The Bank of England’s (BoE) Monetary Policy Committee (MPC) is set to convene on August 7th for what promises to be a pivotal meeting. While market consensus leans towards a 25 basis point rate cut, bringing the base rate down to 4.00% from its current level of 4.25%, a recent surge in inflation has thrown a considerable wrench into the works, rendering the outcome far from certain.

The expectation of a rate cut was initially fueled by signs of economic softening, including slower GDP growth and a cooling labor market.

These indicators aligned with the BoE’s previously stated intention to adopt a “gradual and data-dependent” approach to easing monetary policy.

However, June’s inflation reading, which climbed to a surprising 3.6% year-over-year, significantly above the BoE’s 2% target, has dramatically altered the landscape.

This unexpected inflation spike, driven by increases in petrol prices, airfares, rail tickets, and robust food and clothing costs, has fueled speculation that the BoE may need to maintain its current hawkish stance.

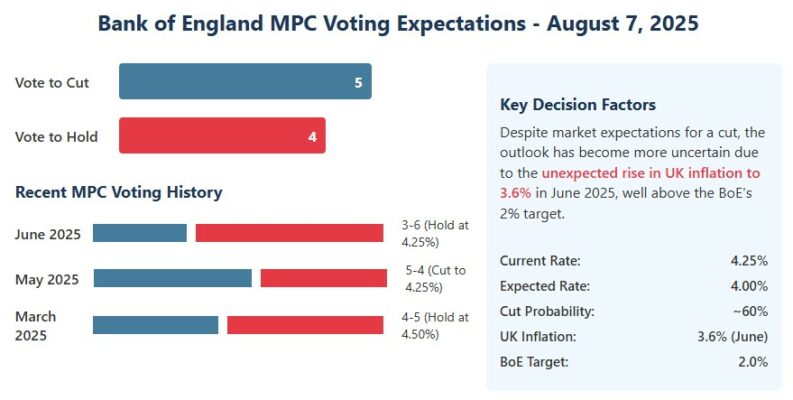

Currently, market odds suggest a roughly 60% probability of a rate cut by September, with traders still pricing in two 25bp cuts by the end of the year, anticipated in August and November.

However, these expectations are increasingly fragile, contingent on upcoming economic data releases and any forward guidance offered by MPC members in the days leading up to the meeting.

The MPC itself is expected to be deeply divided.

Recent voting patterns reveal a committee grappling with the conflicting pressures of inflation and economic slowdown. In the June meeting, the decision to hold the Bank Rate at 4.25% was reached by a narrow 6-3 vote, highlighting the internal debate surrounding the appropriate course of action.

MPC member Catherine Mann has publicly voiced concerns about persistent inflationary pressures, emphasizing the need for careful interest rate management to achieve the BoE’s 2% target. Her hawkish stance underscores the potential for a similar, or even more divided, vote at the upcoming meeting.

A 5-4 or 6-3 split in favour of a cut remains plausible, but a surprise shift towards a hold is equally conceivable, particularly if upcoming data releases further stoke inflation fears.

The implications of the BoE’s decision extend far beyond the immediate impact on borrowing costs. A rate cut would likely provide a boost to rate-sensitive sectors such as real estate and financial services, potentially easing pressure on mortgage rates and stimulating economic activity.

Ultimately, the BoE’s decision will hinge on a delicate balancing act between controlling inflation and supporting economic growth. The recent rise in inflation has complicated this task, leaving the MPC with a difficult choice.

Discover our top-recommended brokers for trading or investing in financial markets. Dive in and test their capabilities with complimentary demo accounts today!

YOUR CAPITAL IS AT RISK. 76% OF RETAIL CFD ACCOUNTS LOSE MONEY

Learn Stock Trading

Latest News