Quick overview

Thursday saw the British pound hold firm against the US dollar, trading near 1.3569 after a big bounce from last week’s 1.3367 low. This despite renewed concerns over UK public finances and a dovish shift in expectations for the Bank of England (BoE).

The UK government’s borrowing figures released Tuesday showed a worrying rise – the second highest June reading since 1993 – driven by high interest costs due to inflation. And talk of tax hikes in the Autumn Statement is back on the table.

But the Pound shrugged it off. Much of the bad news is priced in and markets are waiting for a 25 basis point BoE rate cut in August. Big players like Goldman Sachs and Bank of America are now expecting easing but sentiment is surprisingly steady as the UK economy shows signs of life.

GBP Data Mixed

This morning’s flash PMI figures from the UK showed a slight divergence in sector performance. Services PMI was steady at 52.8, Manufacturing PMI dipped to 47.9, still in contraction. Higher social security costs may be weighing on employment but the steady services reading supported confidence.

Now attention is turning to Friday’s BoE commentary and growth figures. Will the BoE be more dovish or pause, especially with fiscal strain and soft demand?

GBP/USD Hits Technical Barrier at 1.3588

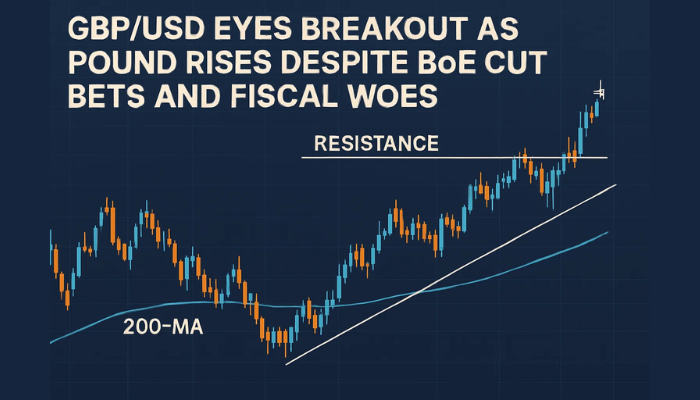

From a technical view, GBP/USD has risen 200 pips from the July lows and is now testing the descending trendline resistance from the June high. The pair is trading just below 1.3588, a level that is both horizontal and dynamic resistance.

GBP/USD Price Chart – Source: Tradingview

GBP/USD Price Chart – Source: Tradingview

50-SMA on the 4H chart at 1.3459 is strong support

RSI is 68.90, overbought

Price has made higher lows, bullish

If bulls can break above 1.3588-1.3600, the next level of resistance is 1.3670 then 1.3722. But if price stalls and prints bearish candles near the trendline, a pullback to 1.3523 or 1.3459 could happen before the next leg up.

Summary

GBP/USD is at the wire, technical and dollar driven. US PMIs and new home sales out today, be ready for action.

Related Articles