U.S. Federal Reserve Chair Jerome Powell gestures during a press conference following the issuance of the Federal Open Market Committee’s statement on interest rate policy in Washington, D.C., U.S., July 30, 2025. REUTERS/Jonathan Ernst

WASHINGTON, July 30 (Reuters Breakingviews) – Federal Reserve Chair Jerome Powell now faces dissent within and without. For the first time in three decades, two members of the interest rate-setting Federal Open Market Committee registered their disagreement with a decision to hold steady rather than cut. It comes as President Donald Trump is already pushing furiously for monetary easing. The tenuousness of Powell’s position doesn’t change the fact that he is right to wait, for now at least: as trade war impacts begin to be felt and new escalations arise, the inflation outlook faces real risks, making a go-slow strategy the best of bad options.

Sign up here.

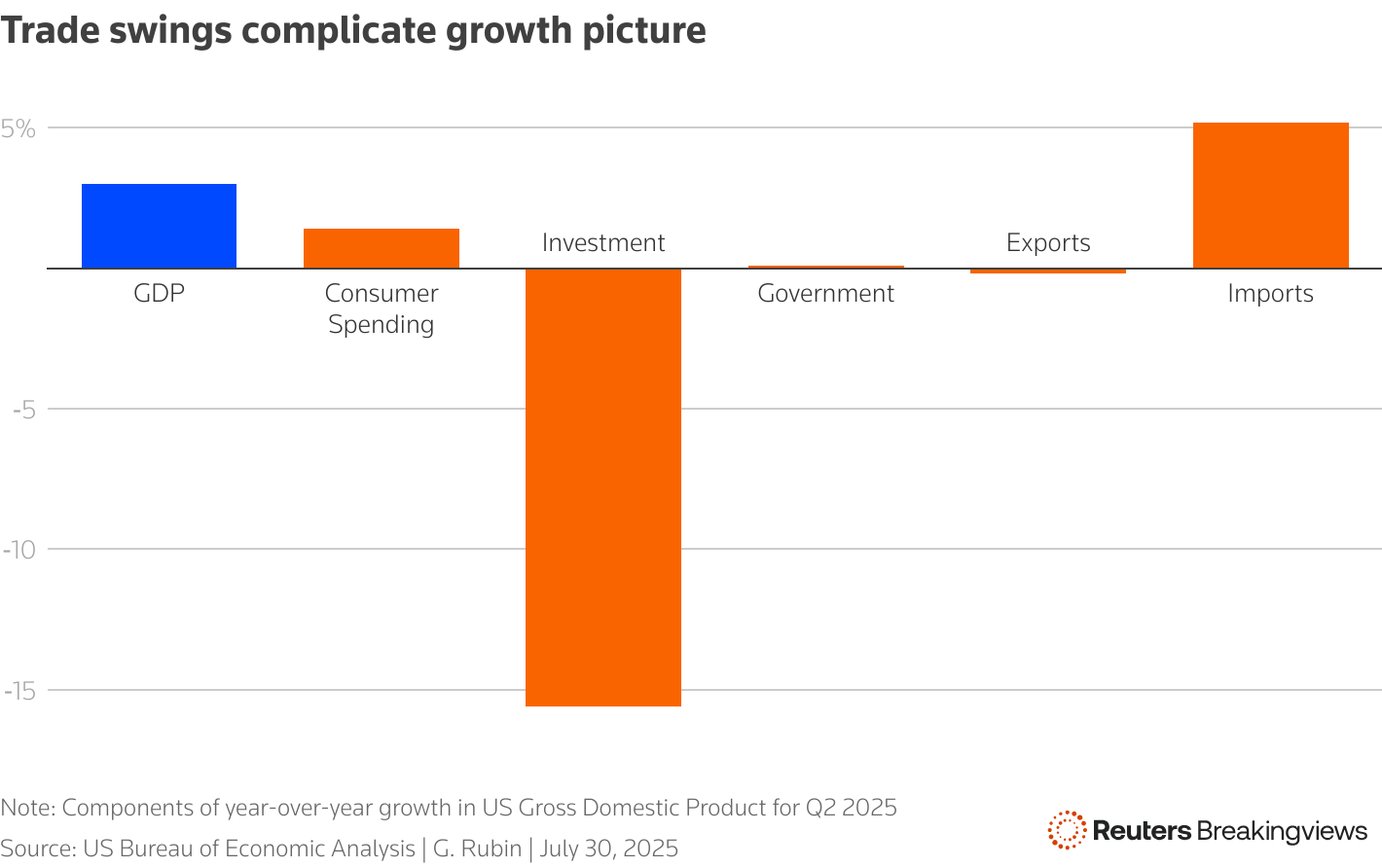

Column chart showing year-over-year growth of US GDP components for Q2 2025.

Meanwhile, any relief from the ill-defined trade deals the Trump administration struck with Japan and the European Union is tempered by new threatened 25% tariffs on India, hiked duties on Brazil, and 50% levies on copper. The breakdown in talks with India, the United States’ 10th-largest trading partner, is perhaps the most ominous sign, suggesting that at least some major tariffs comparable to those announced on “liberation day” in April could stick around.

Powell alluded to the risk that a tariff-based shock would spiral into sustained price increases, blaming them for elevated consumer inflation expectations. Yet as his term draws to a close next year, he faces more presidential pressure to ignore these increasingly visible warning signs than any Fed chairman in a half-century. That those signals clash with decent headline growth and employment makes this task even harder and the future tougher to predict. Rather than risk tripping over these obstacles, it made sense to stand pat.

Editing by Jonathan Guilford; Production by Pranav Kiran

Our Standards: The Thomson Reuters Trust Principles., opens new tab