FX168 Finance News (Asia-Pacific) – On Wednesday (July 30), Bitcoin’s price remained stable in the Asian market, oscillating around $118,000, awaiting further direction ahead of the key Federal Reserve interest rate decision.

After a weekend rebound, Bitcoin pulled back by 2%, remaining within a narrow range of $117,000 to $119,000 for two consecutive weeks. Meanwhile, Ethereum benefited from over $50 billion in ETF inflows and active derivatives trading, approaching the $4,000 mark. Market sentiment for XRP has also improved, with investors hoping for greater regulatory clarity.

Bitcoin is currently trading near $118,100, and despite a minor rebound, the overall momentum remains weak. Continuous ETF outflows, profit-taking by large players around $118,000, and macro factors such as a strong U.S. dollar and hawkish expectations from the Federal Reserve are all constraining Bitcoin’s upward potential.

Market Indicators Overview:

Market Indicators Overview:

The latest Bitcoin quote is $118,094, down 1.21% for the week. According to Coinmarketcap data, the intraday trading range is between $117,441.44 and $119,273.87.

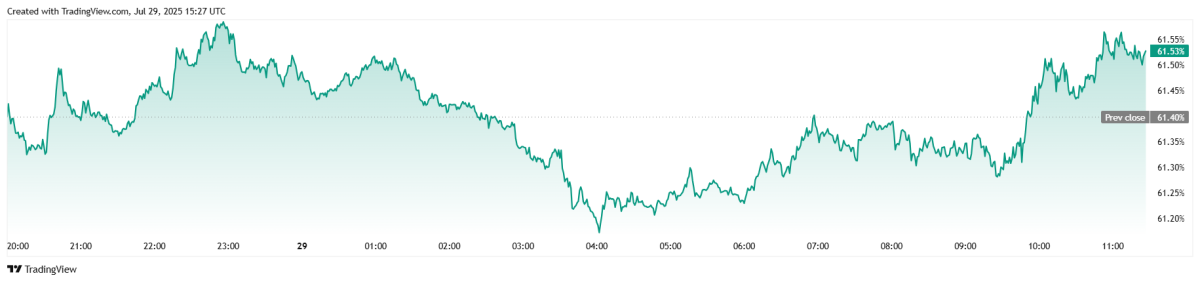

Bitcoin’s trading volume over the past 24 hours increased by 4.26%, reaching $66.58 billion, but the total market capitalization decreased by 0.59% to $2.34 trillion. The proportion of Bitcoin’s market capitalization in the total cryptocurrency market (BTC Dominance) slightly rose by 0.22% to 61.53%.

(Source: tradingview)

According to Coinglass data, Bitcoin Futures open interest decreased by 2.55% in 24 hours, falling to $83.6 billion. The total amount of Bitcoin liquidations over 24 hours was $3.56 million, at a relatively low level. Among these, the amount of long positions liquidated was $3.38 million, while short positions liquidated amounted to only $175,840.

As of now, Bitcoin has maintained a trading range between $115,000 and $119,900 for 11 consecutive days. Vtrader founder Steve Gregory told Decrypt: ‘Despite the recent low volatility, I still believe the price will continue to rise. I expect the next wave of increases to push Bitcoin to $139,000.’

Ethereum Becomes Market Focus

With Bitcoin’s sideways movement, many mainstream altcoins that had been following its upward trend have seen their momentum slow down, leading to an overall market fatigue.

Ethereum is currently the center of market attention. Its total open interest has reached $71 billion, significantly higher than Bitcoin’s $37 billion, and it also ranks first in global perpetual contract 24-hour trading volume.

Ethereum is currently trading above $3,700. Bizantine Capital partner March Zheng noted in a statement to CoinDesk: ‘Since its inception, Ethereum, like Bitcoin, has withstood the test of time. Today, ETH is likely seen by institutions as a strong asymmetric investment opportunity after Bitcoin.’

GAIA COO and co-founder Shashank Sripada stated: ‘Structurally, Ethereum’s trend is very healthy.’ However, he also pointed out that, aside from ETF inflows, Ethereum lacks short-term catalysts.

Sripada believes: ‘This technical structure is different. If Ethereum can break through $4,000 with volume, the next target could be $4,500–$4,800.’

