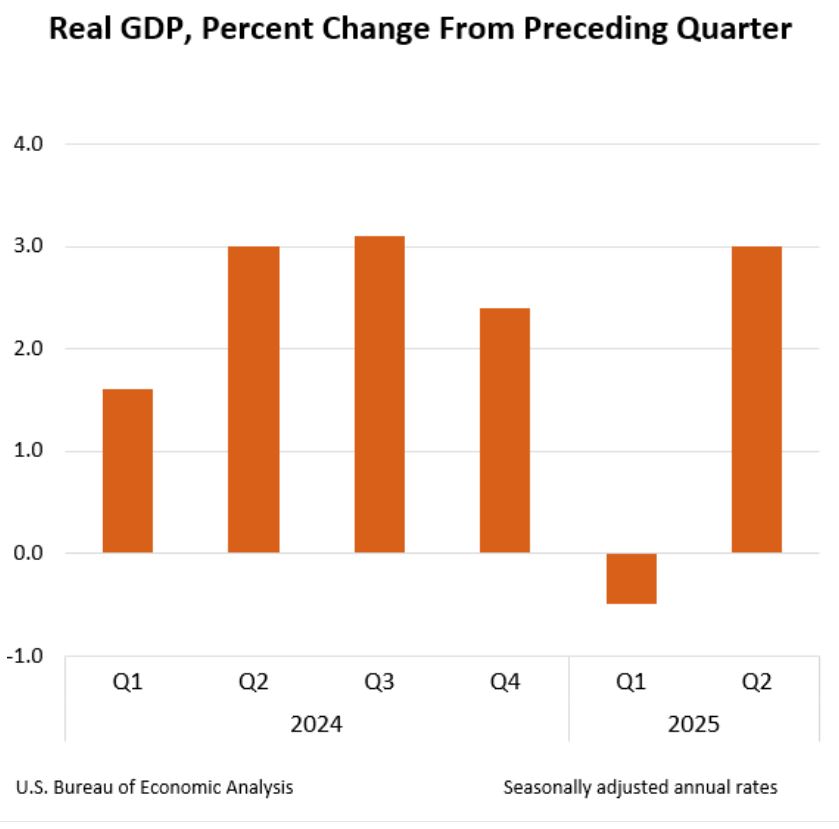

The US economy grew at an annualized rate of 3.0% in the second quarter of 2025, surpassing economists’ expectations and signaling robust economic momentum driven by private-sector activity. Consumer spending accelerated, inflation cooled, and real disposable income rose, while manufacturing and auto output posted significant gains. Despite concerns over trade policies and tariffs, the economy demonstrated resilience, with the Trump administration’s focus on domestic production contributing to a notable budget surplus.

President Donald J Trump

President Donald J Trump

The Bureau of Economic Analysis reported that real gross domestic product (GDP) increased at a 3.0% annualized rate in Q2 2025, a sharp rebound from a 0.5% decline in the first quarter. This growth exceeded the consensus forecast of 2.3% from economists surveyed by Bloomberg, with nearly three-fourths of respondents underestimating the economy’s performance.

US economy Gross Domestic Product, 2nd Quarter 2025 (Advance Estimate). Source: Bureau of Economic Analysis

US economy Gross Domestic Product, 2nd Quarter 2025 (Advance Estimate). Source: Bureau of Economic Analysis

Consumer spending, which accounts for roughly two-thirds of U.S. economic activity, rose by 1.4% in Q2, up from 0.5% in Q1, reflecting stronger household demand. The Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation gauge, increased by 2.1% in Q2, down from 3.7% in the prior quarter, while core PCE, excluding volatile food and energy prices, rose by 2.5%, down from 3.5%. These figures indicate inflation is aligning closely with the Fed’s 2% target, easing concerns about persistent price pressures.

Additionally, real disposable income grew by a robust 3.0% in Q2, following a 2.5% increase in Q1, providing consumers with greater purchasing power.

Private-sector activity was a key driver of growth, contrasting with declining federal government spending, which fell for the second consecutive quarter. Real business fixed investment grew by 1.9% in Q2, following a strong Q1, compared to an average of 0.5% in the final two quarters of the Biden administration.

The auto industry saw a 35.5% annualized increase in output, the largest since 2020, while manufacturing output rose by 1.8% in the first five months of 2025, reversing a 0.7% decline in the final five months of 2024.

In a statement on Wednesday’s U.S. Bureau of Economic Analysis GDP announcement, Press Secretary Karoline Leavitt wrote, “Today, GDP growth came in above market expectations, and yesterday, consumer confidence rose. Americans trust in President Trump’s America First economic agenda that continues to prove the so-called ‘experts’ wrong. President Trump has reduced America’s reliance on foreign products, boosted investment in the US, and created thousands of jobs — delivering on his promise to Make America Wealthy Again. The data is clear, and there are no more excuses — now is the time for ‘too late’ Powell to cut the rates!”

These gains align with the Trump administration’s “Made in America” agenda, which emphasizes reducing reliance on foreign products and boosting domestic production through trade policies and tariffs. Customs and tariff revenues exceeded $150 billion in the first five months of President Trump’s second term, contributing to the first June budget surplus in nearly a decade.

Despite the strong performance, some analysts caution that trade policies, including significant tariff announcements, could introduce uncertainty.

The New York Times noted that President Trump’s trade strategy, marked by frequent policy shifts, may lead to higher prices and slower growth in the coming months, particularly if tariffs fully take effect after the August 1 deadline. The Conference Board projects real GDP growth to slow to 1.6% for 2025, with consumer spending expected to weaken in the second half due to tariff-induced price increases. However, the labor market remains resilient, with jobless claims falling for six consecutive weeks and consumer spending and industrial production exceeding expectations in June.

The Federal Reserve, meeting on Wednesday, July 30, maintained its key interest rate in the 4.25%-4.5% range, reflecting a cautious approach as inflation cools but tariff-related risks linger. However, for the first time in more than 30 years, the vote saw the first double dissent from Fed board officials with two of nine members voting to lower the interest rate.

Since taking office for his second term, President Donald J Trump has consistently pressured Federal Reserve Chair Jerome Powell to lower the federal funds rate by a full percentage cut arguing that it would act as “rocket fuel” for an already robust economy.