements in order to increase the number of federal employees who’re eligible for retirement during periods of substantial restructuring, reshaping, downsizing, or reorganization. Management uses it to incentivize employees to separate in order to avoid or lessen the impact of involuntary reductions. Employees taking the VERA must separate under the TDRP.

As of May, there were 23,409 employees who requested the TDRP offer, and 17,071 were approved, according to TIGTA. An additional 776 employees were approved for the VSIP for a total of 17,847.

The VSIP, also known as a “buyout,” allows federal agencies that are downsizing or restructuring to offer employees lump-sum payments up to $25,000 (or the employee’s severance pay amount, whichever is less) as an incentive to retire or resign.

TIGTA also identified an additional 3,093 employees classified as “other separations” (resignations, retirements, terminations, etc.) since January.

In April, the IRS began implementing a RIF that resulted in involuntary staffing cuts across multiple offices and job categories. As of May, 294 employees received RIF notices. The RIF notices were sent to employees in three offices:

Office of Civil Rights and Compliance: 179 employees.

Taxpayer Experience Office:106 employees.

Taxpayer Service’s Office of Equity, Diversity, and Inclusion: 9 employees.

In addition, according to the IRS, in March, 48 senior IT employees were placed on administrative leave. Of the 48 employees, 26 took the Treasury incentive offerings, while 22 remain on administrative leave.

According to TIGTA, the top six IRS business units impacted by the separations include:

Taxpayer Services: TS helps taxpayers understand and comply with the tax laws. (8,604 separations; 20% of unit)

Human Capital Office: HCO supports IRS employees with human resources topics. (827 separations; 28% of unit)

Information Technology: IT supports IRS employees by delivering IT services and solutions. (2,163 separations; 25% of unit)

Large Business and International: LB&I helps corporations and partnerships with assets of more than $10 million to comply with tax laws, including emerging international issues. (1,331 separations; 19% of unit)

Small Business/Self Employed: SB/SE helps small business and self-employed taxpayers understand and meet their tax obligations. (8,669 separations; 35% of unit)

Tax Exempt & Government Entities: TE/GE helps taxpayers with pension plans, exempt organizations, and government entities to comply with the tax laws. (569 separations; 25% of unit)

The top six positions, or job series, impacted by the separations include:

Management and program analysts: 28% (1,397 separations)

Tax examiners: 27% (4,180 separations)

Revenue agents: 26% (3,070 separations)

Contact representatives: 23% (5,931 separations)

IT management: 23% (1,853 separations)

Miscellaneous clerks and assistants: 22% (1,617 separations)

“These separations will have nationwide implications,” TIGTA said. “Every state, Washington D.C., Puerto Rico, and the Virgin Islands have employees who will separate from the IRS. California, Georgia, New York, Texas, and Utah have the highest numbers of anticipated employee separations. Delaware, Idaho, Iowa, Maine, and Mississippi have the highest percentage of anticipated employee separations compared to the IRS workforce in those states.”

And remember those 7,315 IRS probationary employees who were given the boot by the Trump administration in February but court rulings allowed them to return to work in May? According to TIGTA, 3,023 returned to full-time work status, 3,531 took the second DRP offer, and 752 resigned.

TIGTA said it plans to issue a separate report on the actions taken by the IRS to terminate its probationary employees.

Subscribe for free to get personalized daily content, newsletters, continuing education, podcasts, whitepapers and more…

Subscribe

Already registered? Log In

Need more information? Read the FAQs