According to SoSoValue data, the U.S. spot Ethereum ETF has seen a net inflow for 16 consecutive days, with the total amount exceeding $50 billion. Previously, multiple analysts told Decrypt that they expected Ethereum to reach new highs within the next 6 to 12 months.

Gregory is also bullish on Ethereum, noting that most of the gains have occurred over the past six weeks and predicting that it will rise rapidly and strongly in the coming weeks, reaching a new all-time high.

The Federal Reserve Decision Approaches

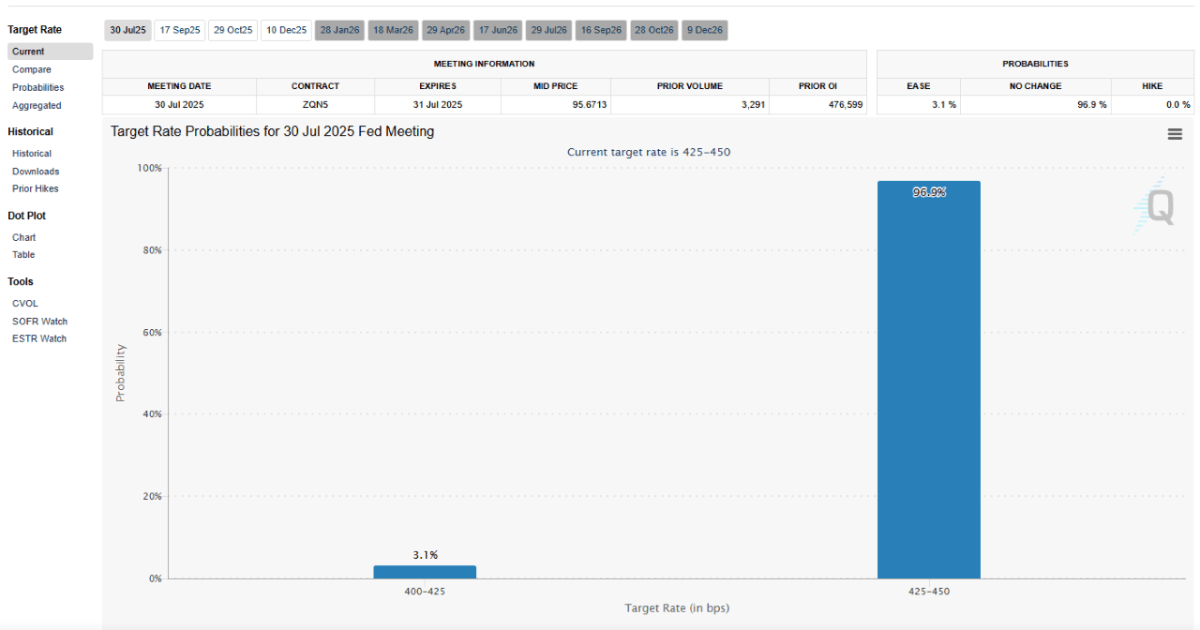

Currently, the market’s focus has shifted to the Federal Reserve’s interest rate decision. Most experts predict that when Federal Reserve Chair Jerome Powell appears after the two-day Federal Open Market Committee (FOMC) meeting, the interest rate will remain unchanged at the 4.25%-4.50% range. However, U.S. President Donald Trump remains an uncertain factor in this prediction, as he has exerted significant pressure on Powell, demanding either a rate cut or his resignation.

(Source: CME)

Yesterday, U.S. stock indices were mixed, with Bitcoin remaining largely flat, trading around $117,000. The market is preparing for Powell’s press conference on Wednesday, which is expected to be politically charged.

Trump’s attitude towards the Federal Reserve Chair is clear. Powell has frequently been the target of Trump’s sarcasm and ridicule. Just last week, Trump intensified his attacks by personally visiting the Federal Reserve headquarters and publicly criticizing the 72-year-old former lawyer and investment banker, accusing him of mismanaging the $25 billion renovation project of the Federal Reserve building.

Despite facing significant political pressure, Powell appears resolute in maintaining the current interest rate levels. The U.S. inflation rate stands at 2.7%, exceeding the Federal Reserve’s target of 2.0%. According to the CME FedWatch tool, the probability of no rate cut by the Federal Reserve is 97%. The low volatility in the stock market and Bitcoin also supports this consensus.